Bitget:全球日交易量排名前 4!

BTC 市占率62.72%

BTC/USDT$77627.56 (-6.89%)恐懼與貪婪指數23(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$64.9M(1 天);-$169.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率62.72%

BTC/USDT$77627.56 (-6.89%)恐懼與貪婪指數23(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$64.9M(1 天);-$169.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率62.72%

BTC/USDT$77627.56 (-6.89%)恐懼與貪婪指數23(極度恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種BABY,PAWS,WCT比特幣現貨 ETF 總淨流量:-$64.9M(1 天);-$169.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Jambo 價格J

上架

報價幣種:

TWD

NT$6.29-3.89%1D

價格走勢圖

TradingView

最近更新時間 2025-04-07 04:22:20(UTC+0)

市值:--

完全稀釋市值:--

24 小時交易額:--

24 小時交易額/市值:0.00%

24 小時最高價:NT$6.79

24 小時最低價:NT$6.18

歷史最高價:NT$34.78

歷史最低價:NT$5.69

流通量:-- J

總發行量:

--J

流通率:0.00%

最大發行量:

--J

以 BTC 計價:6,913.32 BTC

以 ETH 計價:-- ETH

以 BTC 市值計價:

--

以 ETH 市值計價:

--

合約:--

您今天對 Jambo 感覺如何?

注意:此資訊僅供參考。

Jambo 今日價格

Jambo 的即時價格是今天每 (J / TWD) NT$6.29,目前市值為 -- TWD。24 小時交易量為 NT$0.00 TWD。J 至 TWD 的價格為即時更新。Jambo 在過去 24 小時內的變化為 -3.89%。其流通供應量為 -- 。

J 的最高價格是多少?

J 的歷史最高價(ATH)為 NT$34.78,於 錄得。

J 的最低價格是多少?

J 的歷史最低價(ATL)為 NT$5.69,於 錄得。

Jambo 價格預測

J 在 2026 的價格是多少?

根據 J 的歷史價格表現預測模型,預計 J 的價格將在 2026 達到 NT$0.00。

J 在 2031 的價格是多少?

2031,J 的價格預計將上漲 +10.00%。 到 2031 底,預計 J 的價格將達到 NT$0.00,累計投資報酬率為 -100.00%。

Jambo 價格歷史(TWD)

過去一年,Jambo 價格上漲了 -62.00%。在此期間,J 兌 TWD 的最高價格為 NT$34.78,J 兌 TWD 的最低價格為 NT$5.69。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h-3.89%NT$6.18NT$6.79

7d-3.89%NT$6.18NT$6.79

30d-6.03%NT$6.18NT$8.63

90d-32.77%NT$5.69NT$16.07

1y-62.00%NT$5.69NT$34.78

全部時間-62.00%NT$5.69(--, 今天 )NT$34.78(--, 今天 )

Jambo 行情

Jambo 持幣分布集中度

巨鯨

投資者

散戶

Jambo 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Jambo 評級

社群的平均評分

4.5

此內容僅供參考。

J 兌換當地法幣匯率表

1 J 兌換 MXN$3.921 J 兌換 GTQQ1.471 J 兌換 CLP$183.111 J 兌換 UGXSh698.811 J 兌換 HNLL4.891 J 兌換 ZARR3.661 J 兌換 TNDد.ت0.591 J 兌換 IQDع.د248.881 J 兌換 TWDNT$6.321 J 兌換 RSDдин.20.311 J 兌換 DOP$11.941 J 兌換 MYRRM0.851 J 兌換 GEL₾0.521 J 兌換 UYU$8.091 J 兌換 MADد.م.1.811 J 兌換 OMRر.ع.0.071 J 兌換 AZN₼0.321 J 兌換 SEKkr1.921 J 兌換 KESSh24.711 J 兌換 UAH₴7.84

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-04-07 04:22:20(UTC+0)

如何購買 Jambo(J)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 Jambo 兌換為 J

我們將為您示範使用多種支付方式在 Bitget 上購買 Jambo

了解更多交易 J 永續合約

在 Bitget 上註冊並購買 USDT 或 J 後,您可以開始交易衍生品,包括 J 合約和槓桿交易,增加收益。

J 的目前價格為 NT$6.29,24 小時價格變化為 -3.89%。交易者可透過做多或做空 J 合約獲利。

Jambo 動態

日商三井在台營運的第二座 LaLaport 購物中心在南港正式開幕營業

Abmedia•2025-04-05 20:05

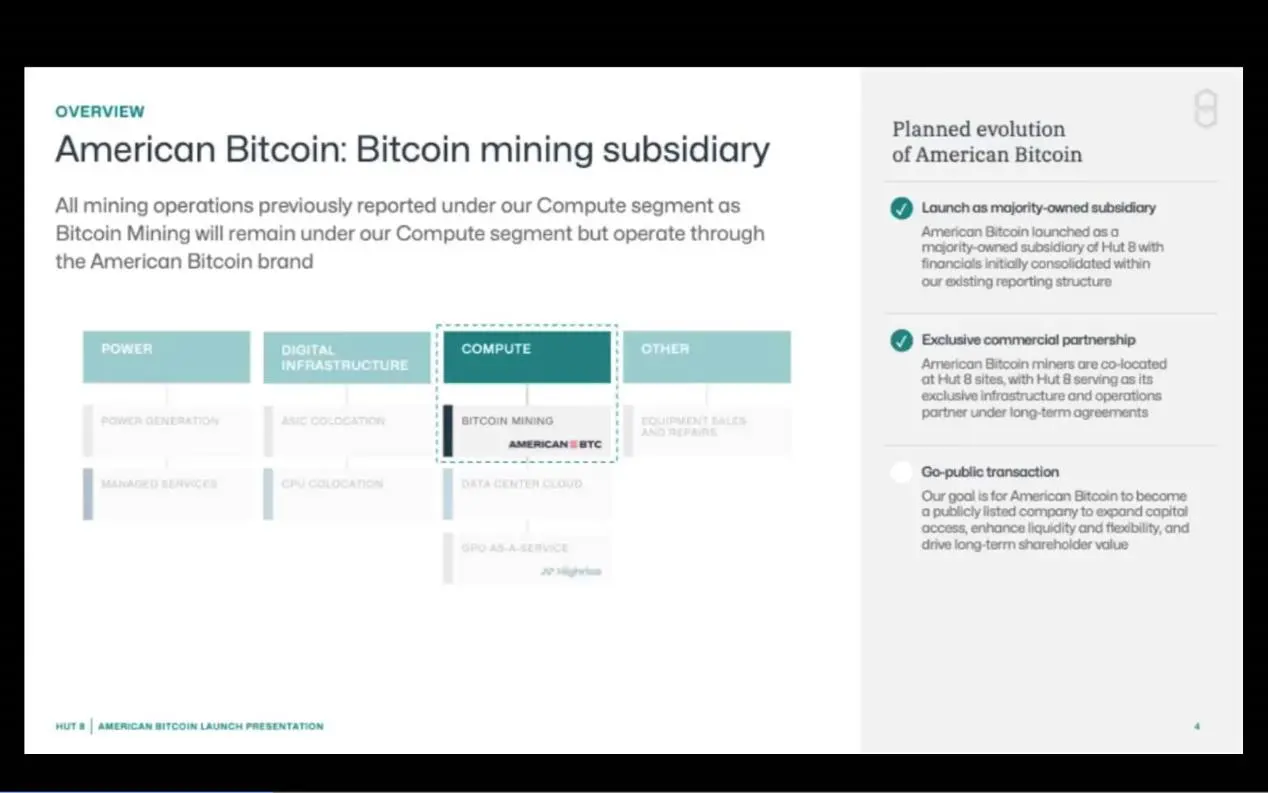

特朗普家族聯手 Hut 8,American Bitcoin 目標打造全球最大比特幣礦企

American Bitcoin 的發展路徑被細緻拆解為四個階段,每一階段都有明確的目標算力與能效指標,並依賴於與 Hut 8 已有資源的協同。

Chaincatcher•2025-04-04 17:55

投資市場的定價權究竟在誰?傳統金融外匯出身的 Fogo 創辦人:交易不看新聞,只看訂單簿

Abmedia•2025-03-29 22:23

Auradine推出首款美國設計的水冷礦機,助力客戶應對海關和關稅問題,應對特朗普推動的“在美國製造比特幣”政策

快速摘要 Auradine推出了首款美國設計的水冷比特幣礦機,旨在幫助應對不斷增長的計算需求、上升的能源成本以及對海外硬體供應商的依賴。該公司聲稱,Teraflux AH3880的算力可達600 TH/s,效率低至14.5 J/TH,根據這些指標,超越了市場上一些領先的比特幣礦機。

The Block•2025-03-25 15:44

Robinhood 與 Kalshi 合作推出專注於政治、經濟和體育的預測市場中心

Robinhood 透過其專注於期貨的子公司 Robinhood Derivatives,在其應用程式內推出了一個預測市場中心。預測市場將首先專注於政治、經濟和體育,並計劃在未來擴大預測類別。

The Block•2025-03-18 00:03

購買其他幣種

用戶還在查詢 Jambo 的價格。

Jambo 的目前價格是多少?

Jambo 的即時價格為 NT$6.29(J/TWD),目前市值為 -- TWD。由於加密貨幣市場全天候不間斷交易,Jambo 的價格經常波動。您可以在 Bitget 上查看 Jambo 的市場價格及其歷史數據。

Jambo 的 24 小時交易量是多少?

在最近 24 小時內,Jambo 的交易量為 --。

Jambo 的歷史最高價是多少?

Jambo 的歷史最高價是 NT$34.78。這個歷史最高價是 Jambo 自推出以來的最高價。

我可以在 Bitget 上購買 Jambo 嗎?

可以,Jambo 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 jambo 指南。

我可以透過投資 Jambo 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Jambo?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 Jambo(J)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Jambo)具有市場風險。Bitget 為您提供購買 Jambo 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Jambo 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

J 資料來源

Bitget 觀點

Nusrat_Mim_CryptoQue

9小時前

$DOGE

DOGE/USDT Price Analysis | Technical Breakdown & Future Outlook

Current Snapshot:

DOGE is trading around 0.15276 USDT, down -9.24% in the last 24 hours. The recent sharp drop has pushed it below key EMAs, with strong selling pressure evident in the volume spike.

Technical Insights (1H Chart):

MACD: Bearish momentum intensifying. MACD line below signal line with widening gap.

EMAs (5, 10, 20): All pointing downward. EMA(10) ≈ 0.15886 and EMA(20) ≈ 0.16189, acting as resistance.

Parabolic SAR: Dots are well above the candles, indicating continued downtrend.

KDJ Oscillator: In oversold zone (J = -0.72), hinting at a potential short-term bounce.

Volume Spike: Sudden rise in sell volume suggests panic or large liquidations.

Multi-Timeframe Cross-Check:

4H Chart: Downtrend persists, but RSI and KDJ nearing oversold territory. A bounce is possible if price stabilizes around support at 0.150.

Daily Chart: Medium-term trend still bearish. The price needs to regain 0.165+ to confirm a reversal.

15Min Chart: Showing early signs of a recovery attempt after hitting local low at 0.15066.

Future Prediction:

Short-Term (1-2 Days):

We may see a technical rebound toward the 0.156–0.158 zone if buyers step in from oversold conditions. However, any failure to hold above 0.150 could open doors to retesting 0.145 or lower.

Mid-Term (1 Week):

A sustained move above 0.162 with strong volume could shift sentiment to neutral-bullish. Watch for consolidation between 0.150–0.165.

Long-Term (April End):

DOGE’s broader structure suggests a possible accumulation phase if it holds the 0.145–0.150 support zone. If bulls regain control, we might revisit the 0.170–0.175 region by the end of the month.

Refinement Using Other Indicators:

Bollinger Bands (not shown): Likely widened, suggesting volatility surge.

Support Zones: 0.15066 (local low), 0.145 (historical).

Resistance Zones: 0.158, 0.162, 0.169.

Conclusion:

DOGE is currently under pressure but nearing a possible oversold bounce zone. Traders should monitor volume, price action near 0.150, and EMA resistance levels before making decisions. Patience and proper risk management are key.

HOLD-1.67%

MOVE-0.82%

Nusrat_Mim_CryptoQue

9小時前

FUNUSDT Market Analysis & Price Prediction Update

The FUNUSDT pair has shown an interesting movement pattern in the 1H chart, with strong upward momentum seen on April 5–6, reaching a recent high of 0.008729. Currently, it's consolidating near 0.007936, showing signs of potential accumulation before the next move.

Technical Overview (1H Chart)

EMA crossover indicates a bullish trend shift, with EMA(5) at 0.008004 above EMA(10) and EMA(20).

MACD remains slightly negative (MACD: -0.000041) but is narrowing toward the signal line, hinting at possible momentum reversal.

KDJ values (K: 47.8, D: 60.7) are in a neutral zone, indicating market indecision, but J line at 21.9 could suggest a short-term oversold opportunity.

Parabolic SAR (0.007347) lies below the current price, supporting a bullish trend continuation.

Volume has been fairly stable with occasional spikes, which might precede a breakout.

Future Prediction:

Short-Term (1H–4H):

Price might retest the resistance at 0.0087–0.0089.

If volume continues rising, a breakout above 0.0092 is possible.

Support lies at 0.0073 and 0.0068.

Mid-Term (1D):

A clean bullish structure may form if the price holds above EMA(20) on the 1D chart.

MACD on the 1D is still catching up, suggesting a possible swing opportunity in the upcoming days.

Graph Suggestion:

You can create a combined view showing:

Candlestick + EMA(5/10/20)

MACD & KDJ below

Volume bars with MA(5 & 10)

Parabolic SAR dots on main price chart

If you want me to generate this graph for you visually, I can do that now.

Conclusion:

FUNUSDT is currently in a consolidation phase with a bullish bias. Traders should watch for volume confirmation and momentum shifts on higher timeframes. Maintaining proper risk management is key during sideways conditions. The next 24–48 hours could define its breakout direction.

MOVE-0.82%

ME-1.35%

ZORJISBGB

10小時前

BTC/USDT Market Analysis | April 6th, 2025

Current Overview

At the time of analysis, BTC/USDT is trading near $81,916, down 0.97% in the last 24 hours. The short-term market shows signs of consolidation after recent volatility. Let's break down the technicals and project potential future movements.

Technical Indicator Breakdown

1. EMA & SAR (1H timeframe)

EMA(5): $82,263

EMA(10): $82,522

EMA(20): $82,786

SAR: $82,986 (trailing downward)

Price is currently trending below all EMAs, showing short-term bearish momentum. SAR dots above the candles indicate potential for continued downward pressure.

2. MACD (12,26,9)

MACD Line: -112.83

Signal Line (DEA): -171.81

Histogram: Negative, showing weakening bullish divergence

The MACD histogram shows no signs of reversal yet, keeping the short-term bias bearish.

3. KDJ (9,3,3)

K: 12.88

D: 18.55

J: 1.53

Oversold zone. Historically, such low KDJ readings can signal an upcoming bounce or temporary relief rally.

4. Volume Analysis

Decreasing trading volume on the decline hints at possible seller exhaustion. However, a volume spike is needed for a strong reversal confirmation.

$BTC

Multi-Timeframe Refinement

4H Chart View

EMAs aligned downward, but the price is approaching a key support zone (~$81,500).

A bullish divergence is brewing on MACD and RSI in this timeframe.

1D Chart View

Mid-term trend remains bullish as BTC is still above the macro EMA(50) despite short-term pullbacks.

Pullbacks toward the $81,000–$80,000 region can be considered healthy retests unless broken with high volume.

Short-Term Prediction (Next 24-48H)

Expect possible consolidation between $81,500 and $82,500

Break below $81,500 could test $80,000

If volume supports a rebound, a move toward $83,000 is possible

Mid-Term Outlook (Next 1–2 Weeks)

As long as BTC holds the macro uptrend support and global markets remain stable, a recovery toward $85,000–$86,500 remains viable.

Watch for macroeconomic data or policy news impacting investor sentiment.

Conclusion

BTC is experiencing short-term correction pressure, but indicators suggest a possible bounce if critical support holds. Multi-timeframe analysis strengthens the idea of cautious optimism while watching for confirmation through volume and bullish divergence.

What’s your strategy for this range-bound action? Share your thoughts below and let’s discuss the next move together.

BTC-1.15%

MOVE-0.82%

Nusrat_Mim_CryptoQue

10小時前

BTC/USDT Market Analysis | April 6th, 2025

Current Overview

At the time of analysis, BTC/USDT is trading near $81,916, down 0.97% in the last 24 hours. The short-term market shows signs of consolidation after recent volatility. Let's break down the technicals and project potential future movements.

Technical Indicator Breakdown

1. EMA & SAR (1H timeframe)

EMA(5): $82,263

EMA(10): $82,522

EMA(20): $82,786

SAR: $82,986 (trailing downward)

Price is currently trending below all EMAs, showing short-term bearish momentum. SAR dots above the candles indicate potential for continued downward pressure.

2. MACD (12,26,9)

MACD Line: -112.83

Signal Line (DEA): -171.81

Histogram: Negative, showing weakening bullish divergence

The MACD histogram shows no signs of reversal yet, keeping the short-term bias bearish.

3. KDJ (9,3,3)

K: 12.88

D: 18.55

J: 1.53

Oversold zone. Historically, such low KDJ readings can signal an upcoming bounce or temporary relief rally.

4. Volume Analysis

Decreasing trading volume on the decline hints at possible seller exhaustion. However, a volume spike is needed for a strong reversal confirmation.

$BTC

Multi-Timeframe Refinement

4H Chart View

EMAs aligned downward, but the price is approaching a key support zone (~$81,500).

A bullish divergence is brewing on MACD and RSI in this timeframe.

1D Chart View

Mid-term trend remains bullish as BTC is still above the macro EMA(50) despite short-term pullbacks.

Pullbacks toward the $81,000–$80,000 region can be considered healthy retests unless broken with high volume.

Short-Term Prediction (Next 24-48H)

Expect possible consolidation between $81,500 and $82,500

Break below $81,500 could test $80,000

If volume supports a rebound, a move toward $83,000 is possible

Mid-Term Outlook (Next 1–2 Weeks)

As long as BTC holds the macro uptrend support and global markets remain stable, a recovery toward $85,000–$86,500 remains viable.

Watch for macroeconomic data or policy news impacting investor sentiment.

Conclusion

BTC is experiencing short-term correction pressure, but indicators suggest a possible bounce if critical support holds. Multi-timeframe analysis strengthens the idea of cautious optimism while watching for confirmation through volume and bullish divergence.

What’s your strategy for this range-bound action? Share your thoughts below and let’s discuss the next move together.

BTC-1.15%

MOVE-0.82%

Nusrat_Mim_CryptoQue

15小時前

$SUI

SUI/USDT Technical Analysis & Forecast – Bearish Momentum or Buy-the-Dip Opportunity?

The current SUI/USDT market is showing clear short-term weakness, with the price hovering around $2.1394, down by 4.15% in the past 24 hours. After hitting a local high of $2.3019, the price has gradually declined to a low of $2.1277, indicating intensified selling pressure.

1H Chart Breakdown:

EMA Analysis: EMA(5) = 2.1471, EMA(10) = 2.1585, EMA(20) = 2.1759

These short-term EMAs are currently acting as resistance, confirming a bearish crossover.

SAR: Parabolic SAR at 2.1957 remains above the price, suggesting continued downtrend pressure.

MACD: Negative values (MACD: -0.0033, DIF: -0.0214, DEA: -0.0181) point toward weak momentum.

KDJ: All values are declining; K: 17.30, D: 18.81, J: 14.29 – signaling oversold conditions.

EMV: EMV = -0.8558 and MAEMV = -0.6866 – confirming capital outflow and low ease of movement.

Multi-Timeframe Insights:

4H Chart (not shown): Longer-term indicators remain bearish but hint at possible support near $2.10.

Daily Chart: SUI is testing a previous breakout zone; a rebound is possible if volume picks up.

Volume Analysis: Volume is downtrending (Current MA(5): 164.95K vs MA(10): 189.33K), showing caution from both buyers and sellers.

Future Prediction & Scenarios

Bearish Continuation: If price breaks below $2.12 with volume, next support lies at $2.05–$2.00.

Bullish Reversal: Watch for a breakout above $2.18 with strong volume. If confirmed, next target is $2.25–$2.30.

Neutral Zone: Sideways consolidation between $2.12–$2.18 is possible if market remains uncertain.

Suggested Strategy:

Short-term traders: Wait for confirmation before entering – risk of fakeouts is high.

Long-term holders: Accumulation zone may be forming near $2.05–$2.10.

Watchlist Levels: $2.05 (support), $2.18 (resistance), $2.30 (breakout confirmation)

UP-3.77%

NEAR-0.41%

相關資產

最近新增

最近新增的加密貨幣

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 Jambo。