From tokens to points, looking back at the origin and pros and cons of airdrop points incentives

Original title: "Organic growth point or top PUA, what are the advantages and disadvantages of the points incentive model?"

Original author: Pzai, Foresight News

In the long history of the development of the cryptocurrency field, the economic model based on decentralized consensus has brought the dawn of the crypto holy grail to countless users. But as the wheels of the industry roll, project parties have also begun to think about how to balance the relationship between the long-term development of the protocol and user retention in the crypto tide. As a relatively "moderate" incentive model between news and tokens, points are being adopted by more and more project parties. And many opinions believe that the attention brought by the point incentive can form an organic growth point for the protocol indicators and strongly promote the growth of the project.

But recently, the TGE distribution of projects such as Blast has triggered a wave of anger among people, which is reflected in the dissatisfaction with the low returns brought by the extended incentive cycle. Some big players are calling for similar airdrops to become "top PUA" for all participants, so this article explores the advantages and disadvantages of the points model from a multi-dimensional perspective and tries to find a corresponding solution.

Early Incentive Model

In the earliest days of the wave, when Ethereum ICO was in full swing, airdrops can be said to be relatively simple and crude. You only need to submit a simple 0x address to reap a considerable amount of tokens. Since the main feature of ICO-era projects is that they are mainly based on concept speculation, and the construction of on-chain interactions is almost blank, for everyone, the (coin holding) address itself can become an incentive indicator.

At the beginning of DeFi Summer, Balancer and Compound both adopted liquidity mining as an incentive. It is not difficult to see that for the DeFi projects at the time, the scale of on-chain liquidity determined the development of the protocol, and the demand for liquidity was also more urgent in terms of the market situation at the time, so they all adopted direct token incentives. Although it has contributed a lot to the growth of TVL, it has also led to the drawbacks of "mining, selling and withdrawing".

After that, Uniswap's airdrop was a big hit, bringing the interactive airdrop paradigm into the crypto field, and thus giving birth to a group of professional airdrop hunters. Many DeFi projects followed up, and with the implementation of many L2 and public chain technologies, the construction of a governance model for the ecosystem was also put on the agenda. Since the governance of many protocols is essentially a subset of their token economy, it is inevitable that participants will have related airdrop expectations. From then on, the incentive model centered on tokens and interactions began to merge into the crypto economy.

To sum up, we can summarize the characteristics of the incentive model in the early cryptocurrency field:

· Direct token incentives: For early projects, the growth space brought by the unsaturated competitive environment gives them enough freedom and enables them to benefit users through token incentives while achieving scale growth.

· Low interaction threshold: Since the on-chain ecology was not mature at the time, the product model of the protocol was relatively simple, and the interaction process was also simple for users.

· Instant returns (synchronicity): Before Uniswap, many projects adopted mining to achieve instant token feedback for users' deposits, and what they did was what they got.

The origin of point incentives

Before point incentives, with the vigorous development of the ecology, the project was faced with the dilemma of user retention and incentives. Galxe and other task platforms provide a solution. Specifically, the task platform allows projects to spread the incentive process to specific tasks of user interaction, and use NFTs instead of tokens for a certain degree of incentive (marking). Overall, this incentive method has begun to produce incentive asynchrony, that is, the period between the issuance of token incentives and the actual interaction of users has been lengthened. In fact, the point incentive, like the task platform, is one of the products of the refinement of interaction in the crypto field.

The earliest project to widely adopt the point model was Blur. Pacman innovatively used points to calculate the incentive for NFT transactions, and related measures have significantly increased Blur's protocol, specifically in terms of liquidity and trading volume. Analyzing the scale development of Blur from the data in Figure 1, we can see that points mainly play the following three roles:

· Raise confidence: Through point incentives, users can have a certain sense of gain in advance, increase their confidence in subsequent airdrops, and affect the initial launch of the coin price.

· Extended cycle: Points can spread users’ expectations for protocol airdrops and extend the overall incentive cycle. An obvious example is that after Blur implemented the token launch, it still maintained the existence of point incentives, reducing selling pressure while creating a sustainable incentive environment for users, which is reflected in the continuity of trading volume and TVL.

· Reality: Compared with NFTs after the interactive tasks are completed, points can give users a sense of token corresponding mapping, making users feel that they have obtained tokens rather than just symbolic badges, which is reflected in the correlation between the trading volume of early mining and token prices.

Figure 1 Blur related data (DefiLlama)

Based on the above effects, several advantages of point incentives can be derived:

· Improve retention rate: In the past, under the background of "mining, selling and withdrawing", users were usually not very loyal to the protocol. Through point incentives, project parties can guide users to generate continuous cash flow and on-chain interaction.

· Avoid token costs: Point-based incentives can reduce the cost of project parties in token market making and corresponding operations, and sometimes reduce compliance risks.

· Higher flexibility: The organic adjustment of point incentives gives project parties higher flexibility, and is not affected by the trend of related tokens, focusing more on product construction.

Confidence created by points

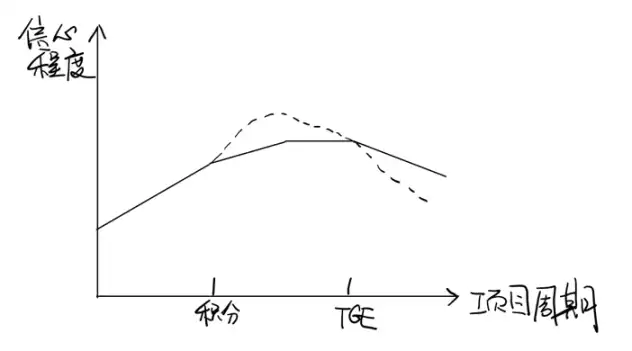

In the operation cycle of crypto projects with points as the main incentive model, we can roughly divide it into three stages, with two important nodes being the use of points incentives and TGE (token generation events). Figure 2 shows the changes in users' confidence during the project cycle.

Figure 2 Changes in users' confidence during the entire project cycle

Before the points incentive, we can see that the overall confidence showed a linear growth trend, because in the early stages of the project, users are usually optimistic about the development of the project, and there are also many positive news in the early stages. After the implementation of the points incentive, compared with the non-points incentive, the users' sense of gain generated by the points themselves led to a short-term increase in confidence. However, the subsequent points incentive cycle began to spread users' expectations for project airdrops, and the market began to price the incentives of the project off-site, so the overall confidence fell back to the level without points incentives. After TGE, the confidence of users who have experienced point incentives will be further reduced, because the overall cycle of point incentives is long, which makes it impossible for users to continue to bear the costs generated by the cycle when the overall benefits are clear after TGE, and then choose to sell, which is reflected in greater selling pressure.

To sum up, we can see that the confidence brought by points is mainly reflected in the early stage of point incentives, which essentially provides users with an opportunity to enter the ecosystem. But for user retention, the most core part must be the actions of the project party. The point incentive itself provides project parties with a variety of manipulation space.

The manipulation space of points

The current point incentive model has fundamentally become a tool for project parties to manage expectations, and because point incentives are a long process, users will have corresponding sunk costs, based on these sunk costs will bring some passive retention to the project, so the project party only needs to extend the incentive cycle and maintain the basic incentives within the cycle to maintain the performance of the basic indicators of the project. In addition to the basic incentives, the allocation space of the project party is gradually increasing.

In terms of issuance, the manipulation space of points is mainly reflected in not being on the chain and the clarity of rules. Compared with token incentives, point incentives are usually not on the chain, and thus there is more room for manipulation for the project party. In terms of rule clarity, the project party has the right to allocate incentives to various parts of the protocol, and from the incentives of Blast, it can be seen that the long cycle of incentives represents the strong flexibility of the rules, which can neutralize the emotional reactions of most users to the greatest extent within the cycle and reduce confidence loss. However, the distribution of the second phase of Blast actually diluted the deposit points of the big players before the launch, and transferred this part of the benefits to the on-chain interactors. For the big players, such a flattening may result in the airdrop not being able to cover the capital costs incurred in the early stage, and increase the interaction costs on the chain in the later stage, but if they withdraw their deposits, they will face the problem of sunk costs. And when the airdrop is finally distributed, the passive linear release of the big players has proved that the project party has chosen to transfer the benefits of the big players to the hands of retail investors in the distribution.

In terms of market pricing, over-the-counter points trading platforms such as Whales Market also provide a measurable data source for the project party. Specifically, they have made considerable market-based pricing for the points OTC transactions in the market, and the project party can make appropriate adjustments to the expected pricing brought by the points through market makers, and the low liquidity environment before TGE reduces the difficulty of market making. Of course, such transactions also exacerbate the overdraft of potential project expectations.

To summarize, the disadvantages of point incentives can be derived from the manipulation space of points:

· Large manipulation space: Whether in issuance or market pricing, the project party can perform sufficient operations.

· Overdraft expectations: The long cycle of point incentives and excessive speculation in the secondary market have led to the consumption of users' airdrop expectations.

· Spreading benefits: Due to the long release cycle of points, the value generated by early participants and late participants is spread, which will correspondingly harm the interests of the participants.

How to play to one’s strengths and avoid one’s weaknesses

After analyzing the advantages and disadvantages of point incentives, we can explore how to play to one’s strengths and avoid one’s weaknesses based on the point model and better build an incentive model in the encryption field.

Allocation Design

In the long cycle of point incentives, point allocation is crucial to the development of the protocol. Unlike the interaction on the task platform, most projects do not clarify the correspondence between interaction indicators and points, forming a kind of black box, and users have no right to know in this case. However, completely open rules will also facilitate the studio's targeted play, resulting in higher anti-witch costs on the chain. A possible solution is to control the visibility of rules to users through decentralized incentive processes. For example, points can be organically distributed through protocols within the ecosystem. While spreading the distribution cost, the user's on-chain behavior can be further incentivized and refined. The decentralized distribution rights give specific project parties greater dynamic adjustment space, and it is also convenient for users to kill two birds with one stone based on strong composability.

Weighing the interests of all parties

Now many protocols need to face the trade-off between TVL and on-chain interaction data, which is reflected in how to allocate corresponding weights in the points mechanism. For projects such as Blur that are dominated by transactions or DeFi that are dominated by TVL, the two can essentially form a flywheel effect that promotes each other, so the role of points is to motivate a single indicator. But when this logic is transferred to Layer 2, participants begin to split, and the demands of the project parties also shift from a single indicator to diversified growth, which in turn puts forward higher requirements for the points allocation mechanism. Blast's gold points attempt to solve this split, but in the end, due to the problem of distribution ratio, the overall effect is still unsatisfactory. In other projects, there is currently no similar mechanism design, so the point mechanism design of future protocols can consider corresponding refinement of interaction and deposit incentives.

Demand space for incentive space

Today, the original intention of many projects to use points incentives is just to delay TGE while maintaining incentive activities. Compared with the traditional point incentive use cases, the points themselves are lacking in use, and this part of the demand gap is also the fundamental reason why points exist only as another token in the eyes of users. Therefore, this part of the demand can be effectively developed. For example, for cross-chain bridges or on-chain derivatives, using points to offset related fees can not only enable users to obtain the utility generated by points immediately, attract users to continue to use the protocol, but also release the space for point allocation, reduce inflationary pressure and control expectations. However, in this part, it is necessary to effectively and accurately measure the actual interaction of users and handling fees.

In addition, whether it is for traditional fields or encryption fields, demand will always be greater than incentives, and a large part of the demand space is generated by the protocol itself. Just as many MEME-related projects do not have point incentives, because they naturally occupy the advantage of the demand side, and users get more value from outside the protocol when using these projects. Therefore, for project owners, they need to consider whether their product model construction has the corresponding PMF, so that users can participate in it not for the sake of illusory tokens.

Consensus Incentives

For users, consensus incentives create an environment with clear rules for them and allow them to participate in consensus building as independent individuals. For example, in the community, project parties can build some decentralized environments to allow users to participate in free competition and make organic distributions similar to PoW according to the results. On the one hand, such competition can eliminate the impact of the airdrop distribution cycle in the consensus, and on the other hand, it can also improve user loyalty and retention. However, the consensus itself changes relatively slowly and has low flexibility, which may not be suitable for a fast-growing ecosystem.

On-chain Points

Putting points on the chain is different from issuing tokens directly. Compared with tokens, it removes liquidity and increases the immutability and composability of the chain. Linea LXP presents us with a good example. When all addresses and points can be traced on the chain, the operating space is visibly reduced, and the smart contract provides chain-based composability, which greatly improves the index of points in the ecosystem, allowing the protocols in the ecosystem to adjust incentives based on relevant indicators.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群: https://t.me/theblockbeats

Telegram 交流群: https://t.me/BlockBeats_App

Twitter 官方账号: https://twitter.com/BlockBeatsAsia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale bought HYPE for $4.8 million 3 hours ago

Three associated addresses under the same entity unstaked 168,498 SOL, worth $17.86 million

Aave launches token repurchase mechanism, with first-month repurchase budget reaching $4 million