Token FET from AI project Fetch.AI has risen 40% in a week, breaking out of a consolidation phase that lasted almost nine months. The bullish momentum similar to the rally in 2023 continues.

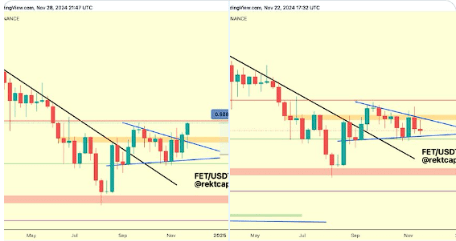

FET Graph

According to experts, the ongoing rally will depend on whether the bulls can turn the $1,77 level, which served as a resistance point in March 2024, into reliable support.

One of the reasons for the bullish sentiment may be a recent announcement made by the developers of Fetch.AI. They presented the “earn and burn” mechanism, a deflationary strategy aimed at reducing the token supply by burning a portion of the fees received by artificial superintelligence (ASI) services. The program, scheduled to launch in December, will reduce the total supply of FET, which should theoretically increase the value of the token.

The development team plans to reduce the total number of FET tokens from 2,8 billion to 2,7 billion, destroying 100 million to begin with. This initiative coincides with the launch of a new platform, ASI Train, designed to incentivize developers to create specialized artificial intelligence models.

Collaboration between first-layer blockchain Injectable (INJ) and the AI protocol Fetch.AI has also sent bullish signals to the crypto community and investors. The partnership will improve interoperability between the two platforms, simplifying the transfer of assets between the networks and strengthening the overall integration of the ecosystem.