Chainlink’s 29% Surge Positions LINK as the Real ‘Bank Coin’, Dismissing XRP

- An analyst tags XRP as the “banker-themed meme-coin” while labeling Chainlink (LINK) as the real “bank coin.”

- He also questioned the relevance of XRP as a bridge currency in cross-border payment with the existence of stablecoins and Central Bank Digital Currencies (CBDCs).

Chainlink (LINK) embarks on a significant rally from $18 on December 2 to $25 on December 3. According to our market data, the asset has printed a 27% surge on its 24-hour price chart. Meanwhile, its weekly gains have significantly extended to 53% from the $16.54 recorded on November 26.

Analyzing the factors behind this unexpected surge, we discovered that XRP’s rally could have influenced it. Additionally, the increase in development activities on its blockchain Oracle network’s ecosystem could have triggered this upsurge.

Chainlink (LINK) is the Real “Bank Coin”?

Following the ongoing rally, a crypto commentator has been forced to put the longstanding comparison between Chainlink and XRP to bed. According to Zach Rynes, also known as ChainLinkGod, LINK is the real “bank coin.” Throwing shades at XRP, Rynes highlighted that Chainlink is working in collaboration with SWIFT to connect more than 11,500 banks to the blockchain. He also pointed out that the platform is working with Sygnum, Fidelity International, Euroclear, and Wenia.

Commenting on XRP , Rynes labeled the token as a banker-themed memecoin. According to him, XRP “failed to gain meaningful traction for the cross-border payment use case.” Additionally, Rynes emphasized that Ripple is not working with SWIFT and cannot replace it.

His reason is that the operations of the blockchain company are far from the modus operandi of SWIFT. Also, Rynes highlighted the irrelevance of bridge currency in the current dispensation of cross-border payment when stablecoins and Central Bank Digital Currencies (CBDCs) exist.

There is simply no need for a “bridge currency” in a world of stablecoins and CBDCs, hence the pivot to other products like RLUSD, custody, and CBDC platforms that don’t use XRP. Ripple is not working with Swift, nor are they going to replace Swift, they aren’t at all relevant to the blockchain-related work Swift is doing, which is centered around Chainlink.

Another Analyst Joins the Discussion as Others Assess Future Price Direction

Ayo, an advisor to the decentralized finance protocol Kamino, believes that “LINK is XRP.” According to him, the recent XRP rally drew attention to Chainlink’s collaborations, especially with traditional finance and capital markets.

One of the benefits of the XRP run is I think people will finally pay attention to the insane banking and capital markets partners that Chainlink has. LINK is XRP but they actually work with TradFi. https://t.co/vNbLIstJx2 — Aylo (@alpha_pls) December 2, 2024

According to a recent report published by CNF, LINK could surge to $50 once it breaks out of a crucial resistance range of $18.4 to $26.3. As highlighted by analyst Ali Martinez, 100,220 LINK addresses bought 57.2 million LINK within this range. However, the average value of $22 currently holds the basis of several investors. Failure to sustain its level above this zone could see LINK falling to find support within $11 and $15.

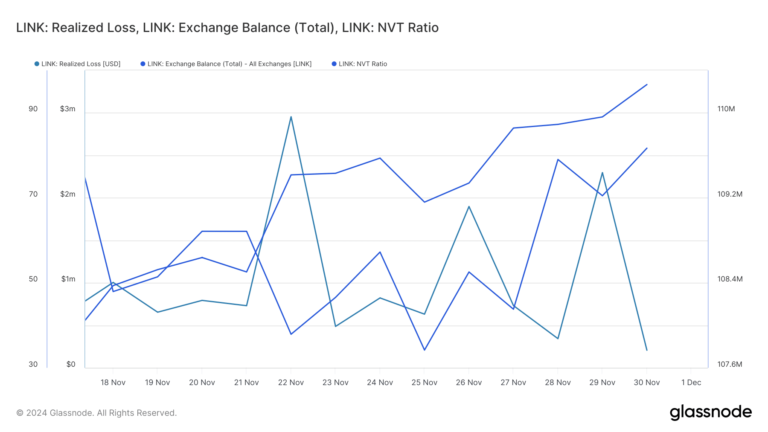

Analyzing other reports, we discovered that the asset recently broke out of a falling wedge as it attempted to create a bullish flag pattern. Other indicators, such as the NVT ratio, show that LINK is overvalued. This implies that there could be a temporal pullback before “charging up” the price curve. In any case, $18.66 has been found as the immediate support level.

Recommended for you:

- Buy Ripple (XRP) Guide

- Ripple XRP Wallet Tutorial

- Check 24-hour XRP Price

- More Ripple (XRP) News

- What is Ripple (XRP)?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Senator Hagerty introduces the GENIUS Act to regulate stablecoins

Bank of England cuts interest rates by 25 basis points

ETH falls below $2,800

Telegram requires all crypto wallets to use TON Connect