1inch to Turn Cross-Chain Swaps into an Intent-Based System with Fusion+

Quick Take Aiming to revolutionize cross-chain transactions in DeFi, 1inch is launching Fusion+, a system that eliminates bridges and introduces intent-based swaps.

The decentralized finance (DeFi) industry is revolutionizing how users interact with financial systems, offering unparalleled autonomy and global accessibility. Yet, despite its transformative potential, DeFi continues to face significant challenges, particularly the lack of seamless cross-chain interoperability.

When users attempt to transfer assets between blockchains, they often encounter complex methods, high fees and slow transaction speeds. Bridges, the main tools for cross-chain transfers, usually fail and expose users to significant security risks.

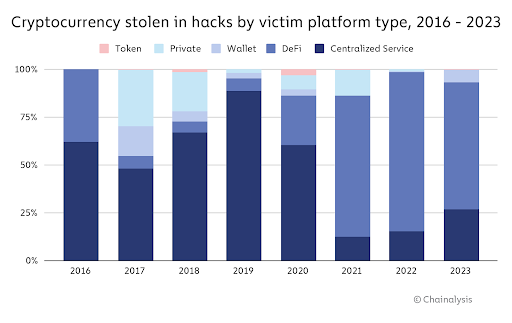

Recent data reveals that cross-chain bridges have been the target of significant hacks, resulting in over $2.8 billion in compromised user funds due to insecure infrastructure.

The majority of stolen crypto originated from hacks targeting DeFi protocols. Source: Chainalysis

Meanwhile, decentralized technologies like atomic swaps, which enable trustless asset exchanges across different chains without intermediaries, remain technically complex for the average user to adopt effectively.

Analysts suggest that if these gaps are addressed, the DeFi market could expand significantly, with an estimated compound annual growth rate (CAGR) of 46.8% between 2024 and 2032, signaling immense growth potential for the industry.

Intent-Based Cross-Chain Swaps: Fusion+

Recognizing the persistent challenges of cross-chain interoperability, a one-stop DeFi platform, 1inch , has introduced Fusion+ . With its innovative approach, 1inch aims to eliminate the reliance on centralized bridges, resolve security vulnerabilities and simplify complex transaction processes.

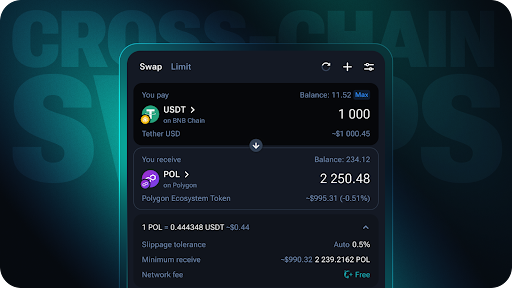

Fusion+ addresses the interoperability challenges that have long hindered user experience and mass adoption in the DeFi ecosystem. Source: 1inch

At the heart of Fusion+ is its intent-based architecture, which prioritizes user goals over the steps required to achieve them. Unlike traditional blockchain transactions, which expose users to risks like MEV (maximum extractable value) attacks —where advanced bots exploit transaction timing— the upgrade allows users to define their desired outcome or “intent.” Simply put, users specify what they want to achieve, such as exchanging tokens or completing a transaction, leaving the technical details to the system.

Professional market makers, known as resolvers, execute these intents, shielding users from risks while optimizing transactions. The architecture transforms the DeFi experience, enabling even highly complex cross-chain swaps to be automated and streamlined.

Bridging the Gap with Bridge-less Architecture

To prioritize security, Fusion+ favors atomic swaps conducted by professional resolvers over traditional cross-chain bridges that are often vulnerable to attacks. Smart contracts manage encrypted transactions and provide an all-or-nothing guarantee. In other words, if any transaction is left incomplete or fails, users will receive a refund.

Fusion+ offers gas-free cross-chain swaps and MEV protection. Source: 1inch

Another key feature of the upgrade is seamless integration across multiple blockchains. Supporting major networks like Ethereum, BNB Chain and Polygon, Fusion+ allows users to access liquidity from the Web3 ecosystem without encountering barriers or inefficiencies. Additionally, the platform employs a Dutch auction mechanism to determine the best transaction rates. By fostering competition among resolvers, this pricing model ensures users receive optimal rates for their swaps.

Fusion+ also enhances the user experience by offering gasless execution. Instead of requiring users to pay transaction fees directly, these costs are seamlessly incorporated into the transaction price.

Step-by-Step: How Fusion+ Simplifies Cross-Chain Swaps

Here’s a simplified breakdown of how Fusion+ streamlines cross-chain swaps:

- Initiating the Swap: The user enters swap details, and the order is broadcast to resolvers. A Dutch auction determines the best rate.

- Locking the Funds: The resolver locks the user’s assets in escrow on the source chain and deposits equivalent assets, protected by cryptographic secrets, on the destination chain.

- Completing the Swap: Once both escrows are active, the cryptographic secret unlocks the assets, completing the exchange.

Timelock Protection: If the swap isn’t completed in time, assets are automatically returned to the user.

With Fusion+, users gain full ownership of their assets without the need to trust any third party. Source: 1inch

Users enjoy a seamless experience while the platform handles the complexity, making cross-chain swaps accessible even to those unfamiliar with blockchain intricacies.

A Step Toward the Future of DeFi

With its Fusion+ upgrade, 1inch aims to transform the DeFi space. Combining intent-based architecture with atomic swap technology eliminates reliance on insecure bridges and simplifies cross-chain transactions into a seamless, secure experience. Users are no longer burdened with technical complexities or risks, as professional resolvers handle the intricacies of execution.

Offering an alternative to cross-chain interoperability, 1inch’s Fusion+ prioritizes user needs by simplifying exchange processes and is readily accessible. Users can start using Fusion+ immediately on the 1inch dApp and 1inch Wallet without any additional settings or configurations—just select the tokens and networks to swap, confirm the transaction, and let the system handle the rest.

As developers develop new ideas that focus on security, scalability and user-centric design, tremendous potential for a truly decentralized and borderless financial ecosystem could be unlocked.

This post is commissioned by Blockman and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction For February 23

Tokenized social network ResearchHub completes $2 million financing