Investor Enthusiasm for Coinbase Shares May Prove Short-Lived: Berenberg

The crypto exchange is faced with several risks that could trigger a reversal of the stock’s recent gains, the report said.

Coinbase (COIN) shares have jumped more than 30% since June 15 following news that Blackrock (BLK) (ETF), outpacing the 20% gain in the bitcoin price over the same period, investment bank Berenberg said in a research report Thursday.

“We believe the surge in Coinbase’s share price was driven not only by the positive change in sentiment toward bitcoin and cryptocurrencies resulting from the prospect of the world’s largest asset manager playing a prominent role in the space, but also by the fact that the company was designated as the provider of custody for the fund,” analysts led by Mark Palmer wrote.

However, investors looking at the crypto exchange's shares as a play on increasing institutional adoption of digital assets should first consider the risks the company is facing that could trigger a reversal of the stock’s recent gains, the report said.

The U.S. Securities and Exchange Commission (SEC) said it was earlier this month, accusing it of violating federal securities law. The same day, a task force of 10 U.S. state regulators said it was coming after the firm, to residents.

Berenberg notes that the potential cease and desist orders on Coinbase’s staking rewards program are looming. The deadline is July 4, and the bank says it is highly unlikely Coinbase will be able to convince the states that their concerns are misplaced. Staking represented 9.5% of Coinbase’s net revenue in first-quarter 2023.

The downside from the loss of potential revenue from the staking rewards program is much larger than the potential upside from the firm’s role as custody provider for Blackrock’s planned spot bitcoin ETF, the note said.

The SEC could still target the USD Coin (USDC) stablecoin as an unregistered security, which would “jeopardize the significant amount of revenue that Coinbase generates from its portion of the interest income earned on the assets backing the stablecoin,” the report added.

The bank has a hold rating on the stock with a $39 price target. The shares closed at $72.43 on Thursday.

Edited by Sheldon Reback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

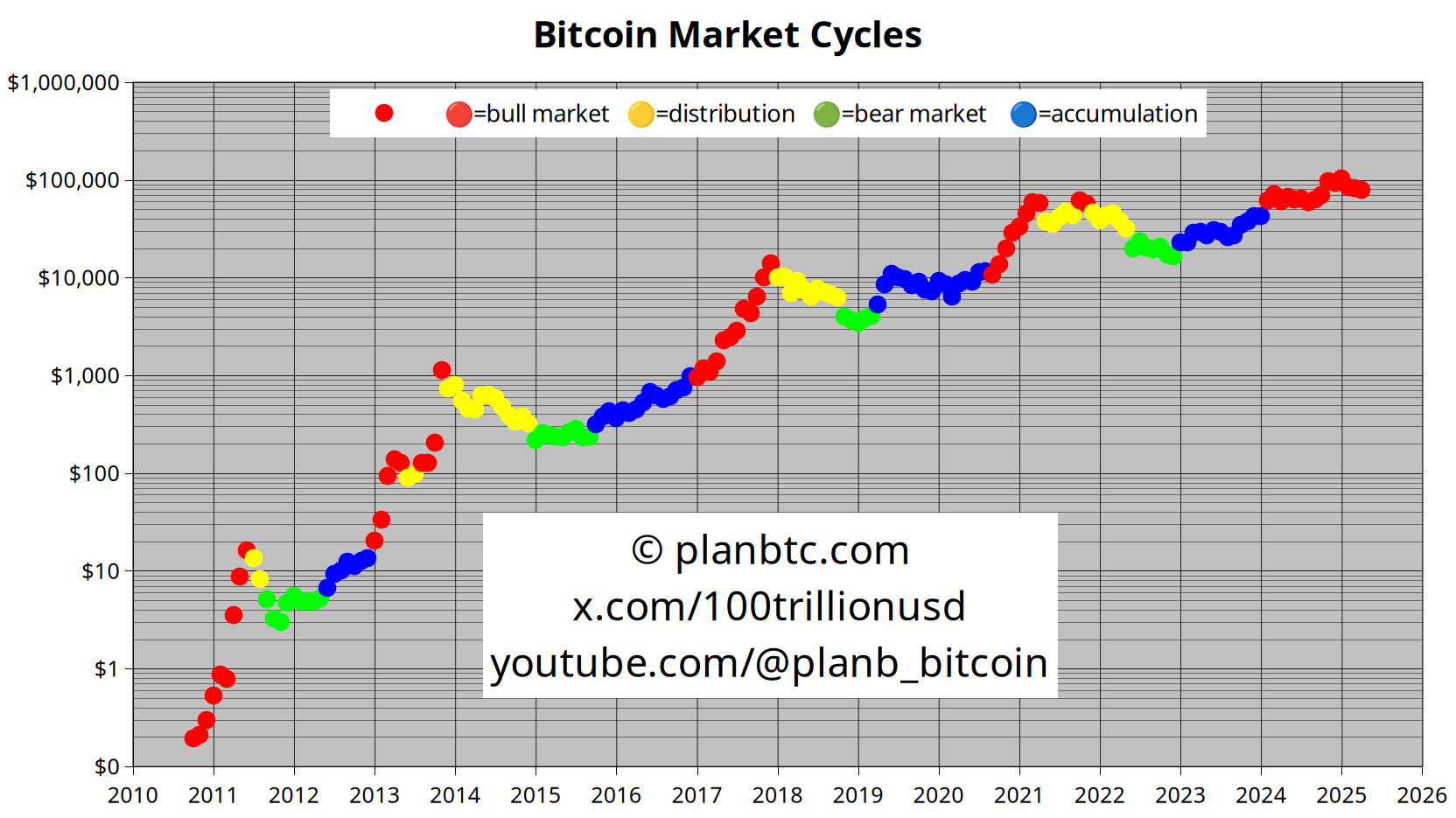

Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Cardano Surpasses Bitcoin and Ethereum in Institutional Inflows

VIPBitget VIP Weekly Research Insights

In recent weeks, rising risk-averse sentiment and declining demand for leverage have led to a sharp drop in yields across Earn products. On major DeFi platforms, stablecoin yields have fallen below 4%, while on centralized exchanges, yields on stablecoin-based Earn products now hover around 2%. In contrast, Bitget HodlerYield offers users a 10% APR on stablecoins, with no 7-day cooldown for withdrawals or claims. Funds can be deposited and redeemed instantly, offering greater convenience and flexibility.