Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC63.82%

Nuevos listados en Bitget : Pi Network

BTC/USDT$96793.11 (+0.67%)Índice de miedo y codicia67(Codicia)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoSIGNFlujo neto total de ETF en spot de Bitcoin +$422.5M (1d); +$2.87B (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC63.82%

Nuevos listados en Bitget : Pi Network

BTC/USDT$96793.11 (+0.67%)Índice de miedo y codicia67(Codicia)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoSIGNFlujo neto total de ETF en spot de Bitcoin +$422.5M (1d); +$2.87B (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Bitget: ¡En el Top 4 por volumen de trading diario global!

Cuota de mercado de BTC63.82%

Nuevos listados en Bitget : Pi Network

BTC/USDT$96793.11 (+0.67%)Índice de miedo y codicia67(Codicia)

Índice de la temporada de altcoins:0(Temporada de Bitcoin)

Monedas listadas en el pre-mercadoSIGNFlujo neto total de ETF en spot de Bitcoin +$422.5M (1d); +$2.87B (7d). Paquete de obsequios de bienvenida para nuevos usuarios por valor de 6.200 USDT.Reclamar ahora

Tradea en cualquier momento y lugar con la app de Bitget. Descargar ahora

Precio de ELON CoinELON

No listado

Moneda de cotización:

EUR

Los datos proceden de proveedores externos. Esta página y la información proporcionada no respaldan ninguna criptomoneda específica. ¿Quieres tradear monedas listadas? Haz clic aquí

€0.{6}1126-0.59%1D

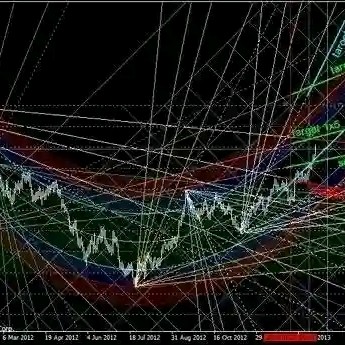

Gráfico de precios

ELON Coin price chart (ELON/EUR)

Última actualización el 2025-05-02 13:51:53(UTC+0)

Capitalización de mercado:€77,173.09

Capitalización de mercado totalmente diluida:€77,173.09

Volumen (24h):--

Volumen en 24h/Capitalización de mercado:0.00%

Máximo 24h:€0.{6}1133

Mínimo 24h:€0.{6}1126

Máximo histórico:€0.{4}6867

Mínimo histórico:€0.{7}9082

Suministro circulante:685,219,800,000 ELON

Suministro total:

690,420,000,000ELON

Tasa de circulación:99.00%

Suministro máx.:

--ELON

Precio en BTC:0.{11}1321 BTC

Precio en ETH:0.{10}6976 ETH

Precio en la capitalización de mercado de BTC:

€2.47

Precio en la capitalización de mercado de ETH:

€0.28

Contratos:

0x6942...ddb9528(Ethereum)

Más

¿Qué opinas hoy de ELON Coin?

Nota: Esta información es solo de referencia.

AI analysis report on ELON Coin

Today's crypto market highlightsView report

Precio actual de ELON Coin en EUR

The live ELON Coin price today is €0.{6}1126 EUR, with a current market cap of €77,173.09. The ELON Coin price is down by 0.59% in the last 24 hours, and the 24-hour trading volume is €0.00. The ELON/EUR (ELON Coin to EUR) conversion rate is updated in real time.

Historial del precio de ELON Coin (EUR)

El precio de ELON Coin fluctuó un -99.45% en el último año. El precio más alto de en EUR en el último año fue de €0.{4}6867 y el precio más bajo de en EUR en el último año fue de €0.{7}9082.

FechaCambio en el precio (%) Precio más bajo

Precio más bajo Precio más alto

Precio más alto

Precio más bajo

Precio más bajo Precio más alto

Precio más alto

24h-0.59%€0.{6}1126€0.{6}1133

7d-80.11%€0.{7}9082€0.{6}5727

30d-79.06%€0.{7}9082€0.{6}6823

90d-95.86%€0.{7}9082€0.{5}2353

1y-99.45%€0.{7}9082€0.{4}6867

Histórico-98.32%€0.{7}9082(2025-04-28, 4 día(s) atrás )€0.{4}6867(2024-06-04, 332 día(s) atrás )

¿Cuál es el precio más alto de ELON Coin?

The all-time high (ATH) price of ELON Coin in EUR was €0.{4}6867, recorded on 2024-06-04. Compared to the ELON Coin ATH, the current price of ELON Coin is down by 99.84%.

¿Cuál es el precio más bajo de ELON Coin?

The all-time low (ATL) price of ELON Coin in EUR was €0.{7}9082, recorded on 2025-04-28. Compared to the ELON Coin ATL, the current price of ELON Coin is up by 24.00%.

Predicción de precios de ELON Coin

¿Cuál será el precio de ELON en 2026?

Según el modelo de predicción del rendimiento histórico del precio de ELON, se prevé que el precio de ELON alcance los €0.{6}3297 en 2026.

¿Cuál será el precio de ELON en 2031?

En 2031, se espera que el precio de ELON aumente en un +34.00%. Al final de 2031, se prevé que el precio de ELON alcance los €0.{6}8627, con un ROI acumulado de +661.68%.

Preguntas frecuentes

¿Cuál es el precio actual de ELON Coin?

El precio en tiempo real de ELON Coin es €0 por (ELON/EUR) con una capitalización de mercado actual de €77,173.09 EUR. El valor de ELON Coin sufre fluctuaciones frecuentes debido a la actividad continua 24/7 en el mercado cripto. El precio actual de ELON Coin en tiempo real y sus datos históricos están disponibles en Bitget.

¿Cuál es el volumen de trading de 24 horas de ELON Coin?

En las últimas 24 horas, el volumen de trading de ELON Coin es de €0.00.

¿Cuál es el máximo histórico de ELON Coin?

El máximo histórico de ELON Coin es €0.{4}6867. Este máximo histórico es el precio más alto de ELON Coin desde su lanzamiento.

¿Puedo comprar ELON Coin en Bitget?

Sí, ELON Coin está disponible actualmente en el exchange centralizado de Bitget. Para obtener instrucciones más detalladas, consulta nuestra útil guía Cómo comprar .

¿Puedo obtener un ingreso estable invirtiendo en ELON Coin?

Desde luego, Bitget ofrece un plataforma de trading estratégico, con bots de trading inteligentes para automatizar tus trades y obtener ganancias.

¿Dónde puedo comprar ELON Coin con la comisión más baja?

Nos complace anunciar que plataforma de trading estratégico ahora está disponible en el exchange de Bitget. Bitget ofrece comisiones de trading y profundidad líderes en la industria para garantizar inversiones rentables para los traders.

Holdings de ELON Coin

Matriz de distribución de holdings de ELON Coin

Holdings por concentración de ELON Coin

Ballenas

Inversores

Minoristas

ELON Coin direcciones por tiempo en holding

Holders

Cruisers

Traders

Gráfico de precios de coinInfo.name (12) en tiempo real

Precios mundiales de ELON Coin

How much is ELON Coin worth right now in other currencies? Last updated: 2025-05-02 13:51:53(UTC+0)

ELON a MXN

Mexican Peso

Mex$0ELON a GTQGuatemalan Quetzal

Q0ELON a CLPChilean Peso

CLP$0ELON a HNLHonduran Lempira

L0ELON a UGXUgandan Shilling

Sh0ELON a ZARSouth African Rand

R0ELON a TNDTunisian Dinar

د.ت0ELON a IQDIraqi Dinar

ع.د0ELON a TWDNew Taiwan Dollar

NT$0ELON a RSDSerbian Dinar

дин.0ELON a DOPDominican Peso

RD$0ELON a MYRMalaysian Ringgit

RM0ELON a GELGeorgian Lari

₾0ELON a UYUUruguayan Peso

$0ELON a MADMoroccan Dirham

د.م.0ELON a AZNAzerbaijani Manat

₼0ELON a OMROmani Rial

ر.ع.0ELON a KESKenyan Shilling

Sh0ELON a SEKSwedish Krona

kr0ELON a UAHUkrainian Hryvnia

₴0- 1

- 2

- 3

- 4

- 5

Nuevos listados en Bitget

Nuevos listados

Comprar más

¿Dónde puedo comprar cripto?

Compra cripto en la app de Bitget

Regístrate en cuestión de minutos para comprar criptomonedas con tarjeta de crédito o transferencia bancaria.

Sección de video: verificación rápida, trading rápido

Cómo completar la verificación de identidad en Bitget y protegerte del fraude

1. Inicia sesión en tu cuenta de Bitget.

2. Si eres nuevo en Bitget, mira nuestro tutorial sobre cómo crear una cuenta.

3. Pasa el cursor por encima del ícono de tu perfil, haz clic en "No verificado" y haz clic en "Verificar".

4. Elige tu país o región emisora y el tipo de ID, y sigue las instrucciones.

5. Selecciona "Verificación por teléfono" o "PC" según tus preferencias.

6. Ingresa tus datos, envía una copia de tu ID y tómate una selfie.

7. Envía tu solicitud, ¡y listo! Habrás completado la verificación de identidad.

Las inversiones en criptomoneda, lo que incluye la compra de ELON Coin en línea a través de Bitget, están sujetas al riesgo de mercado. Bitget te ofrece formas fáciles y convenientes de comprar ELON Coin, y hacemos todo lo posible por informar exhaustivamente a nuestros usuarios sobre cada criptomoneda que ofrecemos en el exchange. No obstante, no somos responsables de los resultados que puedan surgir de tu compra de ELON Coin. Ni esta página ni ninguna parte de la información que incluye deben considerarse respaldos de ninguna criptomoneda en particular.

Clasificación de ELON Coin

Clasificaciones promedio de la comunidad

4.6

Este contenido solo tiene fines informativos.

Bitget Insights

Young-Hunter001

20h

100 Days of Trump: Crypto’s Wild Ride Through the Golden Gilded Tower

As the dust settles on President Trump’s first 100 days back in the Oval Office — now freshly renamed "The Executive Suite" — the crypto market finds itself somewhere between Mar-a-Lambo and Mt. Volatility. The question isn’t just what’s next, but how cinematic it’s going to be.

1. Executive Order 1337: "Make Bitcoin Great Again"

Trump, never one for subtlety, may drop an executive order calling Bitcoin a “strategic digital asset.” Picture this: a gold-plated cold wallet buried under the new TrumpCoin Tower in Manhattan. Speculation sends Bitcoin mooning faster than SpaceX rockets, but with the added drama of Congress trying to subpoena Satoshi Nakamoto.

2. TRUMP Coin (TRMP): The Official Currency of Truth Social

Forget memecoins. TrumpCoin is no joke — it’s an NFT-wrapped stablecoin with daily tweet-based staking rewards. Price rises every time Trump tweets “WITCH HUNT,” and falls whenever he says “FAKE NEWS.” Wall Street shrugs; Reddit apes go all in.

3. Crypto Regulation by Reality Show

Introducing The SEC Apprentice, where Gary Gensler and Trump face off to determine which altcoin gets regulated, delisted, or crowned king. Each week, one coin hears the words: “You’re delisted.”

4. Elon and Trump: Crypto’s New Odd Couple

Rumors fly that Trump and Elon Musk are planning “X-Crypto” — a decentralized social-finance-media platform that runs on Doge, TrumpCoin, and pure chaos. China bans it immediately. The U.S. threatens to nationalize it. The market? Loves it.

5. The Next 100 Days: Chaos is the New Catalyst

Markets hate uncertainty — but crypto thrives on it. With Trump back in power, expect massive pumps on tweets, policy leaks, and the occasional golf-cart livestream from Camp David featuring crypto commentary.

X-1.08%

DOGE+0.33%

Nilesh Rohilla | Analyst

1d

$TESLA UPDATE: Earlier today, there was a media report erroneously claiming that the Tesla Board had contacted recruitment firms to initiate a CEO search at the company.

This is absolutely false (and this was communicated to the media before the report was published).

The CEO of Tesla is Elon Musk and the Board is highly confident in his ability to continue executing on the exciting growth plan ahead.

– Robyn Denholm

ELON-0.30%

NURUDDEEN61

1d

Elon Musk: My prediction is that long-term, 90% or more of all power on Earth will be solar panels with batteries.”

ELON-0.30%

Saifullahi_Sani

1d

Crypto Outlook for May 2025: The Sectors and Coins Poised for a Breakout

$INIT $HAEDAL As the crypto market surges into May 2025, riding the momentum of Bitcoin’s historic $100,000 milestone in late 2024, investors are buzzing with anticipation. The total market cap has climbed past $2.82 trillion, and whispers of an impending altcoin season are growing louder. With macroeconomic tailwinds, technological innovation, and shifting regulatory landscapes, certain sectors and coins are emerging as prime candidates for explosive growth this month. In this deep dive, we’ll explore the most promising sectors—Artificial Intelligence (AI) tokens, Decentralized Finance (DeFi), Real-World Assets (RWAs), and even the wildcard meme coin space—while spotlighting coins like Ethereum, Solana, Render Token, and Bitcoin that could lead the charge. Buckle up for a unique, forward-looking analysis of what May 2025 has in store for crypto enthusiasts.

The Macro Backdrop: Why May 2025 Could Be a Turning Point

The crypto market doesn’t exist in a vacuum, and May 2025 is shaping up to be a pivotal month. Global central banks, including the U.S. Federal Reserve, have signaled continued interest rate cuts, boosting risk assets like cryptocurrencies. The pro-crypto stance of the Trump administration, with talks of a U.S. Bitcoin strategic reserve, has injected optimism into the market. Meanwhile, Europe’s MiCA framework is providing regulatory clarity, encouraging institutional inflows into blockchain projects.

On the technical side, Bitcoin’s 50-day moving average is trending upward, and the Blockchain Center’s Altcoin Season Index hints at a potential altcoin rally. However, investors should remain cautious: analysts warn of a possible 30% Bitcoin correction and up to 60% pullbacks in altcoins by mid-2025. For now, the sentiment is bullish, but timing and sector selection will be critical.

Sectors to Watch in May 2025

1. Artificial Intelligence (AI) Tokens: The Future Is Decentralized

The fusion of AI and blockchain is no longer a sci-fi fantasy—it’s a thriving sector with a market cap soaring from $2.7 billion in April 2023 to over $39 billion in 2024. AI tokens are powering decentralized solutions for machine learning, data processing, and GPU rendering, addressing real-world needs in industries like gaming, healthcare, and finance.

Why It’s Hot: The demand for cost-effective AI infrastructure is skyrocketing, and blockchain’s transparency ensures fair resource allocation. Events like Nvidia’s GTCAI conference could amplify interest, driving capital into AI-driven crypto projects.

Top Picks:

Render Token (RNDR): Priced at $4.50, RNDR is the backbone of decentralized GPU rendering for AI and 3D applications. Its partnerships with gaming and metaverse platforms position it for a breakout if AI hype accelerates.

Fetch.ai (FET): Focused on autonomous AI agents for DeFi and logistics, FET’s ecosystem is gaining traction among developers.

Superintelligence Alliance: This coalition of AI-blockchain projects is pushing the boundaries of decentralized intelligence, making it a speculative but exciting bet.

May Outlook: AI tokens are primed for a sentiment-driven rally, especially if major tech firms announce blockchain integrations. Watch for RNDR to test $6–$8 if market conditions align.

2. Decentralized Finance (DeFi): The Backbone of Crypto’s Revival

DeFi is back with a vengeance, with Total Value Locked (TVL) hitting record highs above $150 billion in 2024 and analysts forecasting $200 billion by year-end 2025. Scalable platforms like Ethereum, Solana, and Cardano are leading the charge, fueled by innovations in decentralized lending, trading, and tokenized securities.

Why It’s Hot: Institutional adoption is accelerating, with traditional finance giants exploring DeFi for yield generation. Regulatory clarity in Europe and Asia is reducing barriers, while AI-driven trading algorithms are boosting DeFi efficiency.

Top Picks:

Ethereum (ETH): The DeFi king, Ethereum’s ecosystem thrives on dApps and layer-2 solutions like Arbitrum and Optimism. Priced around $3,000, analysts see it climbing to $4,910–$5,590 by mid-2025.

Solana (SOL): With transaction speeds rivaling centralized systems and DEX volumes exceeding $20 billion, Solana’s $122–$490 price range makes it a favorite for DeFi and NFT projects.

Cardano (ADA): After a 300% rally in late 2024, Cardano’s focus on sustainability and interoperability could push it to $1.5–$1.7.

May Outlook: DeFi’s fundamentals are rock-solid, and a broader altcoin rally could propel ETH and SOL to new highs. ADA’s community-driven momentum makes it a dark horse to watch.

3. Real-World Assets (RWAs): Tokenizing the World

The tokenization of real-world assets—think real estate, bonds, and even fine art—is reshaping finance. The RWA sector’s market cap surged 82% in 2024, driven by projects enabling fractional ownership and cross-border transactions.

Why It’s Hot: RWAs bridge traditional finance and crypto, attracting institutional players seeking liquidity and transparency. Use cases like supply chain tracking and tokenized securities are gaining real-world traction.

Top Picks:

Stellar (XLM): Known for low-cost cross-border payments, Stellar is a leader in tokenizing financial instruments.

VeChain (VET): VeChain’s supply chain solutions are adopted by global brands, making it a practical RWA play.

May Outlook: RWAs are a slow burn but could see steady gains as institutional adoption grows. XLM and VET are undervalued gems for patient investors.

4. Meme Coins: The Wildcard of Crypto

Love them or hate them, meme coins thrive on community hype and market euphoria. With Bitcoin’s rise often sparking altcoin seasons, meme coins like Dogecoin and Shiba Inu could steal the spotlight in May.

Why It’s Hot: Social media buzz, celebrity endorsements (looking at you, Elon), and speculative fervor make meme coins a high-risk, high-reward play.

Top Pick:

Dogecoin (DOGE): Priced around $0.14, DOGE’s stability and loyal community make it a contender for a 20–50% spike if market sentiment turns euphoric.

May Outlook: Meme coins are a gamble, but DOGE could ride the wave of an altcoin rally. Monitor X posts for sudden surges in community activity.

Coins to Bet On in May 2025

Bitcoin (BTC): The market’s anchor, Bitcoin’s $80,440–$151,200 trading range reflects its role as a store of value. Institutional ETF inflows and potential U.S. policy shifts could push it toward $175,000. For May, expect steady gains with volatility.

Ethereum (ETH): Ethereum’s DeFi dominance and layer-2 scalability make it a must-have. A move above $4,000 is plausible if altcoin season ignites.

Solana (SOL): Solana’s speed and ecosystem growth position it for a run to $200–$300, especially if DeFi and NFT volumes surge.

Render Token (RNDR): As AI’s rising star, RNDR could double to $8–$10 if tech headlines align.

Cardano (ADA): Cardano’s technical upgrades and community strength make it a sleeper hit, with $1.5 in sight.

Navigating Risks in a Volatile Market

While the outlook is bullish, crypto remains a rollercoaster. Here are key risks to watch:

Corrections: A 30% Bitcoin dip or 60% altcoin pullback could hit by summer 2025, per analyst warnings.

Regulation: Unexpected crackdowns, especially in Asia, could spook markets.

Geopolitics: Trade tariffs and global economic uncertainty may trigger risk-off sentiment.

To mitigate risks, diversify across sectors, monitor technical indicators like RSI and MACD, and avoid over-leveraging. If you’re new to crypto, start with Bitcoin and Ethereum for stability.

How to Play May 2025

For Conservative Investors: Allocate 60% to BTC and ETH, 30% to SOL and ADA, and 10% to AI tokens like RNDR for growth.

For Risk-Takers: Add 10–15% exposure to meme coins like DOGE and speculative AI plays like FET, but set tight stop-losses.

Stay Informed: Follow X for real-time sentiment and news catalysts. If you’re curious about a specific coin’s chart or fundamentals, tools like DeepSearch can provide deeper insights.

The Bottom Line: Seize the Moment, but Stay Sharp

May 2025 is shaping up to be a dynamic month for crypto, with AI tokens, DeFi, and RWAs leading the charge, and Bitcoin holding the fort. Coins like Ethereum, Solana, and Render Token offer a blend of innovation and momentum, while Dogecoin keeps the speculative spirit alive. But in crypto, opportunity comes with risk—stay disciplined, do your homework, and never bet the farm.

BTC+0.30%

X-1.08%

Bpay-News

1d

Dogecoin Unfazed as Elon Musk Rubbishes Report of His Exit From Tesla

ELON-0.30%

Activos relacionados

Criptomonedas populares

Una selección de las 8 criptomonedas principales por capitalización de mercado.

Agregada recientemente

Las criptomonedas agregadas más recientemente.

Capitalización de mercado comparable

Entre todos los activos de Bitget, estos 8 son los más cercanos a ELON Coin en capitalización de mercado.

Additional info on ELON Coin

Resumen de la moneda

Relacionado con la moneda

Relacionado con el trading

Actualizaciones de la moneda

.png)