BlackRock Revises Spot Bitcoin ETF Proposal Ahead of Rumored SEC Approvals

Black Rock's ETF proposal now includes cash redemptions, a concession to the SEC that may improve the fund's approval odds.

On Monday, Blackrock (BLK) filed a revised spot bitcoin (BTC) exchange-traded fund (ETF) proposal in a bid to appease regulators, likely boosting its odds of securing a first-of-its-kind approval in the U.S.

Under the updated proposal, Blackrock’s ETF will feature cash creation and redemption mechanisms, the model favored by the Securities and Exchange Commission (SEC). The world’s largest asset manager is the latest of several firms to update its proposal amid speculation the SEC could approve a swath of spot bitcoin ETF applications as early as January.

Blackrock first applied for its iShares Blockchain and Tech ETF last month, proposing an in-kind redemption model.

However, the SEC scrutinized the proposal, raising concerns about investor safety and market manipulation. ETFs typically feature one of two types of redemption and creation mechanisms: In-kind or cash.

An in-kind redemption structure, which many firms say is more appealing to investors, enables firms to redeem shares for bitcoin held by their ETFs. Cash redemptions, which the SEC regards as the safer and more accessible redemption option, replace those shares with their equivalent cash value.

Blackrock is the latest of several firms to agree to issue cash redemptions until in-kind redemptions are approved. More than a dozen firms have filed ETF applications so far. ARK 21Shares has also published a revised S-1 with a similar change.

The SEC has delayed aseveralether ETF applications by Grayscale, Ark 21shares, Vaneck and Hashdex.

UPDATE (Dec. 19, 04:55 UTC): Updated with additional context and information.

Edited by Sam Reynolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

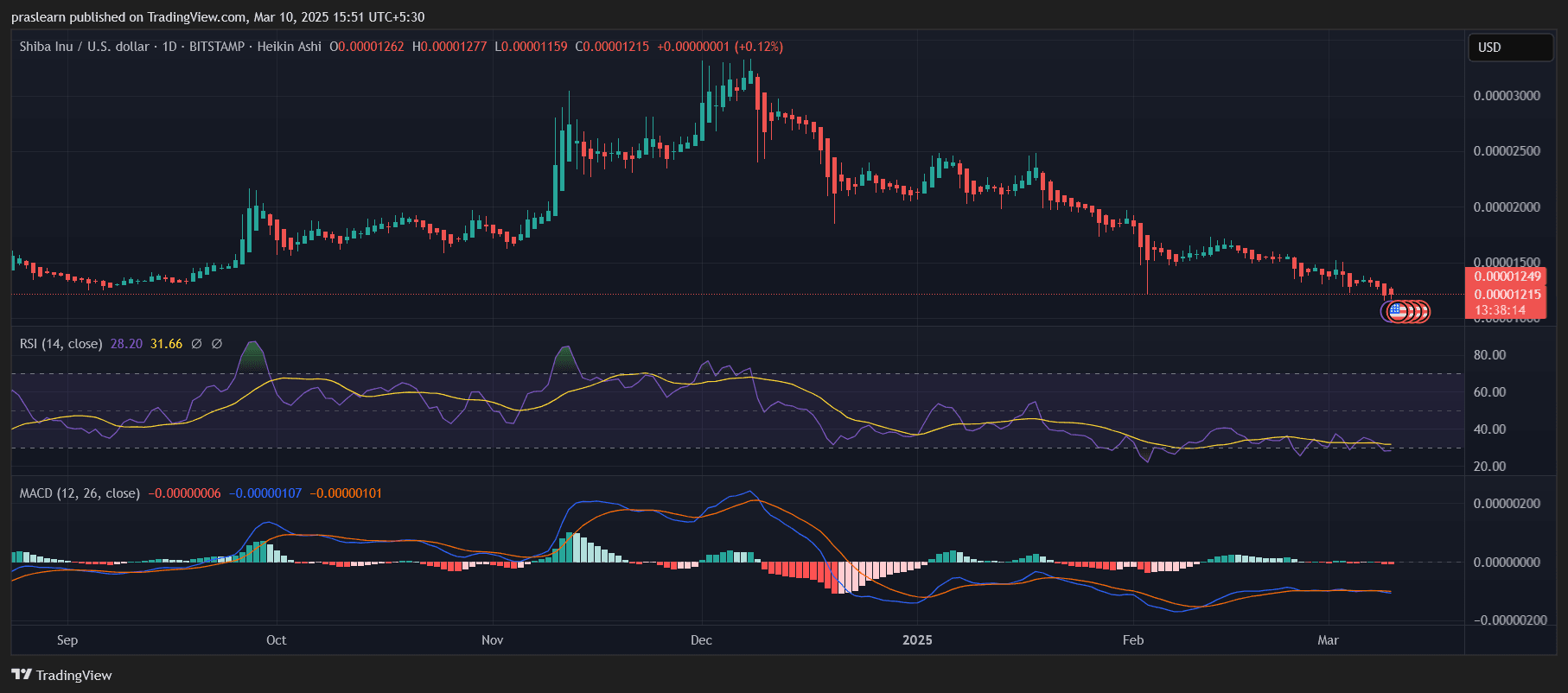

SHIB Price: Will Shiba Inu Price Crash to Zero?

4 reasons why Solana (SOL) price could rally back to $180

VIPBitget VIP Weekly Research Insights

Over the past few weeks, BTC has repeatedly tested the $100,000 resistance level, briefly breaking through multiple times before failing to hold, resulting in sharp declines Altcoins have entered a technical bear market, though SOL has shown resilience during both downturns and rebounds. However, the trading frenzy surrounding Solana-based memecoins has cooled, while discussions of institutional unlocking have gained traction on social media. On the night of March 2, Trump announced plans to establish a strategic crypto reserve, explicitly mentioning BTC, ETH, XRP, SOL, and ADA. This statement briefly reignited market sentiment amid oversold conditions, triggering a sharp crypto rebound. However, macroeconomic conditions remain largely unchanged, and liquidity recovery is a gradual process. The rally sparked by Trump's comments quickly faded, suggesting the market may still face further downsides. The following recommendations highlight projects worth monitoring in the current cycle, though they may not yet have reached an optimal entry point.

Texas Senate Passes Bitcoin Reserve Bill With 80% Votes in Favor

Texas' Bitcoin Reserve bill cleared the Senate with strong bipartisan support. Without mandatory Bitcoin purchases, it now moves to the House for a final vote.