Shiba Inu Price Runs into TD Sequential: Here’s What It Does

- Canine coin Shiba Inu storms past key resistance in a 10% daily run.

- OG crypto trader Ali Martinez explains Shiba Inu’s TD Sequential.

- Shibarium L2 mainnet saw a major upswing on October 25th, 2023.

Veteran crypto trader Ali Martinez pointed to a flashing bullish signal for Shiba Inu’s price in the weekly charts. The signal, called the TD (Tom Demark) Sequential, is utilized by crypto traders to identify the end of a trend and the beginning of the asset’s price reversal, according to the crypto analyst. Shiba Inu’s price flashed a nine-candle count graphic called the TD Setup.

The counter-trend tool had previously been the catalyst for Shiba Inu’s 118% and 71% bull runs. Equipped with the price reversal triggering TD Sequential, the popular cryptocurrency SHIB scorched past the $0.000008 resistance to reach a new monthly high of $0.00000817.

Tsunami of Transactions on Shibarium L2

Meanwhile, the newcomer Layer-2 scaling solution Shibarium is reaping the benefits of an upsurge in daily transactions. Shibarium saw a colossal increase from 12.69K to 62.57K on October 25, 2023. Despite the surge in daily transactions, Shiba Inu’s blockchain continues to operate at a five-second average block production time, according to ShibariumScan.io.

Shiba Inu’s Layer-2 network grew by 16.67% in total value locked (TVL), as more projects are being welcomed to Shibarium L2 via the assistance of the Bad Idea AI (BAD) chatbot on the Shibarium Tech Telegram channel. Currently, Shibarium L2 mainnet encompasses $869,641, with MARSWAP dominating the DeFi with 45.26% of the total TVL , according to DefiLlama.

The positive shift has tackled the prices of all alternative tokens in the Shiba Inu Ecosystem , including the Shibarium L2 gas token Bone ShibaSwap (BONE). BONE soared by 10.3% to briefly reclaim long-term support at $0.80 but dropped below to trade at $0.791441, according to CoinGecko.

The Fibonacci Circles mark a possible price correction bottom for $BONE at $0.7783; failing to sustain that level could result in a full retracement of BONE’s 10.3% run. While Shiba Inu fetched some of the latest gains following the BlackRock BTC ETF progress, $BONE stands at a -0.11 negative price correlation with the leading digital asset.

On The Flipside

- SHIB couldn’t hold the key resistance barrier at $0.000008 and slid to $0.00000793 on a market correction.

- The latest daily bull run for Shiba Inu softens the canine coin’s yearly deficit to 23.7%.

Why This Matters

Technical cryptocurrency price analysis tools help understand long-term price performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

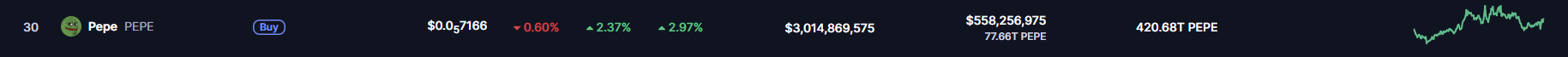

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CORE Approaches Key Resistance – Could Breakout Spark a Recovery?