Analytics Firm Reveals Levels of “Liquidity Gap” in Bitcoin Price

A cryptocurrency analytics firm has shared the levels of alleged liquidity gap in Bitcoin price.

In its latest comprehensive analysis titled “Liquidity Trading Profile, Bitcoin’s 4-Year Price Analysis,” crypto research firm Alphractal has offered an in-depth look at Bitcoin’s trading behavior across 11 major exchanges.

The study focused on identifying price zones characterized by high trading volume, leverage interest and trading frequency, providing important information for traders and investors.

Here are the key points from the report:

- Alphractal’s analysis highlighted certain price zones that have seen little to no price consolidation over the past four years. These areas, known as liquidity “gaps,” have historically tended to capture the market’s attention as prices revisit them to create new pools of liquidity. These gaps often play a significant role in future price action, the firm said, as they attract traders looking for opportunities.

- Alphractal identified several key price points that show minimal consolidation: $71,600, $59,700, $53,000, $46,800, $32,300, and $25,400. The firm suggested that these areas could become important in future trading as Bitcoin’s price dynamics evolve.

- The report noted an interesting trend in volume and trading activity. While trading frequency remains high, Open Interest, which indicates open contracts, has not kept pace. This suggests significant involvement of High Frequency Trading (HFT) algorithms, which increase short-term market liquidity by rapidly opening and closing positions but do not contribute to persistent open positions.

- Alphractal observed that as Bitcoin’s price increases, trading volume typically decreases. This trend occurs because fewer buyers are willing to trade at higher prices, and most existing investors prefer to hold rather than trade. According to the analysis, this behavior could signal a potential loss of momentum in the ongoing price uptrend and signal a possible pause or reversal.

*This is not investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

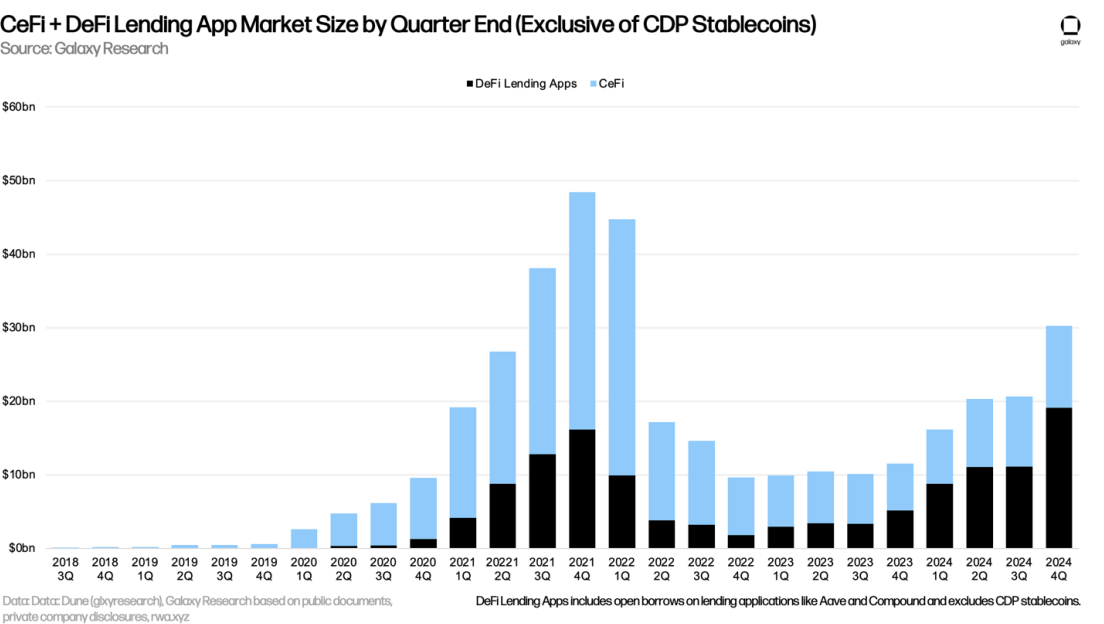

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection