Top Crypto Gainers Today Sep 30 – Artrade, Mina Protocol, Enjin Coin, Coti

As the cryptocurrency market shifts rapidly, our distinct selection of top crypto gainers today is turning heads with notable price increases and unique offerings. Artrade is transforming the NFT sector with its eco-friendly platform. Meanwhile, Mina Protocol offers a groundbreaking, succinct blockchain for efficient decentralized applications. Enjin Coin empowers gamers by providing real ownership of digital assets. Plus, Coti enhances transaction speed and privacy with its cutting-edge technology. Let’s dive into what’s driving these tokens’ remarkable gains and their potential impact on investors.

Biggest Crypto Gainers Today – Top List

In our analysis of each token, we will focus on key metrics that reveal their performance and potential. We’ll examine 24-hour price changes for short-term momentum, liquidity ratios for trading ease, and the Relative Strength Index (RSI) for market sentiment.

Additionally, we’ll analyze trading days for consistency and volatility for stability. The Simple Moving Average (SMA) will provide insights into long-term trends, while annual performance will help evaluate growth potential. Together, these metrics will guide investors in the fast-paced cryptocurrency market.

1. Artrade (ATR)

Artrade is redefining the NFT market by offering a streamlined, eco-friendly platform for creators and investors. Traditional NFT marketplaces often come with high fees, commissions, and environmental concerns. However, Artrade’s innovative approach eliminates these issues. With features like NFT Live and NFT Real, it provides a seamless user experience. Plus, its utility token, ATR, offers reduced costs and lets users participate in platform decisions.

In the short term, Artrade’s performance has been impressive. Priced at $0.015422, ATR has surged 16.04% in the last 24 hours. This is backed by high liquidity, with a volume-to-market cap ratio of 0.0399. Moreover, its RSI stands at 64.96, signaling that the token is neutral and could trade sideways for now. While volatility is at a low 13% over the last 30 days, Artrade has recorded 12 green days or 40% of the time. Clearly, it’s showing promising stability.

Looking at the long-term picture, Artrade’s growth is even more remarkable. The token is trading a massive 838.26% above its 200-day SMA, demonstrating strong upward momentum. Over the past year, ATR has skyrocketed by 1,077%. In fact, it has outperformed 96% of the top 100 crypto assets. These statistics highlight Artrade’s potential as both a short-term and long-term investment.

Artrade’s unique value proposition lies in its eco-responsible platform and blockchain-powered transparency. Its recent price surge and impressive long-term gains make it an exciting project to watch. Could this be the future of NFT marketplaces? Investors may want to keep a close eye on this one.

2. Mina Protocol (MINA)

This second top crypto gainer, Mina Protocol, is undeniably a game-changer in the blockchain space. Unlike many traditional blockchains that expand as they grow, Mina’s “succinct blockchain” stays constant at just 22KB, no matter how much it’s used.

This, in turn, minimizes computational requirements, which allows decentralized applications (DApps) to run much more efficiently. Additionally, its use of zk-SNARKs, a cryptographic proof system, enables users to verify blockchain transactions without revealing any specifics.

When it comes to the market, Mina has shown strong price performance. In the last 24 hours, it surged by 9.62%, signaling a notable increase in investor interest. Moreover, the token’s high liquidity, with a 0.3173 volume-to-market cap ratio, ensures smooth trading and healthy market activity for all investors.

In addition, the 14-day RSI sits at 46.98, indicating that the asset is currently neutral and may see sideways trading. Despite its low volatility of 10%, Mina has seen 19 green days in the last 30, which highlights its stable upward momentum. Clearly, this is an asset that continues to perform well.

In terms of long-term performance, Mina has increased by an impressive 57% over the past year. Even more importantly, it is currently trading 5.64% above its 200-day SMA, which shows strength and potential for further growth. Furthermore, Mina’s ability to outperform nearly half of the top 100 crypto assets demonstrates its resilience in a competitive market. With continued demand for DApps, Mina’s long-term outlook looks increasingly promising.

3. Pepe Unchained (PEPU)

Pepe Unchained has already raised $16,466,311.95 in its presale, gaining over 20% in value. Currently, the price of $PEPU is $0.00989, and it is expected to rise further. As the presale continues, investors are looking to buy in before the price increases after the launch. This makes it an attractive opportunity for early investors.

Moreover, Pepe Unchained offers more than just meme coin appeal. It is developing Pepe Chain, a Layer 2 blockchain that promises to be 100x faster than Ethereum. Additionally, transaction fees are lower, which appeals to users looking for cost-efficient solutions. With this innovation, Pepe Chain supports instant bridging between Ethereum and Pepe Chain, enabling seamless transfers between the two networks.

Furthermore, the token offers double staking rewards, giving holders the chance to earn up to 130% annually. This adds another layer of appeal for long-term investors. Also, with 7.5% of its liquidity allocated to decentralized exchanges, Pepe Unchained is positioning itself for strong growth after launch. This liquidity allocation will help maintain price stability and ensure smooth trading after it hits the market.

Overall, investors have a promising opportunity to benefit from both the token’s current growth and its long-term potential in the fast-evolving blockchain space. With continuous advancements, Pepe Unchained is expected to see further gains in the near future.

Visit Pepe Unchained Presale

4. Enjin Coin (ENJ)

Enjin Coin is a key player in the blockchain gaming and NFT space. As the native token of the Enjin ecosystem, ENJ plays a critical role in backing digital assets within games and apps. Enjin lets game developers tokenize in-game items on the blockchain, enabling their creation, trade, and ownership with real-world value. By locking ENJ in NFTs it ensures each asset has inherent value, adding transparency and scarcity to the platform.

The core functionality of Enjin Coin revolves around minting and melting digital assets. When assets are minted on the Enjin platform, ENJ is locked into the asset, which can later be melted to retrieve the ENJ within it. This process ensures liquidity and helps regulate the circulation of ENJ.

Observing the market performance, at the time of print, its current price stands at $0.17573, marking a 3.02% increase in the last 24 hours. With a high liquidity ratio (0.1138), it’s clear that the token is trading actively. Also, the 14-day RSI of 54.15 suggests neutral conditions, meaning the token is neither overbought nor oversold. Additionally, Enjin has seen 17 green days out of the last 30, with low volatility at 8%, indicating steady performance.

However, long-term performance presents a mixed picture. Enjin Coin is currently trading 22.67% below its 200-day simple moving average, with a price decrease of 22% over the past year. This underperformance has led it to outperform only 7% of the top 100 crypto assets by market cap, signaling caution for long-term investors.

5. Coti (COTI)

Coti is also gaining momentum as a fast, secure Layer 2 solution on Ethereum, designed to enhance scalability and privacy. COTI leverages Garbled Circuits, a groundbreaking cryptographic innovation. This makes the network about 1000x faster and 250x more efficient in latency than its competitors.

Furthermore, the technology drastically reduces storage requirements. This makes it perfect for confidential transactions and decentralized applications (dApps). As privacy becomes a growing priority in the blockchain space, COTI’s advanced framework stands out.

Recently, COTI’s benchmarks in Garbled Circuits have solidified its lead in privacy and efficiency. Its performance is up to 3000x faster than that of fully homomorphic encryption alternatives. This remarkable achievement hasn’t gone unnoticed. Combined with the rising demand for decentralized confidential computing, it has fueled COTI’s recent price surge.

As of today, COTI is trading at $0.121128, showing a 1.57% increase in just the last 24 hours. Notably, the token demonstrates strong liquidity, reflected in its market cap-to-volume ratio of 0.2393. Additionally, its 14-day Relative Strength Index (RSI) stands at 69.49, which points to neutral market sentiment. In the past 30 days, COTI has enjoyed 18 positive trading days, making up 60% of the time.

Moreover, its volatility remains moderate at 18%, adding to its stability. Currently, COTI is trading 26.59% above its 200-day simple moving average, a key indicator of long-term growth. Over the past year, the token has surged an impressive 198%, outperforming 75% of the top 100 crypto assets by market cap. All these factors show that COTI is growing and holds great potential for the future.

Read More

- Top Gaining Cryptos

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

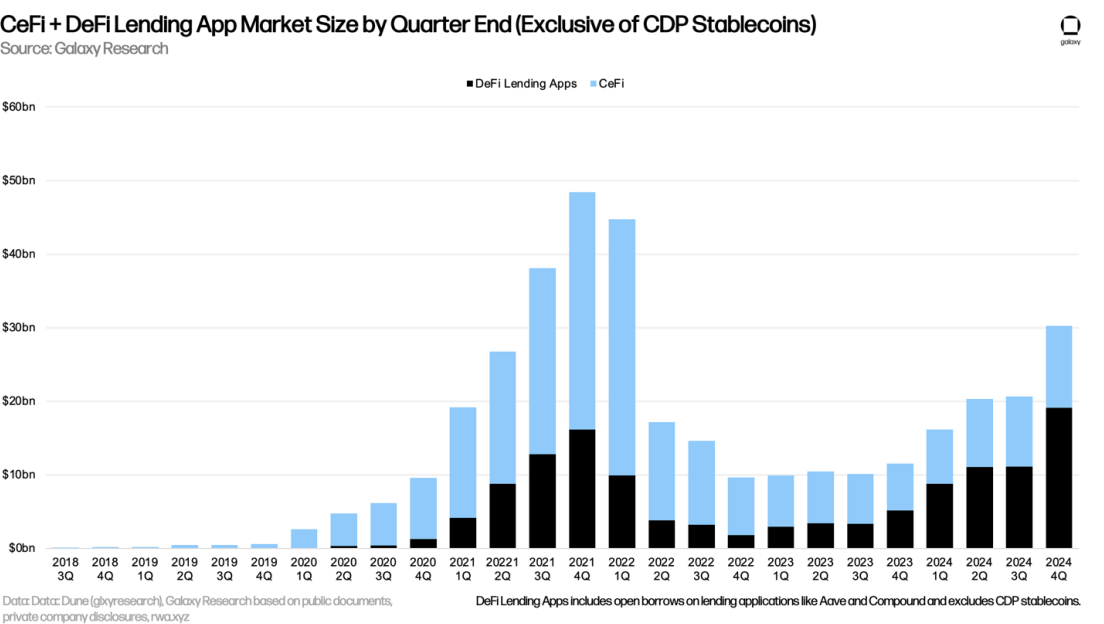

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection