Beginner's guide

Your First Crypto Spot Bots: Bitget Grid Trading

Beginner

2023-01-13 | 5m

What is Grid Trading?

Grid trading is a type of quantitative trading strategy designed to buy low and sell high in a consolidating

market. Grid Trading profits from the ups and downs of the market. You set a Price Range for the bot, set the number of grids you want, and as long as the price stays within your set range, the bot will always sell a portion when the price goes a bit up and buy a portion when it goes a bit down based on your setup.

Hence, Grid Trading is a bot that helps traders place strategic orders and create a so-called “price grid”. A price grid must be defined by a set of parameters, including:

-

The upper limit price: the highest price expected

-

The lower limit price: the lowest price expected

-

Number of grids: the maximum number of buy/sell orders assigned to the grid

-

Grid spacing: the price difference (arithmetic mode) or the percentage difference (geometric mode) between orders, and

-

Trigger/stop loss/take profit levels for the advanced settings.

This trading method has been well-established and well-tested in various

markets, especially the foreign exchange markets (forex). Bitget Team has developed the automated system and successfully integrated it into the platform so that our users can capitalize on the volatility of crypto assets as well.

The original idea behind the Grid Trading Strategy is to buy low and sell high. It works best when the asset is trading sideways -

the bot will constantly pair buy orders and sell orders within a trader’s preferred price range.

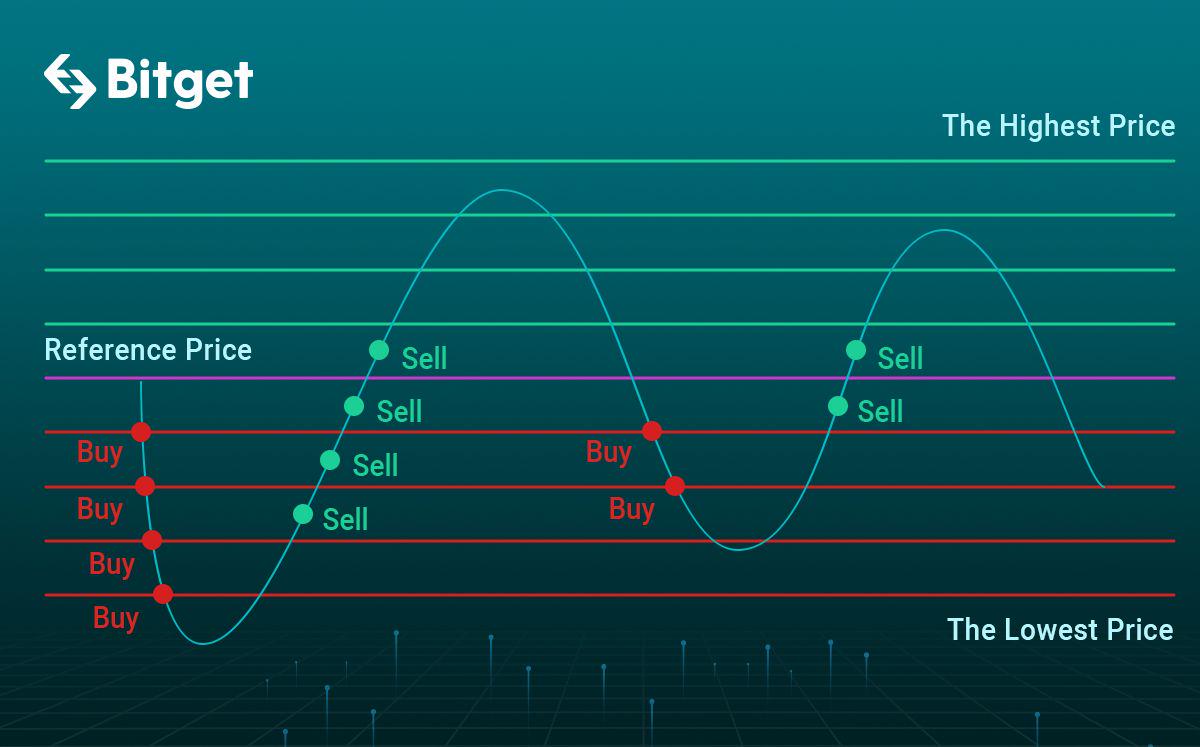

Look at the price grid above. Suppose a trader sets a lowest price and a highest price based on his/her personal preferences. Starting at

the current price level, the bot will place

the first buy order when price falls to the red line below the purple line. The price continues to decline but is still higher than the set lowest price; other

buy orders are placed consecutively afterwards. As we can see, now the price has fallen

below the lowest price - the bot no longer executes buy orders. When the price recovers,

sell orders are automatically completed based on the grid spacing.

These constant buy-and-sell orders rely on the assumption that the asset is oscillating sideways. Otherwise the trader could end up accumulating losing positions and experience heavy losses. Beginners should stick with major trading pairs such as btcusdT or ETHUSDT until they are used to the space and want to adjust their risk appetite accordingly.

Why Grid Trading?

Grid Trading is profitable if markets are bumpy, meaning traders do not need to constantly sit in front of the screen and predict the next price trend. It substantially takes advantage of the market’s natural movements in quieter times.

Besides, consider the amount of work associated with this strategy. The bot will do its job automatically after receiving the input data; of course you are recommended to routinely monitor the results and pay attention to market news, but in general it is simply trading without pain. One thing to keep in mind is Grid Trading involves the execution of many orders, therefore traders should monitor and adjust the number of trades to manage their trading fees wisely.

How to trade Spot Grid on Bitget

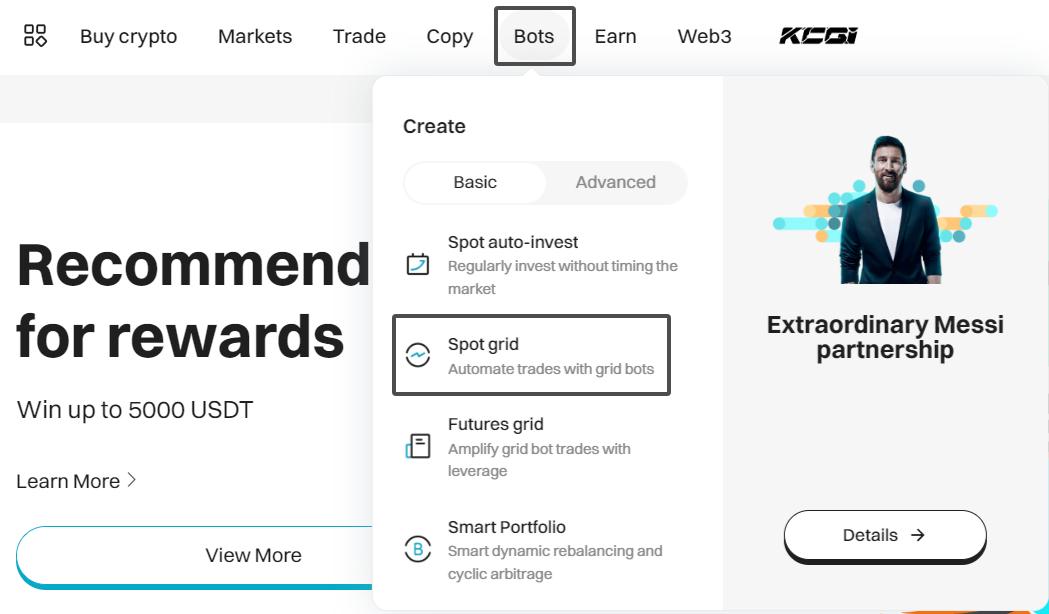

Step 1: Select Spot grid under Bots or head to our

Spot grid bots page.

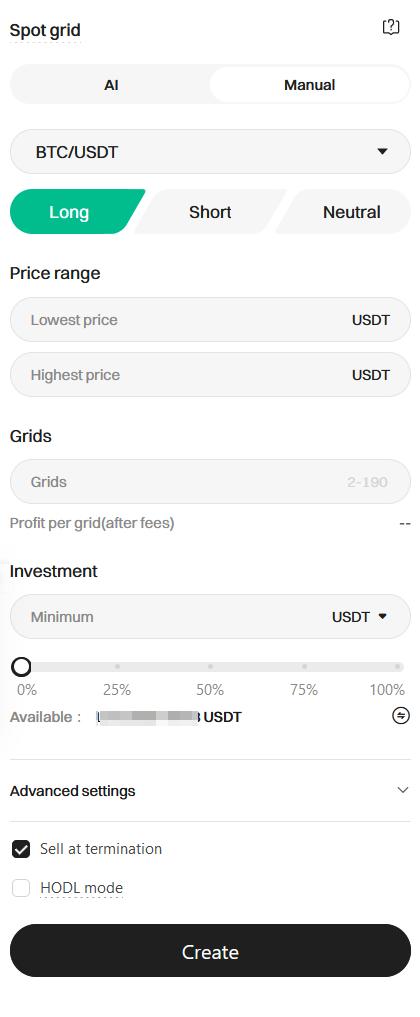

Step 2: Select a trading pair and prepare your strategy. You can either let AI take control of your trading strategy or fine-tune it yourself.

Refer to our guide on

our AI-Powered trading bots for more information.

More experienced traders can choose 'Manual' and create your custom strategy. Simply input the price range you wish to trade in, the number of grids, and your investment. Then click 'Create' to deploy your strategy.

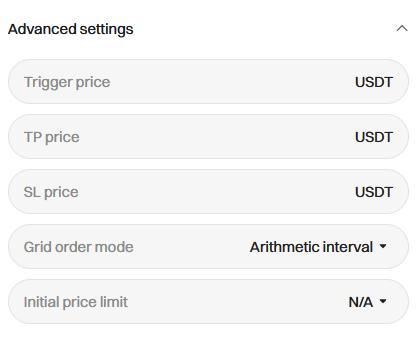

We also have advanced settings available. You can set the trigger price of your strategy, your take profit/stop loss, how your grids are calculated (geometric or arithmetic average), and your initial price limit (slippage).

You can also tick the first box to sell your assets at strategy termination, and tick the second box to

buy crypto at market price with your profit to have more assets to hodl.

That's it! Your first crypto spot bots are up and running!

Register your Bitget account to enjoy new user rewards and turn on your notifications for us on social media:

Share

How to sell PIBitget lists PI – Buy or sell PI quickly on Bitget!

Trade nowRecommended

We offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now