First Mover Asia: Bitcoin Opens the Week Above $30K Amid Rising Investor Optimism

ALSO: Ripple Asia's policy lead praises Japan’s crypto laws that favor consumer protection. Rahul Advani said that the country has created "a very clear taxonomy for digital assets."

Good morning. Here’s what’s happening:

Prices: If bitcoin manages to stay past $30K, we might get another leg up, says one analyst.

Insights: Japan's recent amendment to exclude unrealized gains of self-issued cryptocurrency from taxation promotes a healthy environment for crypto startups. This continued trend of regulatory adaptability has earned praise from stakeholders.

ETF Optimism is Powering Bitcoin's Continued Rally

Bitcoin and ether are both off to a strong start as the week begins in Asia. The world’s largest digital asset is still above the $30K mark, while ether is up 1.3% to $1,901.

Analysts say that this mini-bull market, which has followed multiple applications for spot bitcoin ETFs, is pushing BTC and ETH to some of its . CoinDesk Indices’ shows the asset is in a “significant uptrend” with its price gaining 15.6% during the last week and 17% over the last 14 days.

“Last week, we noted how the market looked strong for mid to long-term opportunities, and Bitcoin was likely to be in the spotlight,” BitBull Capital’s Joe DiPasquale said in a note to CoinDesk. “This week we saw Bitcoin breaking through the $30K resistance and managing to stay above it despite volatility.”

DiPasquale sees continued growth across the market in the coming weeks, but also volatility.

“On the flip side, alts are now also starting to rally. But the market is likely to remain volatile in the coming weeks,” he said. “If Bitcoin manages to stay above $30K for long, we may see another leg up. On the downside, $27K now remains strong support.”

shows that over the weekend, traders with short positions had a slight edge. In the past 24 hours, there were $9.5 million in liquidated long positions and $7.10 in liquidated short positions. Open interest is up to $14.6 billion from $11.7 billion at the start of last week.

The Securities and Exchange Commission (SEC) hasn’t indicated when it intends to announce a decision on the , Invesco and WisdomTree.

Many are optimistic that the inclusion of a would be enough to make the SEC comfortable enough to approve it, much like how the Ontario Securities Commission wanted a mature crypto custodian sector to be listed in Toronto in 2021.

Until then, the question is: how high will bitcoin go?

Crypto-Friendly Japan Recent Tax Moves Keep It at the Forefront of Regulatory Policy

Over the weekend that the National Tax Agency of Japan has amended the nation’s tax law to exclude unrealized gains of self-issued cryptocurrency from taxation.

This is a huge relief for crypto startups that issue their own tokens.

Before the change, the Japanese tax law required corporations to pay taxes on unrealized gains from their cryptocurrency holdings at the end of each fiscal year, irrespective of whether those gains had been realized or not.

In short, if a company was holding a token and its value increased within the fiscal year, the company had to pay taxes on the increased value (the unrealized gain), even if it hadn't sold the cryptocurrency (i.e., hadn't "realized" the gain). This law applied to all types of cryptocurrencies, whether self-issued by the company or not.

Taxing unrealized gains isn’t a policy that’s conducive to building a dynamic, successful environment for entrepreneurship. , and it led to an exodus. But having taxes on the unrealized gains of a token is particularly detrimental to the crypto industry as developers and other team members are often heavily compensated in these tokens to compensatefor the inherent risk of the industry – with its tremendous ups and downs.

For Japan, this is another smart public policy move that has identified a problem and built a specific, crypto-native solution.

“What we see in Japan is a very clear taxonomy for digital assets,” Rahul Advani, Ripple’s policy lead for Asia, said in a recent interview withCoinDesk. "Regulators are now looking beyond just money laundering and terrorist financing. They're looking at capital, they're looking at bank exposures, and a very important part of that is market integrity but also consumer protection."

Japan has been an early adopter of cryptocurrency rules and established regulations and standards for crypto exchanges, Advani explained, praisingthe nation’s laws regarding the segregation of customer funds on exchanges.

For example, despite the global bankruptcy of FTX, its Japanese subsidiary, FTX Japan, appears poised to pay its customers in full, largely due to Japan's careful regulation of crypto exchanges. of Sam Bankman-Fried’s.

“Japan has in its bankruptcy laws, [a priority for] exchange customers above other creditors,” he said. “So that's one reason why exchange customers were able to be made whole before other creditors."

Now, in contrast, none of this is happening in the U.S.

Sure, given existing rules about capital gains in the U.S. it's unlikely that tokens issued by crypto companies would be taxed. But there’s no specific rules to say that this won’t happen. The U.S. Securities and Exchange Commission on how it determines if something – like the issued tokens at the center of this – is or isn’t a security.

If the SEC won’t even advise voluntarily, good luck getting any other sort of policy development in the U.S.

1 p.m. HKT/SGT(5 a.m. UTC):

In case you missed it, here is the most recent episode of on :

Bitcoin (BTC) has seen a 20% price gain since last Thursday, but could now take a breather. co-founder and CEO Hany Rashwan shares\d his crypto markets analysis. This comes as the Nevada Department of Business and Industry said crypto custody firm Prime Trust has "a shortfall in customer funds" and was unable to meet all withdrawal requests this month. Separately, Rajeev Bamra, Moody’s Investors Service SVP, DeFi and Digital Assets, weighed in on the state of U.S. crypto regulation. And, Casa CEO Nick Neuman explained why the cryptocurrency self-custody firm historically focused exclusively on the Bitcoin blockchain has added support for Ethereum.

Empowerment, the second NFT in the football club’s ten-piece Masterpiece collection, is a one-of-one created in collaboration with World of Women that pays tribute to Spanish player Alexia Putellas.

Pseudonymous NFT researcher and artist Elena admitted to tracing other pixel art to pad out her upcoming collection Atomic Ordinals.

The exchange’s share in ETH staking dropped to 9.7%, the lowest since May 2021. The SEC sued the company in June for offering unregistered securities.

The “Twitter hacker” plundered nearly $1 million from victims of his elaborate online schemes.

The company's clear legal victory in the U.S. high court isn't about crypto, but it could play into future court disputes for all businesses.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

The unique value of Proof-of-Work (PoW) tokens lies in their mining mechanism and regulatory positioning. Research shows that mining costs are a defining feature of PoW tokens, involving significant investment in hardware and electricity. When market prices approach miners' breakeven points, miners tend to hold onto their coins in anticipation of future appreciation. This behavior reduces circulating supply, shifts the supply-demand balance, and may contribute to price increases. Regulatory clarity is also critical to the investment appeal of PoW tokens. Both BTC and LTC are classified as commodities by the U.S. SEC rather than securities, which simplifies the ETF approval process. In January 2024, the approval of the BTC spot ETF triggered significant institutional inflows. LTC is currently undergoing the ETF application process. While DOGE and KAS have not yet received formal classification, their PoW nature may position them for similar treatment. Together, these factors enhance market liquidity and attract more institutional investors.

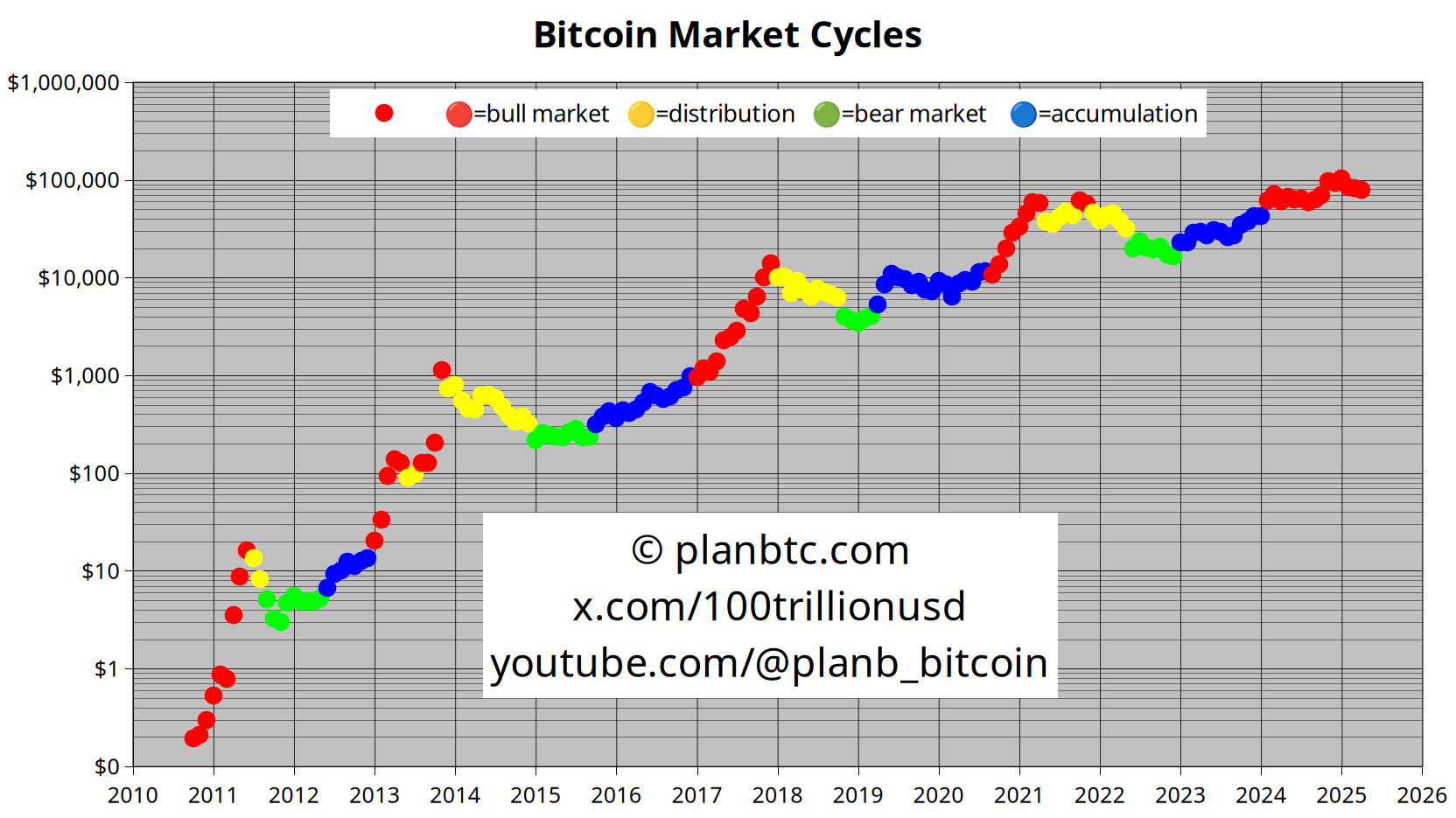

Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Cardano Surpasses Bitcoin and Ethereum in Institutional Inflows