Bitget:全球日交易量排名前 4!

BTC 市占率60.89%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87184.99 (-0.67%)恐懼與貪婪指數47(中性)

比特幣現貨 ETF 總淨流量:+$26.8M(1 天);+$855.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.89%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87184.99 (-0.67%)恐懼與貪婪指數47(中性)

比特幣現貨 ETF 總淨流量:+$26.8M(1 天);+$855.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.89%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$87184.99 (-0.67%)恐懼與貪婪指數47(中性)

比特幣現貨 ETF 總淨流量:+$26.8M(1 天);+$855.3M(7 天)。盤前交易幣種PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

.png)

Rekt (rektcoin.com) 價格REKT

未上架

報價幣種:

TWD

數據來源於第三方提供商。本頁面和提供的資訊不為任何特定的加密貨幣提供背書。想要交易已上架幣種? 點擊此處

NT$0.{5}1643+4.68%1D

價格走勢圖

最近更新時間 2025-03-26 21:55:41(UTC+0)

市值:NT$420,254,253.18

完全稀釋市值:NT$420,254,253.18

24 小時交易額:NT$36,094,155.78

24 小時交易額/市值:8.58%

24 小時最高價:NT$0.{5}1732

24 小時最低價:NT$0.{5}1548

歷史最高價:NT$0.{4}1450

歷史最低價:NT$0.{5}1028

流通量:255,779,580,000,000 REKT

總發行量:

420,690,000,000,000REKT

流通率:60.00%

最大發行量:

--REKT

以 BTC 計價:0.{12}5704 BTC

以 ETH 計價:0.{10}2478 ETH

以 BTC 市值計價:

NT$0.22

以 ETH 市值計價:

NT$0.03

合約:

0xb3e3...291ebba(Base)

更多

您今天對 Rekt (rektcoin.com) 感覺如何?

注意:此資訊僅供參考。

Rekt (rektcoin.com) 今日價格

Rekt (rektcoin.com) 的即時價格是今天每 (REKT / TWD) NT$0.{5}1643,目前市值為 NT$420.25M TWD。24 小時交易量為 NT$36.09M TWD。REKT 至 TWD 的價格為即時更新。Rekt (rektcoin.com) 在過去 24 小時內的變化為 4.68%。其流通供應量為 255,779,580,000,000 。

REKT 的最高價格是多少?

REKT 的歷史最高價(ATH)為 NT$0.{4}1450,於 2024-11-22 錄得。

REKT 的最低價格是多少?

REKT 的歷史最低價(ATL)為 NT$0.{5}1028,於 2025-03-13 錄得。

Rekt (rektcoin.com) 價格預測

REKT 在 2026 的價格是多少?

根據 REKT 的歷史價格表現預測模型,預計 REKT 的價格將在 2026 達到 NT$0.{5}2049。

REKT 在 2031 的價格是多少?

2031,REKT 的價格預計將上漲 -3.00%。 到 2031 底,預計 REKT 的價格將達到 NT$0.{5}2889,累計投資報酬率為 +85.35%。

Rekt (rektcoin.com) 價格歷史(TWD)

過去一年,Rekt (rektcoin.com) 價格上漲了 -74.27%。在此期間, 兌 TWD 的最高價格為 NT$0.{4}1450, 兌 TWD 的最低價格為 NT$0.{5}1028。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h+4.68%NT$0.{5}1548NT$0.{5}1732

7d+23.88%NT$0.{5}1295NT$0.{5}1732

30d-27.36%NT$0.{5}1028NT$0.{5}2268

90d-74.05%NT$0.{5}1028NT$0.{5}6884

1y-74.27%NT$0.{5}1028NT$0.{4}1450

全部時間-68.46%NT$0.{5}1028(2025-03-13, 14 天前 )NT$0.{4}1450(2024-11-22, 125 天前 )

Rekt (rektcoin.com) 市場資訊

Rekt (rektcoin.com) 持幣分布集中度

巨鯨

投資者

散戶

Rekt (rektcoin.com) 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Rekt (rektcoin.com) 評級

社群的平均評分

4.4

此內容僅供參考。

REKT 兌換當地法幣匯率表

1 REKT 兌換 MXN$01 REKT 兌換 GTQQ01 REKT 兌換 CLP$01 REKT 兌換 UGXSh01 REKT 兌換 HNLL01 REKT 兌換 ZARR01 REKT 兌換 TNDد.ت01 REKT 兌換 IQDع.د01 REKT 兌換 TWDNT$01 REKT 兌換 RSDдин.01 REKT 兌換 DOP$01 REKT 兌換 MYRRM01 REKT 兌換 GEL₾01 REKT 兌換 UYU$01 REKT 兌換 MADد.م.01 REKT 兌換 AZN₼01 REKT 兌換 OMRر.ع.01 REKT 兌換 KESSh01 REKT 兌換 SEKkr01 REKT 兌換 UAH₴0

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-26 21:55:41(UTC+0)

Rekt (rektcoin.com) 動態

由於市場對關稅做出反應,比特幣跌至 84,000 美元以下

Coinjournal•2025-03-02 01:33

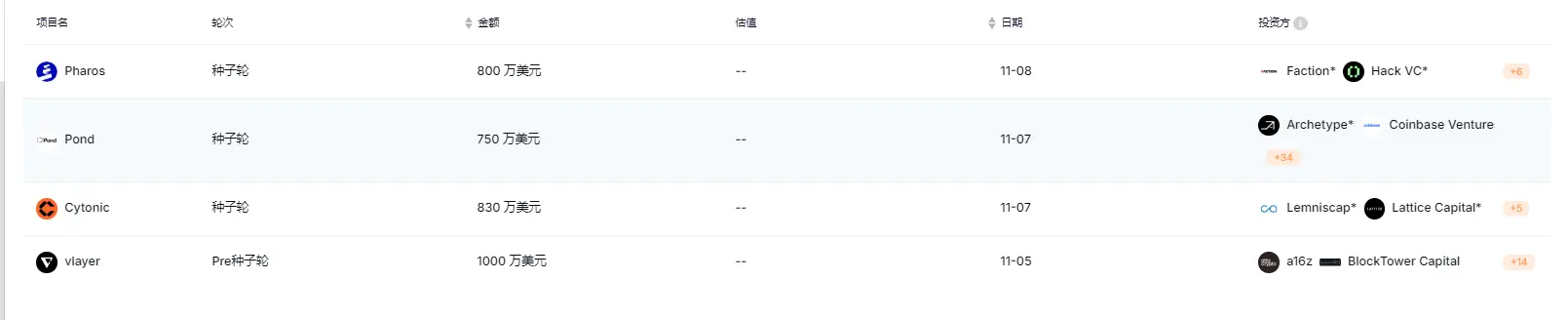

上週加密市場共發生 22 起公開融資事件,累計融資約 4114 萬美元 | 投融資週報

比特幣 L2 互操作層 Map Protocol 完成 100 萬美元戰略融資,Gryps 參投;Binance Labs 宣布投資 BIO Protocol;鏈上身份系統 Phi 完成新一輪戰略融資,Neoclassic Capital 領投

Chaincatcher•2024-11-12 01:22

NFT 項目 Rekt Drinks 的母公司 Rekt 完成了價值 150 萬美元的種子輪融資

Bitget•2024-11-08 12:22

分析師:BTC價格有望迎來重大突破

Bitget•2024-10-20 15:28

比特幣猛漲警告「大清算來了」,分析師:全網未平倉合約、高風險借貸率過高

Blocktempo動區動趨•2024-10-19 04:00

購買其他幣種

用戶還在查詢 Rekt (rektcoin.com) 的價格。

Rekt (rektcoin.com) 的目前價格是多少?

Rekt (rektcoin.com) 的即時價格為 NT$0(REKT/TWD),目前市值為 NT$420,254,253.18 TWD。由於加密貨幣市場全天候不間斷交易,Rekt (rektcoin.com) 的價格經常波動。您可以在 Bitget 上查看 Rekt (rektcoin.com) 的市場價格及其歷史數據。

Rekt (rektcoin.com) 的 24 小時交易量是多少?

在最近 24 小時內,Rekt (rektcoin.com) 的交易量為 NT$36.09M。

Rekt (rektcoin.com) 的歷史最高價是多少?

Rekt (rektcoin.com) 的歷史最高價是 NT$0.{4}1450。這個歷史最高價是 Rekt (rektcoin.com) 自推出以來的最高價。

我可以在 Bitget 上購買 Rekt (rektcoin.com) 嗎?

可以,Rekt (rektcoin.com) 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 Rekt (rektcoin.com) 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Rekt (rektcoin.com)?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

在哪裡可以購買加密貨幣?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Rekt (rektcoin.com))具有市場風險。Bitget 為您提供購買 Rekt (rektcoin.com) 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Rekt (rektcoin.com) 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

Cointribune EN

18小時前

A Rare Signal Is Activating: Bitcoin Ready To Explode

For the first time in eight months, the Hash Ribbon, a key indicator of Bitcoin miners’ health, has just issued a buy signal. A rare event, often a precursor to major reversals. As Bitcoin flirts with $87,492, this technical alert is accompanied by another signal: the break of a historic downtrend on the RSI. Coincidence? Not if you believe the experts.

Since July 2024, the Hash Ribbon had not flashed green. Its awakening on March 24 acts like an electric shock.

Created by Capriole Investments, this tool analyzes the cycles of miners through two moving averages of the hash rate (30 and 60 days). When the short average surpasses the long one, capitulations fade. Miners, previously strangled by declining profitability, are back in the game.

A signal that transcends charts. Historically, each activation of the Hash Ribbon has preceded major rallies.

In July 2024, Bitcoin was still struggling to find a floor, but the bullish movement ultimately swept away the skeptics. A similar scenario occurred in August 2023: after months of hesitation, the price took off.

Today, traders anticipate a repetition of the pattern. “This is a macro-bullish trend,” emphasizes Titan of Crypto on X.

The technological dynamics as an accelerator. Ryan Lee, chief analyst at Bitget, observes a growing correlation between Bitcoin and tech values:

The recent rise in cryptocurrency-related stocks, alongside gains in Bitcoin and the Nasdaq, reflects the growing appetite for risk assets. BTC is now treated as a tech asset rather than just a hedge, driven by innovation and ETF adoption.

But that’s not all. In the shadow of the Hash Ribbon, another key indicator draws a metamorphosis: the Relative Strength Index (RSI).

On the weekly chart, a bullish divergence has formed for the first time since September. Translation? The selling momentum is fading, despite still timid prices.

On the daily chart, the RSI has breached a resistance that had been in place since November. “The multi-month downtrend is over,” confirms Rekt Capital , a technical analyst. A symbolic break, often interpreted as the prelude to a price acceleration.

For Bitcoin, it’s a relief after a disappointing first quarter of 2025, marked by erratic volatility. The convergence between Hash Ribbon and RSI is not insignificant. One validates the network’s strength, the other measures overbought or oversold conditions. Together, they form a coherent narrative: technical fundamentals and miner activity align for a recovery. The question remains whether institutional investors , often hesitant in times of doubt, will join the dance.

BTC-0.25%

RARE-5.45%

Cointribune EN

2天前

Bitcoin Under Pressure This Week With Conflicting Macro And Technical Signals

This week, bitcoin takes us on a new dance between trembling hopes and very real risks. Between technical analyses, macro data, and market signals, the suspense is total. So, are you ready to take stock together of what this new crypto adventure has in store for us? Follow the guide!

The bitcoin market is moving, trembling, hesitating… and with it, the emotions of investors. Here are the 5 key points to absolutely know this week to avoid navigating blindly in this choppy sea.

Bitcoin is flirting with its highest peaks of the last two weeks… but behind the scenes, traders are tense. Despite a surge of nearly 15% from its recent lows, the atmosphere is far from euphoric. After recently going above 85,000 dollars , CrypNuevo, sensing a new jolt orchestrated by market makers, anticipates a return of BTC around 80,000 dollars.

HTL-NL, for its part, sees 90,000 dollars as a ceiling before the reversal. Even Arthur Hayes speaks of a spike to 110,000 dollars followed by a 30% correction. Suffice it to say that calm is relative, and the market could still surprise us.

On Thursday, March 28, we have an appointment with the PCE, this inflation index loved by the FED. In February, it had already calmed things down. If it remains under control, it could give a bit of oxygen to risky assets, including bitcoin. Especially since the market firmly believes in a rate decrease by June 2025.

But beware: with the increase in bitcoin mining difficulty expected for April , the hikes in customs tariffs during the same month could further jam the machine. Jerome Powell has said: inflation of goods, largely, comes from that. So, good news or bad surprise? Verdict at the end of the week.

Among the indicators that traders love, RSI is playing the seducer this week. On daily to weekly charts, it is attempting a bullish breakout, abandoning a bearish trend that has lasted since November. Rekt Capital and Matthew Hyland see it as a nice sign of a bullish continuation.

Currently, the daily RSI is hovering around 51.4, a key level. It may be subtle, but in the world of bitcoin, this kind of sign can sometimes be the starting point for a nice surge. To be watched closely as the bullish trend of BTC is at stake.

Short-term holders (STH), these investors who have had their BTC for only a few months, are going through a complicated period. According to Glassnode, their unrealized losses have exploded, flirting with critical levels. The result: some are panicking and selling at a loss. This explains the 100 million dollars lost a few days ago by short-term traders.

In one month, we talk about 7 billion dollars gone. That’s huge, but far from the records of 2021-2022. The bitcoin market is purging the most fragile, as often. Those who hold firm might well reap the rewards… provided they have a strong heart.

And in the meantime, Binance is thriving. The stablecoin reserves on the platform reached a new record: over 31.8 billion dollars. A number that speaks volumes about the renewed confidence of investors. These funds, well protected, are waiting for the right moment to be deployed.

For some, this is a sign that the market is lying in wait. Binance remains the king of volume, and if the capital is there, it may be because a next movement is preparing. A strategic calm before a new bullish storm? Will bitcoin benefit from this surge?

Bitcoin is really advancing like a tightrope walker. On one hand, technical indicators like the RSI suggest a potential rebound; on the other hand, experienced traders fear a sharp pullback to 80,000 dollars. Add to that the PCE and tariff tensions… and you have an explosive cocktail. So, what posture to adopt?

Stay clear-headed, agile, and ready to react. Neither euphoria nor panic: just a good dose of cold blood. It is in these moments of uncertainty that the best decisions are made. Keep an eye on key supports, and do not let emotions drive your movements.

Thus, bitcoin offers us a week full of promises… and traps. Between technical signals, macro tensions, and market behaviors, every movement counts. So stay curious, vigilant, and a bit patient, especially at this moment when the BTC has just reached 1.3% of the global currency .

BTC-0.25%

S-0.67%

Cryptonews Official

2天前

Dormant whale awakens after 8 years, moves $250m worth of Bitcoin: Arkham

A long-dormant Bitcoin wallet has suddenly woken up after eight years of inactivity. According to blockchain analytics firm Arkham Intelligence, the whale has moved over $250 million worth of Bitcoin.

The transactions were executed within the last 16 hours and show that the value of the holdings has appreciated from approximately $3 million in early 2017 to over $250 million today. Before yesterday’s transfers, the wallet had maintained its Bitcoin ( BTC ) in a single address for more than eight years.

$250M BITCOIN WHALE WAKES UP AFTER 8 YEARS A Bitcoin Whale that has held BTC since late 2016 has just moved over $250M in BTC last night. His Bitcoin stack went from $3M in early 2017 to over $250M today – and he’s held Bitcoin on one address for over 8 years. pic.twitter.com/RF1aewYVgy

The transactions, visible on Arkham’s monitoring dashboard, show the funds moving between several wallets labeled as “250M BTC Whale” addresses.

Specifically, the transactions took place in two batches about 14-16 hours ago, with each transfer involving approximately 3,000 BTC worth roughly $252 million per transfer.

According to the transaction history, the Bitcoin was originally purchased around 2016, when BTC traded at approximately $1,000 or lower.

Before these recent movements, the last transactions from these wallets occurred around 8 years ago, as shown by the timestamps in Arkham’s data—the early transactions from 2016 show the accumulation of Bitcoin when the cryptocurrency was less valuable.

The awakening of dormant wallets from Bitcoin’s earlier years has become increasingly rare. These events offer a glimpse into the major wealth creation experienced by early adopters who maintained their holdings through multiple market cycles.

While some long-term holders maintain their Bitcoin positions, industry experts are debating whether Bitcoin’s traditional four-year market cycle will be sustained into the future. Tomas Greif, Chief of Product & Strategy at Braiins, recently questioned the sustainability of these cycles:

Is the 4-year bitcoin cycle dead? Early on, halvings had a major supply impact. But as the majority of BTC has been mined, their effect is shrinking. In a couple of halvings, they will have a negligible effect on supply. I once tried to trade the cycle theory and got rekt.… pic.twitter.com/Z1zOZhAKy2

“Is the 4-year bitcoin cycle dead? Early on, halvings had a major supply impact. But as the majority of BTC has been mined, their effect is shrinking. In a couple of halvings, they will have a negligible effect on supply,” Greif noted.

He suggests that while historical patterns may continue as a “self-fulfilling prophecy,” the fundamental impact of halvings on Bitcoin’s supply disappears with each cycle. Greif emphasized that halvings will continue to affect Bitcoin mining economics regardless of market cycles.

BTC-0.25%

UP+3.64%

Sonny

4天前

More ETFs that only come out during the home straight

Retail will get rekt, again

Mingo

2025/03/18 13:15

At some point the market will run it back turbo

You need to be ready for this moment

If you are afraid of getting rekt again, focus on buying BTC

You will most likely outperform many if you buy BTC during the fear

BTC-0.25%

TURBO+0.72%