Bitget:全球日交易量排名前 4!

BTC 市占率61.29%

Bitget 新幣上架 : Pi Network

BTC/USDT$82187.50 (-0.41%)恐懼與貪婪指數32(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.29%

Bitget 新幣上架 : Pi Network

BTC/USDT$82187.50 (-0.41%)恐懼與貪婪指數32(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.29%

Bitget 新幣上架 : Pi Network

BTC/USDT$82187.50 (-0.41%)恐懼與貪婪指數32(恐懼)

山寨季指數:0(比特幣季)

盤前交易幣種PAWS,WCT比特幣現貨 ETF 總淨流量:-$93.2M(1 天);+$445.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Legend of Arcadia 價格ARCA

上架

報價幣種:

TWD

NT$0.7720+0.95%1D

價格走勢圖

TradingView

最近更新時間 2025-03-30 23:15:16(UTC+0)

市值:--

完全稀釋市值:--

24 小時交易額:NT$4,329,473.85

24 小時交易額/市值:0.00%

24 小時最高價:NT$0.7744

24 小時最低價:NT$0.7597

歷史最高價:NT$1.54

歷史最低價:NT$0.5341

流通量:-- ARCA

總發行量:

1,000,000,000ARCA

流通率:0.00%

最大發行量:

1,000,000,000ARCA

以 BTC 計價:0.{6}2831 BTC

以 ETH 計價:0.{4}1292 ETH

以 BTC 市值計價:

--

以 ETH 市值計價:

--

合約:

0xDD17...5977AcF(Base)

更多

您今天對 Legend of Arcadia 感覺如何?

注意:此資訊僅供參考。

Legend of Arcadia 今日價格

Legend of Arcadia 的即時價格是今天每 (ARCA / TWD) NT$0.7720,目前市值為 NT$0.00 TWD。24 小時交易量為 NT$4.33M TWD。ARCA 至 TWD 的價格為即時更新。Legend of Arcadia 在過去 24 小時內的變化為 0.95%。其流通供應量為 0 。

ARCA 的最高價格是多少?

ARCA 的歷史最高價(ATH)為 NT$1.54,於 2024-12-27 錄得。

ARCA 的最低價格是多少?

ARCA 的歷史最低價(ATL)為 NT$0.5341,於 2024-11-17 錄得。

Legend of Arcadia 價格預測

ARCA 在 2026 的價格是多少?

根據 ARCA 的歷史價格表現預測模型,預計 ARCA 的價格將在 2026 達到 NT$0.7417。

ARCA 在 2031 的價格是多少?

2031,ARCA 的價格預計將上漲 +20.00%。 到 2031 底,預計 ARCA 的價格將達到 NT$1.18,累計投資報酬率為 +54.72%。

Legend of Arcadia 價格歷史(TWD)

過去一年,Legend of Arcadia 價格上漲了 -33.31%。在此期間,ARCA 兌 TWD 的最高價格為 NT$1.54,ARCA 兌 TWD 的最低價格為 NT$0.5341。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h+0.95%NT$0.7597NT$0.7744

7d+3.85%NT$0.7331NT$0.7937

30d-3.91%NT$0.7110NT$0.8904

90d-36.48%NT$0.7110NT$1.22

1y-33.31%NT$0.5341NT$1.54

全部時間-33.88%NT$0.5341(2024-11-17, 134 天前 )NT$1.54(2024-12-27, 94 天前 )

Legend of Arcadia 市場資訊

Legend of Arcadia 行情

Legend of Arcadia 持幣分布集中度

巨鯨

投資者

散戶

Legend of Arcadia 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Legend of Arcadia 評級

社群的平均評分

4.6

此內容僅供參考。

ARCA 兌換當地法幣匯率表

1 ARCA 兌換 MXN$0.471 ARCA 兌換 GTQQ0.181 ARCA 兌換 CLP$21.611 ARCA 兌換 UGXSh84.261 ARCA 兌換 HNLL0.591 ARCA 兌換 ZARR0.431 ARCA 兌換 TNDد.ت0.071 ARCA 兌換 IQDع.د30.471 ARCA 兌換 TWDNT$0.771 ARCA 兌換 RSDдин.2.51 ARCA 兌換 DOP$1.471 ARCA 兌換 MYRRM0.11 ARCA 兌換 GEL₾0.061 ARCA 兌換 UYU$0.981 ARCA 兌換 MADد.م.0.221 ARCA 兌換 OMRر.ع.0.011 ARCA 兌換 AZN₼0.041 ARCA 兌換 KESSh2.981 ARCA 兌換 SEKkr0.231 ARCA 兌換 UAH₴0.95

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-30 23:15:16(UTC+0)

如何購買 Legend of Arcadia(ARCA)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 Legend of Arcadia 兌換為 ARCA

我們將為您示範使用多種支付方式在 Bitget 上購買 Legend of Arcadia

了解更多Legend of Arcadia 動態

Bitget 現貨交易BOT新增3個交易對的公告

Bitget Announcement•2024-12-16 12:56

深入探討阿卡迪亞未來價值的傳奇:分析$ARCA的潛在上升空間

远山洞见•2024-11-06 10:06

Legend of Arcadia(ARCA):將邊玩邊賺(Play to Earn)帶入玩具英雄的奇幻世界

什麼是 Legend of Arcadia(ARCA)? Legend of Arcadia (ARCA)是一款多鏈、免費、邊玩邊賺的策略卡牌遊戲,其遊戲模式專為單人玩家和多人競技戰鬥而設計。玩家可以進入一個充滿「玩具英雄(Toy Hero)」的幻想世界,而這些角色可以被當作非同質化代幣(Non-Fungible Token, NFT)來收藏和交易。這些 NFT 玩具英雄是遊戲的核心,讓玩家可以組建團隊、制定策略、參與各種挑戰。 遊戲玩法本身受到經典的角色扮演和卡牌遊戲的啟發,例如:「英雄征戰(Hero Wars)」和「劍與遠征(AFK Arena)」等,玩家將每位擁有獨特技能和力量的英雄組

Bitget Academy•2024-11-05 07:24

今日漲幅前五名:ARCA 24小時漲幅達238.45%

Bitget•2024-11-05 00:21

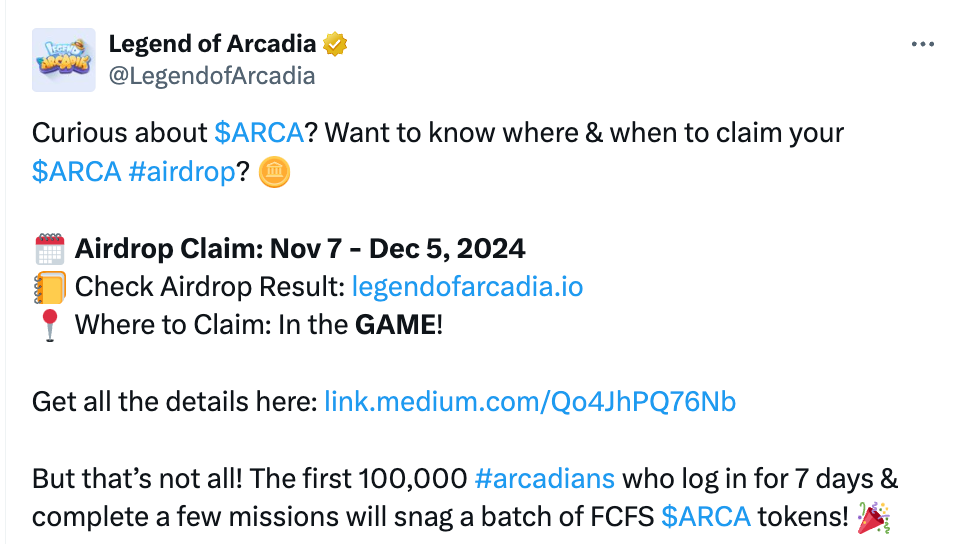

前10萬名連續7天登入並完成一些任務的Arcadians將獲得一批先到先得的$ARCA代幣

X•2024-11-04 07:08

購買其他幣種

用戶還在查詢 Legend of Arcadia 的價格。

Legend of Arcadia 的目前價格是多少?

Legend of Arcadia 的即時價格為 NT$0.77(ARCA/TWD),目前市值為 NT$0 TWD。由於加密貨幣市場全天候不間斷交易,Legend of Arcadia 的價格經常波動。您可以在 Bitget 上查看 Legend of Arcadia 的市場價格及其歷史數據。

Legend of Arcadia 的 24 小時交易量是多少?

在最近 24 小時內,Legend of Arcadia 的交易量為 NT$4.33M。

Legend of Arcadia 的歷史最高價是多少?

Legend of Arcadia 的歷史最高價是 NT$1.54。這個歷史最高價是 Legend of Arcadia 自推出以來的最高價。

我可以在 Bitget 上購買 Legend of Arcadia 嗎?

可以,Legend of Arcadia 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 legend-of-arcadia 指南。

我可以透過投資 Legend of Arcadia 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Legend of Arcadia?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 Legend of Arcadia(ARCA)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Legend of Arcadia)具有市場風險。Bitget 為您提供購買 Legend of Arcadia 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Legend of Arcadia 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

MartyParty_

3天前

#Solana ETF Update: @Fidelity joins 6 other applicants waiting on #SEC approval under new @CBOE BZX 14.11 (e)(4) rule change to "Commodity Based Share Trusts" - to make #SEC approved Spot Solana ETFs.

If any of these get approved then $SOL is reclassified a "commodity" by the #SEC and joins only $BTC and $ETH with this status. $SOL is already classified as a commodity by the #CFTC who approved the listing of @VolShares $SOL Futures products recently.

Franklin Templeton @FTI_US

Franklin Templeton, a major asset manager with over $1.5 trillion in assets, filed for a spot Solana ETF with the SEC. The filing includes both S-1 and 19b-4 forms, with the proposed Franklin Solana ETF intended to be listed on the Cboe BZX Exchange. The SEC has acknowledged this filing, marking a significant step forward. The review process is ongoing, with public comments being sought as part of the standard procedure.

VanEck @vaneck_us

VanEck was one of the first to file for a spot Solana ETF, submitting its 19b-4 application on June 27, 2024, followed by an S-1 form. The filing was added to the Federal Register on February 19, 2025, triggering a 240-day review period, with a potential approval decision expected by October 2025. The ETF is also proposed for listing on the Cboe BZX Exchange.

21Shares @21Shares

21Shares filed its spot Solana ETF application shortly after VanEck on June 28, 2024. Like VanEck’s, this filing was officially added to the Federal Register on February 19, 2025, setting a potential approval deadline in October 2025. It is also slated for the Cboe BZX Exchange.

Bitwise @bitwise

Bitwise submitted an S-1 form for its spot Solana ETF in November 2024, after withdrawing an earlier Delaware trust filing. The 19b-4 form was refiled and added to the Federal Register on February 19, 2025, aligning its review timeline with VanEck and 21Shares for a possible October 2025 decision. The Bitwise Solana ETF is planned for listing on the Cboe BZX Exchange.

Canary Capital @CanaryFunds

Canary Capital filed for a spot Solana ETF in late October 2024, with its application joining the others in the Federal Register on February 19, 2025. This sets its potential approval timeline to October 2025 as well, with the Cboe BZX Exchange as the proposed listing venue.

Grayscale @Grayscale

Grayscale filed a 19b-4 form on December 3, 2024, to convert its existing Grayscale Solana Trust (GSOL) into a spot ETF, to be listed on the NYSE Arca. The SEC acknowledged this filing, and it entered the public comment phase, with a notable deadline for a decision set for October 2025 following its Federal Register listing. This application is distinct as it involves converting an existing trust rather than launching a new fund.

Fidelity @Fidelity

Fidelity recently joined the race by filing an application for a spot Solana ETF, with Cboe submitting the necessary paperwork. While specific dates are less clear compared to others, it is part of the ongoing wave of Solana ETF proposals under SEC review as of early 2025.

BTC-0.46%

ETH-1.36%

comcomabbi

2025/03/21 01:27

News Alert For PI Network?

Now don't miss out on MIRA Network!

Download MIRA Network now and mine Lumira coins. maximum supply of just 250M.

Use The invitation code: comcomabbi

ARCA+1.99%

PI-4.15%

Crypto News Flash

2025/03/18 15:25

Dogecoin Network Booms – Will DOGE Rally to $6 Next?

Dogecoin (DOGE), a leader in the memecoin space, is gaining wide attention amid booming network activity. Driven by strong investor sentiment, Dogecoin address activity has seen a massive spike, raising discussions about DOGE hitting $6.

In an X post , onchain analyst Ali Martinez pointed out that Dogecoin active addresses surged 400%, reaching nearly 395,000. This surge demonstrates the usefulness and engagement within the Dogecoin ecosystem despite wider market volatility.

Additionally, Martinez highlighted the Stochastic Relative Strength Index (RSI) crossover for the Dogecoin price. This technical indicator provides a more sensitive reading of market momentum and potential trend reversal. Based on historical trends, a bullish crossover in the Stochastic RSI on Dogecoin’s weekly chart could signal a potential sharp rally.

In previous instances, this crossover has led to outstanding price surges, with gains of 88%, 187%, and 444%. In the current market cycle, some traders and analysts aim for gains between 200% and 300%. Crypto analyst Marzell has highlighted a critical DOGE support level at $0.14750. The analyst claims this level is crucial for a bullish breakout scenario.

Marzell noted that DOGE exhibits positive signals of breaking out of its falling wedge formation. Just like other known DOGE proponents, the analyst predicts a strong rally, potentially pushing DOGE prices between $0.46 and $0.65 if the support holds firm.

A rise in user engagement could provide DOGE with the essential push needed to break through resistance levels and launch a bullish trend.

Meanwhile, rising expectations for a Dogecoin ETF are probably the main cause of the increasing number of Dogecoin addresses. As we disclosed earlier, NYSE Arca has submitted a 19b-4 filing to the U.S. Securities and Exchange Commission (SEC). The stock exchange seeks approval to list and trade the Bitwise Dogecoin Exchange-Traded Fund (ETF).

According to the SEC filing, the Bitwise Dogecoin ETF is designed to track the price of DOGE. The fund would allow investors to gain exposure without directly holding or managing the asset.

The market has seen DOGE price trade at $0.1773, up 3.8% from the previous day. Following a recent price correction, DOGE has recovered from its weekly resistance of around $0.175.

As the bulls take charge, crypto analysts anticipate a Dogecoin price rally to $6. In his chart, Martinez displays Dogecoin’s price movement weekly from 2015 through early 2025.

The technical analysis reveals DOGE trading within a long-term logarithmic upward channel defined by parallel trend lines. The chart demonstrates that DOGE could hit the $6 level and beyond if it holds above the crucial supports. In our last update, we examined how Martinez predicted a moderate price of $3 for DOGE.

UP-2.37%

X+24.42%

Wu Blockchain

2025/03/12 16:05

BlockTower Capital has announced the spin-off of its venture capital division into Strobe Ventures, with plans to raise $100 million for its second fund. This spin-off follows BlockTower's merger announcement with Arca in November 2024. (The Block)

ARCA+1.99%

S+1.23%

BGUSER-QTXKB0T5

2025/03/12 07:37

The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (ETF), commonly known by its ticker symbol $MINT, is actively traded on the NYSE Arca exchange. This ETF seeks to maximize current income while preserving capital and maintaining daily liquidity. It invests at least 80% of its net assets in a diversified portfolio of fixed income instruments of varying maturities.

ARCA+1.99%

MINT-2.66%

相關資產

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 Legend of Arcadia。