ProShares' Bitcoin Futures ETF Racks Up Biggest Weekly Inflow in a Year

Investors poured in $65 million to BITO in the past week, the data shows, breaking its previous 2023 high of just over $40 million in April.

A flurry of Bitcoin ETF filings in the U.S. has almost instantly spurred interest in the asset from institutional investment circles.

ProShares’ Bitcoin Strategy ETF (BITO) – a Bitcoin futures fund offered in the U.S. – last week recorded the highest weekly inflow in over a year as bitcoin (BTC) prices breached the $30,000 level, by Bloomberg senior ETF analyst Eric Balchunas shows.

BITO allows investors to gain exposure to bitcoin-linked returns with a regulated product and holds over $1 billion worth of CME Bitcoin Futures, shows.

Investors poured in $65 million to BITO in the past week, the data shows, breaking a previous 2023 high of just over $40 million in April. As such, the product did not see meaningful inflows in May and most of June as demand for bitcoin lulled.

BITO has closely tracked spot bitcoin prices which has likely added to its allure among traders. “It pretty much has tracked bitcoin perfectly. It lagged spot by 1.05% (annually), but its fee is 0.95%,” Balchunas tweeted.

The BITO buying pressure likely indicates interest in bitcoin exposure among institutional investors closely on the back of a bitcoin ETF frenzy in the U.S.

Bitcoin prices rallied in the past two weeks as investment giant BlackRock (BLK) filed for a spot bitcoin ETF in the U.S.

The world's largest cryptocurrency by market capitalization touched $31,000 over the weekend to extend monthly gains to 14%, as per CoinGecko data.

The U.S. Securities and Exchange Commission (SEC) has consistently blocked spot products from launching, but BlackRock’s stature and history of ETF approvals have spurred for bitcoin among some traders.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

The unique value of Proof-of-Work (PoW) tokens lies in their mining mechanism and regulatory positioning. Research shows that mining costs are a defining feature of PoW tokens, involving significant investment in hardware and electricity. When market prices approach miners' breakeven points, miners tend to hold onto their coins in anticipation of future appreciation. This behavior reduces circulating supply, shifts the supply-demand balance, and may contribute to price increases. Regulatory clarity is also critical to the investment appeal of PoW tokens. Both BTC and LTC are classified as commodities by the U.S. SEC rather than securities, which simplifies the ETF approval process. In January 2024, the approval of the BTC spot ETF triggered significant institutional inflows. LTC is currently undergoing the ETF application process. While DOGE and KAS have not yet received formal classification, their PoW nature may position them for similar treatment. Together, these factors enhance market liquidity and attract more institutional investors.

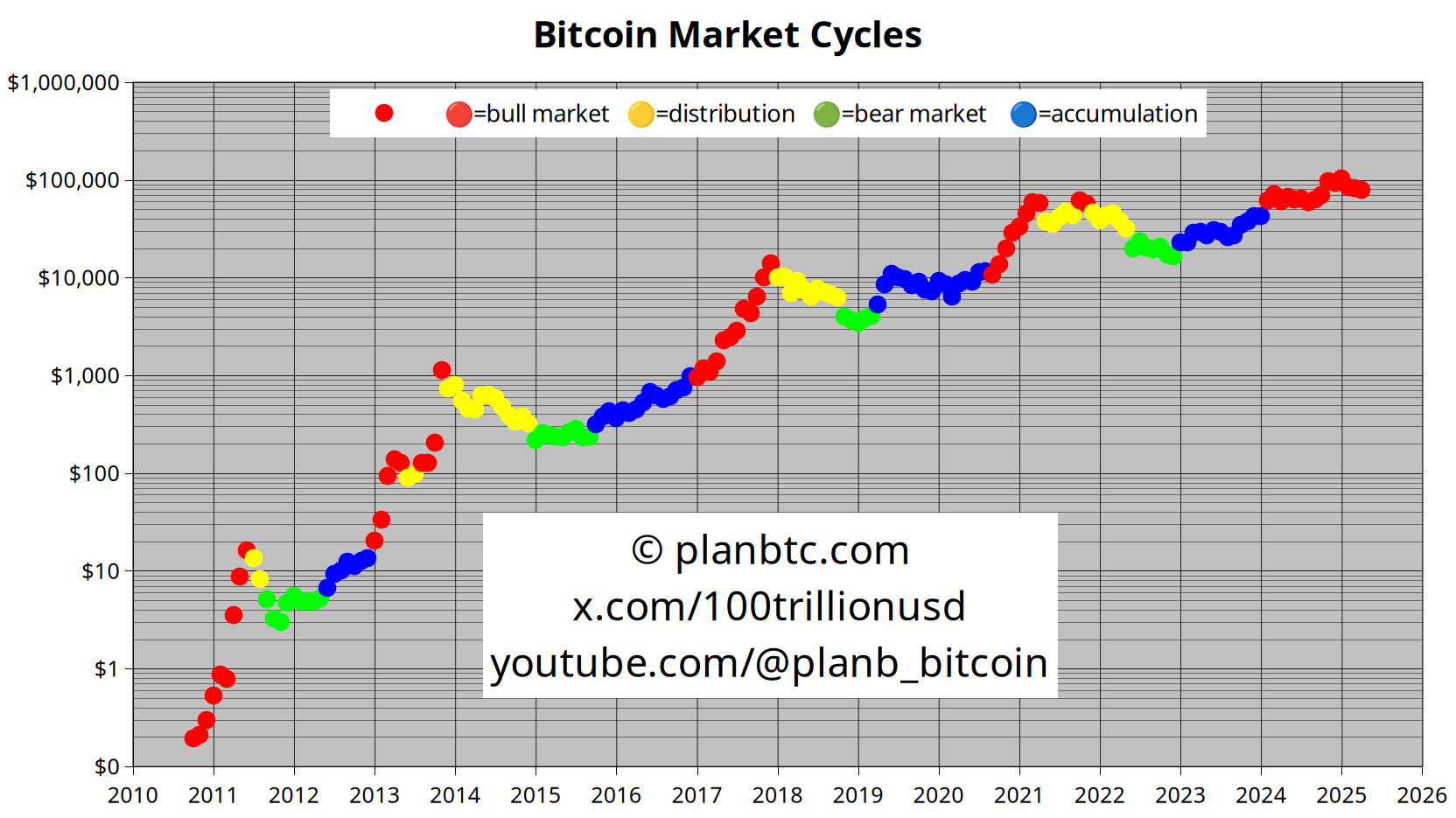

Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Cardano Surpasses Bitcoin and Ethereum in Institutional Inflows