JPMorgan Is Cautious About Crypto Markets Into 2024

Ether is expected to outperform bitcoin and other cryptocurrencies next year due to the Ethereum blockchain’s EIP-4844 upgrade, the report said.

Wall Street giant JPMorgan (JPM) said it is cautious about cryptocurrency markets into 2024, but expects ether (ETH) to outperform bitcoin (BTC) and other cryptocurrencies due to an upgrade that will make the Ethereum blockchain more scalable.

The U.S. Securities and Exchange Commission's (SEC) decision on whether to approve spot bitcoin exchange-traded-funds (ETFs) is unlikely to spur major gains, it said in a report on Wednesday.

There is a “high chance of buy-the-rumor/sell-the-fact effect once the SEC approves spot bitcoin ETFs early next year,” analysts led by Nikolaos Panigirtzoglou wrote.

“Excessive optimism by crypto investors arising from an impending approval of spot bitcoin ETFs by the SEC has shifted bitcoin to the overbought levels seen during 2021,” JPMorgan said, adding that the 2024 bitcoin halving event is “largely priced in.”

Ether is likely to shine due to the EIP-4844 upgrade, or proto-danksharding. That's a development of sharding – splitting the network into shards to improve transaction speed – by way of Danksharding, which uses the shards to increase space for groups of data. Proto-danksharding involves adding a new transaction type to Ethereum: the “blob-carrying transaction.”

The bank notes that there has been some “reinvigoration” in venture capital (VC) funding in the fourth quarter of 2023, but it appears “rather tentative.”

While there has been some improvement in decentralized finance (DeFi) activity, the “biggest disappointment continues to be the inability of DeFi to encroach into the traditional financial system, which is necessary for the crypto ecosystem to transition from crypto native to real world applications,” the report added.

The Crypto Market Rally Looks Overdone, JPMorgan Says

Edited by Sheldon Reback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

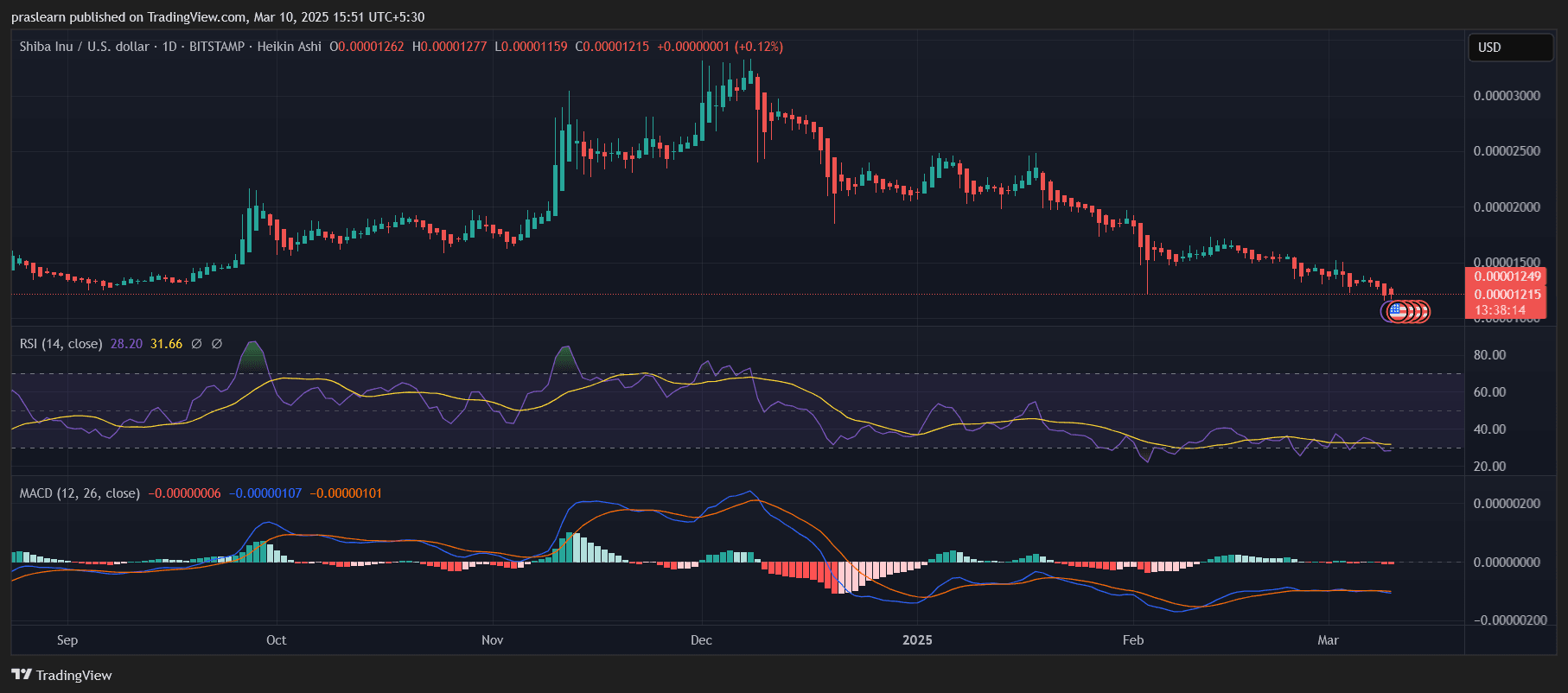

SHIB Price: Will Shiba Inu Price Crash to Zero?

4 reasons why Solana (SOL) price could rally back to $180

VIPBitget VIP Weekly Research Insights

Over the past few weeks, BTC has repeatedly tested the $100,000 resistance level, briefly breaking through multiple times before failing to hold, resulting in sharp declines Altcoins have entered a technical bear market, though SOL has shown resilience during both downturns and rebounds. However, the trading frenzy surrounding Solana-based memecoins has cooled, while discussions of institutional unlocking have gained traction on social media. On the night of March 2, Trump announced plans to establish a strategic crypto reserve, explicitly mentioning BTC, ETH, XRP, SOL, and ADA. This statement briefly reignited market sentiment amid oversold conditions, triggering a sharp crypto rebound. However, macroeconomic conditions remain largely unchanged, and liquidity recovery is a gradual process. The rally sparked by Trump's comments quickly faded, suggesting the market may still face further downsides. The following recommendations highlight projects worth monitoring in the current cycle, though they may not yet have reached an optimal entry point.

Texas Senate Passes Bitcoin Reserve Bill With 80% Votes in Favor

Texas' Bitcoin Reserve bill cleared the Senate with strong bipartisan support. Without mandatory Bitcoin purchases, it now moves to the House for a final vote.