Will Flare 8% Surge Mark the Start of a Bigger Breakout?

- Flare’s price surged 16%, defying bearish market conditions.

- Total Value Locked (TVL) nears all-time high, boosting investor confidence.

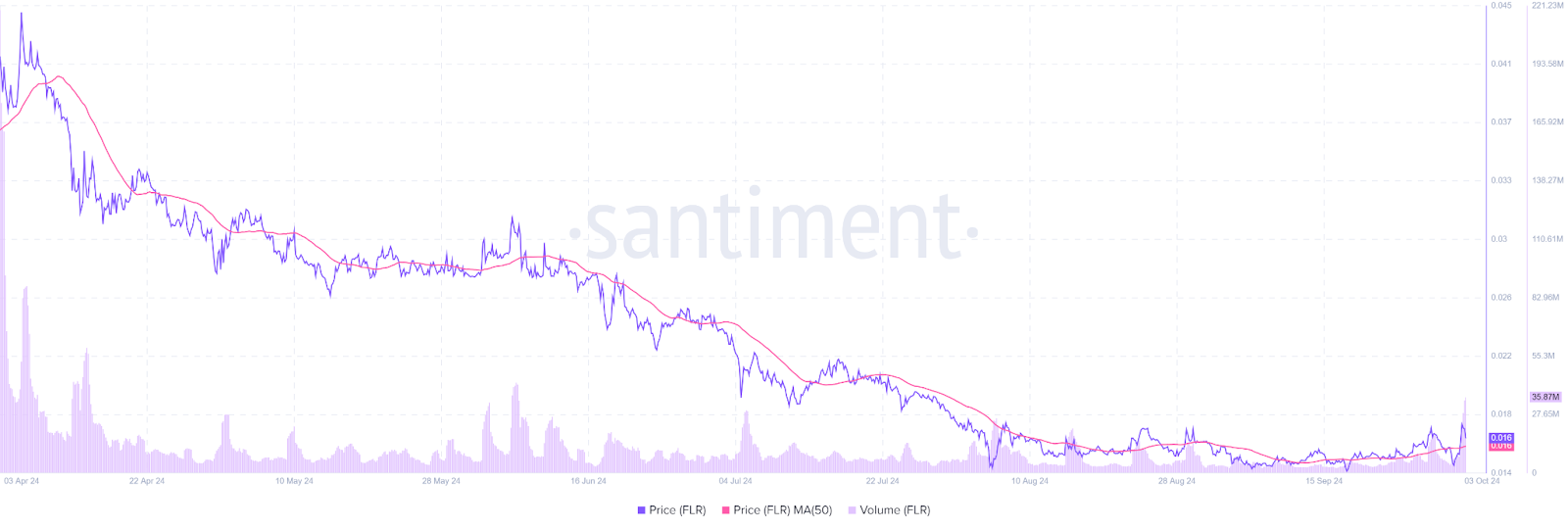

Despite an anticipated bullish “ Uptober ,” the cryptocurrency market has taken a bearish turn, with the global market cap down 2% and trading volume plunging 21%. Top cryptocurrencies are feeling the pressure, with Bitcoin down 3% and Ethereum facing a 6% dip. However, Flare (FLR) has defied the trend, experiencing a 8% surge, trading at $0.01747. The token’s market cap also increased by 8% to $846K, with a trading volume spike of 386%. It reached a three-month high of $0.01808.

Flare’s performance has caught investors by surprise, especially as the token had been consolidating for over a month. The total value locked (TVL) in Flare surged to $16.6 million, approaching its all-time high (ATH) of $16.85 million, reflecting strong network fundamentals and growing investor confidence.

Moreover, the bullish sentiment is further supported by technical indicators. The Chaikin Money Flow (CMF) plotted a reading of 0.15, signaling an influx of liquidity into the market. Analysts believe FLR has bottomed out and may be on the verge of a breakout. It has been in a tight range for two months.

Positive sentiment continues to build, with experts forecasting a potential surge if investor interest remains strong. One crypto analyst tweeted that FLR’s momentum could lead to a significant price increase, with potential for a bullish reversal in the coming sessions.

What is FLR’s Next Resistance?

On the technical front, FLR’s 9-day Exponential Moving Average (EMA) sits at $0.01588, with a neutral Relative Strength Index (RSI) of 53. Resistance stands at $0.01935 and $0.02105, with support at $0.01204.

FLR Price Chart, Source: Sanbase

FLR Price Chart, Source: Sanbase

Onlookers are now focused on whether Flare can sustain this upward trajectory or face a pullback, as the broader market remains unpredictable. Traders are urged to watch for any shifts in momentum as FLR navigates critical resistance levels.

Highlighted News Of The Day

Ethereum (ETH) Price Falls to Previous Support Amid Selloffs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street is suffering a stinky meltdown while Fartcoin is up 30%

Analyst Predicts SOL to Outperform Bitcoin in Growth Race: Solana Rising?

Despite Q1 Underperformance, Analysts Remain Bullish on SOL's Growth Prospects Compared to BTC

Robert Kiyosaki Sees Pain Ahead: Millions Face Job Losses as Trump and Musk Slash to Save US Dollar

New spot margin trading pair — PAXG/USDT!