News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1CME Group to launch Solana futures as Bitcoin Pepe’s presale hits $3.65m2Trump directs working group to 'move forward' on SOL, XRP, and ADA Crypto Strategic Reserve3ADA, XRP, and TRUMP score largest daily gains as strategic reserve announcement boosts crypto market

Spot Bitcoin ETFs See $90M in Inflows After 8-Day Outflow Streak

The reversal follows a turbulent period that saw significant capital exits from Bitcoin ETFs, including a staggering $754.53 million outflow on February 26.

CryptoNews·2025/03/02 22:00

SEC Commissioner Caroline Crenshaw Dissents on Meme Coin Non-Security Ruling

Crenshaw argued that meme coins could meet the Howey test’s criteria.

CryptoNews·2025/03/02 22:00

Ethereum Researcher Proposes Shared Random Algorithm to Decentralize Block Building

The proposal suggests implementing a shared random algorithm to eliminate Maximal Extractable Value (MEV) at the block level and distribute block construction more equitably across the network.

CryptoNews·2025/03/02 22:00

Official Trump Fires Up 19.7% in Past 24 Hours as International Relations Heat: Can This Hold?

CryptoNews·2025/03/02 22:00

Swiss National Bank Rejects Bitcoin as Reserve Asset Over Stability and Security Concerns

Schlegel’s stance contradicts a proposal from Swiss Bitcoin nonprofit think tank 2B4CH, which aims to constitutionally mandate the SNB to hold Bitcoin on its balance sheet.

CryptoNews·2025/03/02 22:00

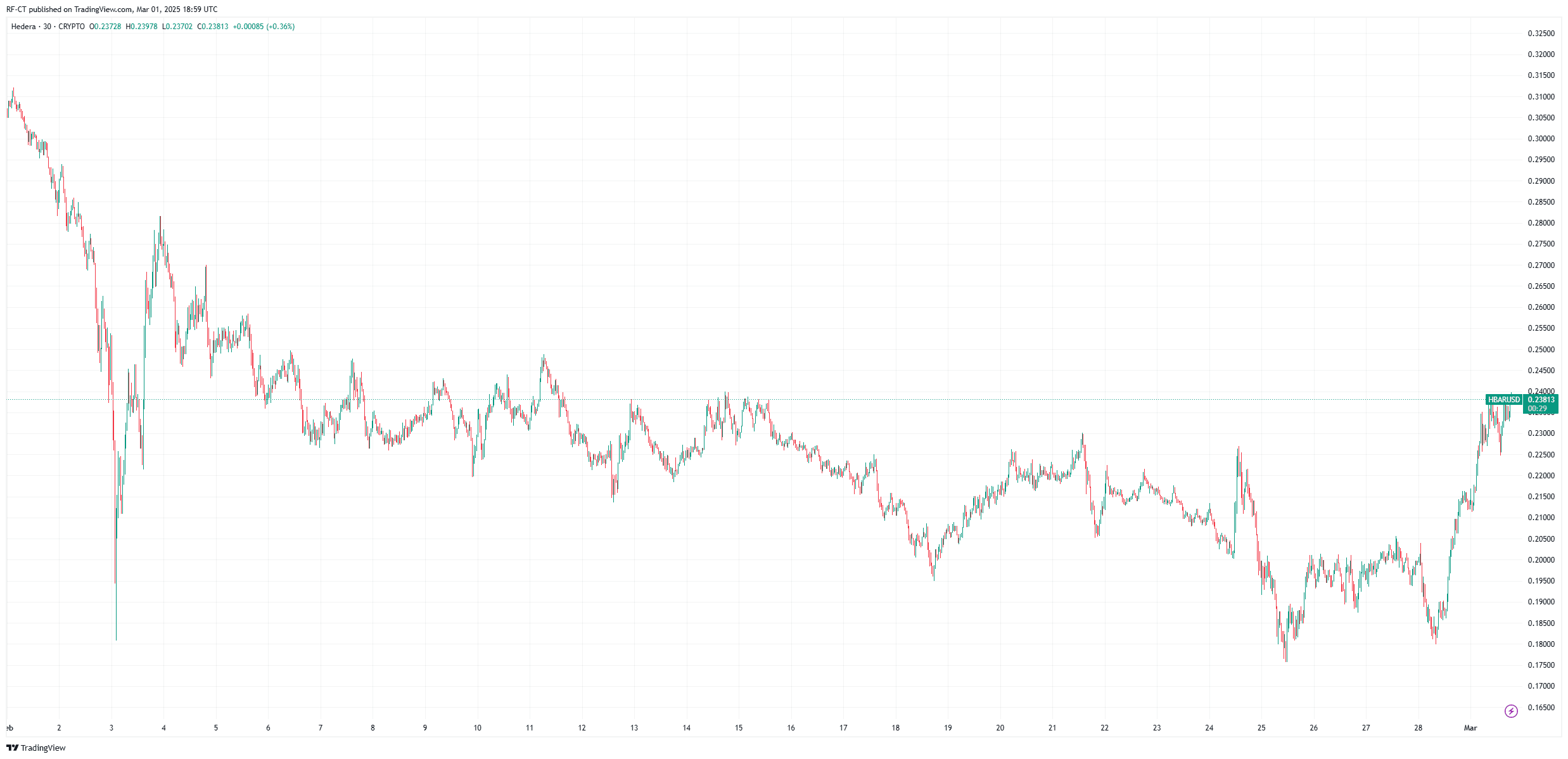

Snoop Dogg’s Tune.fm Partnership Drives HBAR Token Surge: Up 10.9% in Past 24 Hours

CryptoNews·2025/03/02 22:00

SEC to Host Crypto Talks, First Roundtable in March

CryptoNewsFlash·2025/03/02 20:11

El Salvador buys more Bitcoin, totaling 6.093,18 BTC

Portalcripto·2025/03/02 18:22

Trump Orders Development of Crypto Strategic Reserve Including SOL, XRP, and ADA

BTCPEERS·2025/03/02 09:30

Flash

- 04:04CME Bitcoin futures set a record gap of over $10,000ChainCatcher reports, according to Cointelegraph, that the Chicago Mercantile Exchange (CME) recorded its largest ever Bitcoin futures gap following US President Trump's announcement of a cryptocurrency strategic reserve. According to data from TradingView, this news added over $300 billion in trading volume to the spot market and resulted in a $10,000 gap in CME Bitcoin futures. This record gap surpassed the previous record slightly above $4,000 set in August 2024 as observed by Asymmetric founder Joe McCann on March 2nd. Analyst Rekt Capital pointed out: "Bitcoin has filled the CME gap between $92,800 and $94,000 formed during last week's spot market crash." He added that Bitcoin successfully filled two CME gaps within a week but also created a new massive gap ranging from $84,650 to $94,000 during this process.

- 03:49"Crypto Tsar" David Sacks confirmed that he had sold all his cryptocurrency holdings before taking up a position in the U.S. governmentThe head of artificial intelligence and encryption affairs at the White House in the United States, "Encryption Czar" David Sacks, confirmed on platform X that he had sold all his cryptocurrencies, including BTC, ETH, and SOL before starting administrative management.

- 03:37A certain address increased its holdings of 1397 MKR at an average price of $1538, approximately equivalent to $2.15 millionOnchain Data monitoring shows that 30 minutes ago, wallet 0xB4e withdrew 669 MKR (about $1.02 million) from CEX. In the past 24 hours, this wallet has withdrawn a total of 1,397 MKR with an average purchase price of $1,538, totaling approximately $2.15 million. Two years ago, this wallet had accumulated a purchase of 3,234 MKR at an average price of $757.