Bitcoin dips below $42,000 despite major stock indices posting gains

Bitcoin has pulled back below the $42,000 level, causing almost $16 million in long liquidations.Conversely, major stock indices continued to post gains two days after the Fed’s latest rate pause.

Bitcoin BTC -2.70% dipped below $42,000, retracing all the gains made after the U.S. Federal Reserve announced its latest rate pause on Wednesday.

The world's largest cryptocurrency by market capitalization is set to close the week lower and break eight consecutive weeks of positive returns. Bitcoin fell over 2% over the past 24 hours to $41,991 at 12:10 p.m. ET, according to The Block data.

Coinglass data shows the pull-back caused almost $16 million worth of long liquidations, whereas only around $8 million short positions were wiped out.

Bitcoin has dipped below the $42,000 level, according to The Block's Prices Page.

Bitcoin's correlation with stocks weakens

The muted price action comes in contrast to a buoyant mood in traditional markets, calling into question the digital asset's tendency to march in lockstep with major equity indices.

Wall Street continued its uptrend since the Fed's decision to pause rates for the fourth time this year at Wednesday's Federal Open Market Committee meeting. The gains made by major equity indices suggest investors are calculating the possibility of rate cuts in 2024, with the CME FedWatch tool now pricing in around a 65% chance of a rate cut in March.

The Nasdaq is up 0.4%, the SP 500 was flat and the Dow Jones Industrial Average increased by 0.1%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

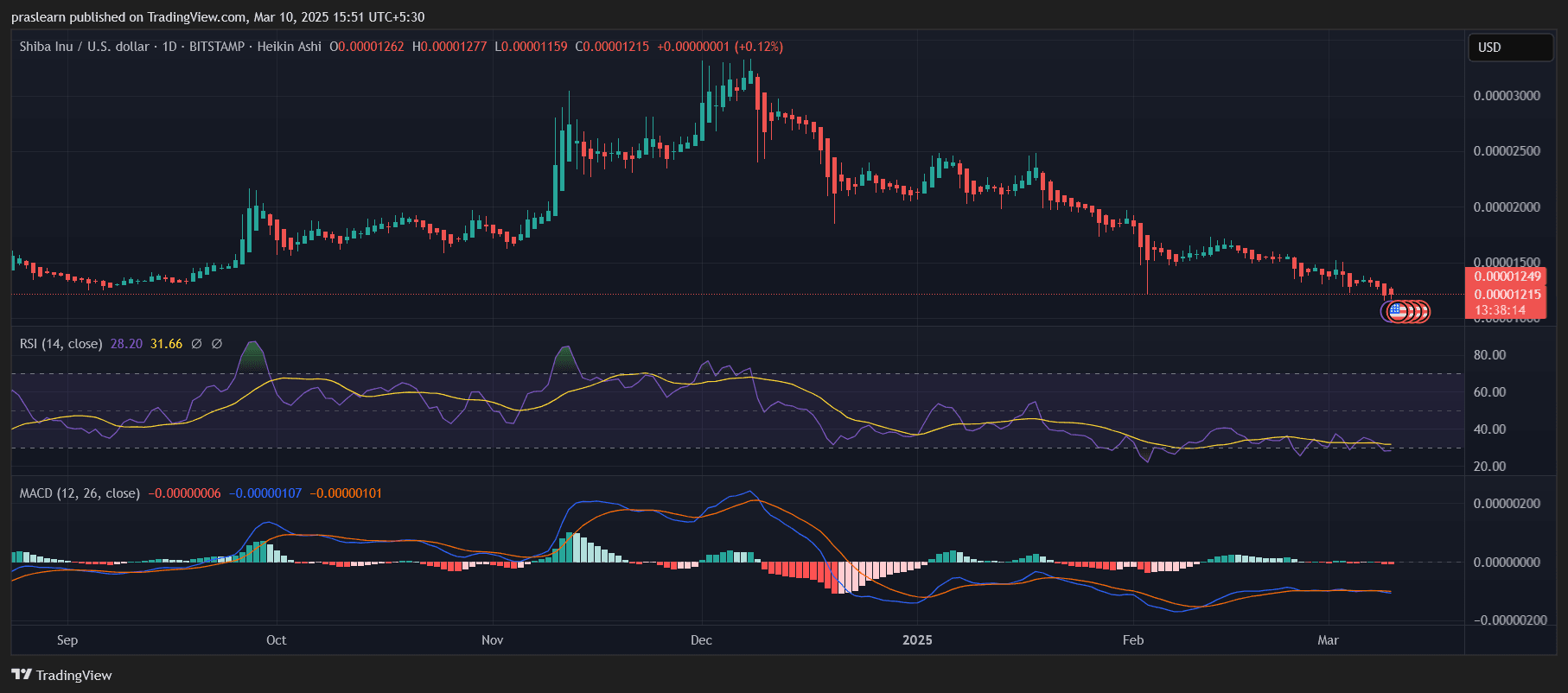

SHIB Price: Will Shiba Inu Price Crash to Zero?

4 reasons why Solana (SOL) price could rally back to $180

VIPBitget VIP Weekly Research Insights

Over the past few weeks, BTC has repeatedly tested the $100,000 resistance level, briefly breaking through multiple times before failing to hold, resulting in sharp declines Altcoins have entered a technical bear market, though SOL has shown resilience during both downturns and rebounds. However, the trading frenzy surrounding Solana-based memecoins has cooled, while discussions of institutional unlocking have gained traction on social media. On the night of March 2, Trump announced plans to establish a strategic crypto reserve, explicitly mentioning BTC, ETH, XRP, SOL, and ADA. This statement briefly reignited market sentiment amid oversold conditions, triggering a sharp crypto rebound. However, macroeconomic conditions remain largely unchanged, and liquidity recovery is a gradual process. The rally sparked by Trump's comments quickly faded, suggesting the market may still face further downsides. The following recommendations highlight projects worth monitoring in the current cycle, though they may not yet have reached an optimal entry point.

Texas Senate Passes Bitcoin Reserve Bill With 80% Votes in Favor

Texas' Bitcoin Reserve bill cleared the Senate with strong bipartisan support. Without mandatory Bitcoin purchases, it now moves to the House for a final vote.