Google Trends Confirms Altcoin Season as Interest Matches Record Highs of 2021

With altcoin interest matching 2021 levels, a new altcoin season is underway. Learn why key metrics point to a potential shift from Bitcoin to altcoins.

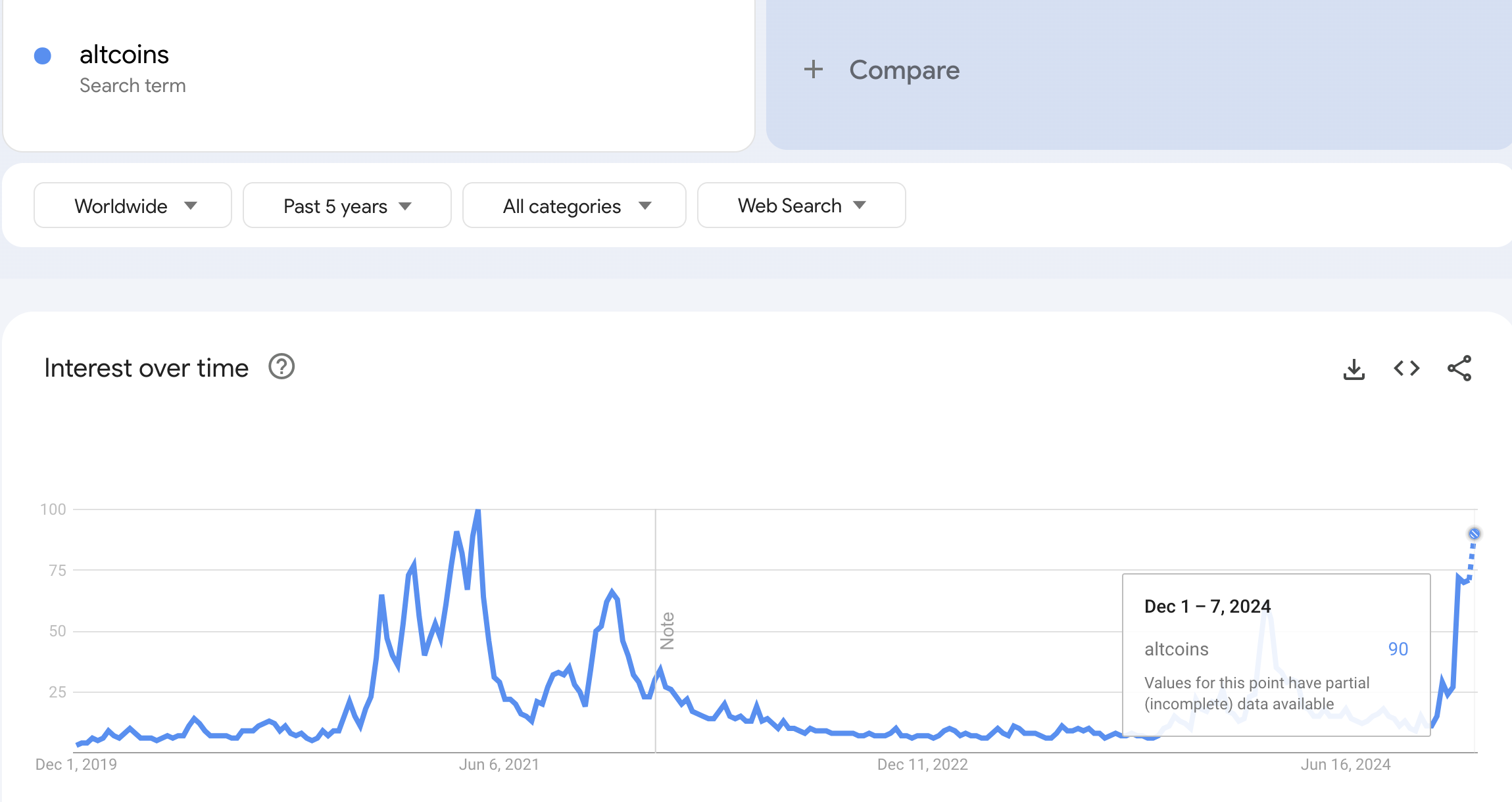

After a long wait, altcoin season is finally here, with Google Trends data revealing a spike in global searches for these cryptocurrencies. Notably, BeInCrypto observed that current search levels also rival the record highs last seen during the bull run of 2021.

Interestingly, this surge in altcoin interest coincides with Bitcoin’s (BTC) recent breakout above $100,000, suggesting a possible capital rotation from the leading cryptocurrency into alternative assets. Key metrics, including price action and on-chain data, further support the narrative of a sustained altcoin season.

Altcoins Search Climbs to Previous Bull Market Peak

In October, the global search for altcoins had a Google Trends score of 11. The numbers displayed alongside search terms at the top of a Google Trends graph represent their total search volume. A downward-trending line (close to 0) indicates a decline in the term’s relative popularity.

On the other hand, a Google Trends score near 100 signifies peak search interest for a term. Currently, the worldwide search for ‘altcoins’ scores 90, reflecting exceptionally high interest in these cryptocurrencies.

Interest reached similar levels last during the 2021 bull run, which propelled many altcoins to new all-time highs. Notably, the pattern seems to be repeating, with altcoins like BNB and Tron (TRX) recently setting new records while others approach similar milestones.

Altcoins Interest Over Time. Source:

GoogleTrends

Altcoins Interest Over Time. Source:

GoogleTrends

Analysts Agree That It’s Altcoins’ Time to Shine

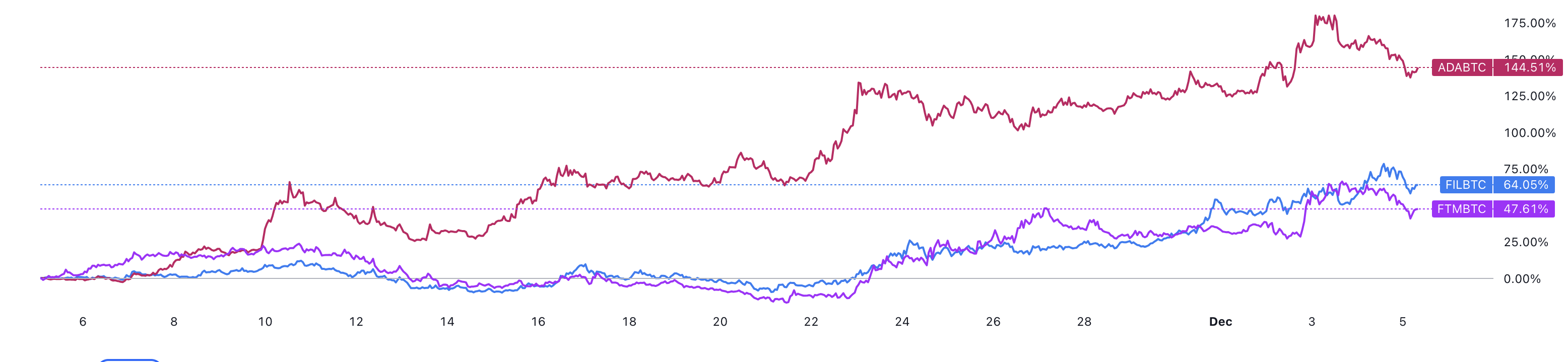

This trend also aligns with the views of several analysts. For many, the performance of altcoins relative to Bitcoin (BTC) is a more significant indicator than their performance against the US Dollar. Technical analyst Mr. Anderson is one such expert who emphasizes this perspective.

“To the geniuses that think ALT season already happened…ALT season is not when ALTs pump vs USD. USD is a shit coin, so that’s ALT vs shitcoin. A true ALT season is when ALTs pump vs BTC. It’s comin,g and it will be glorious!” The analyst opined.

Interestingly, a look at the performance of tokens like Fanton (FTM), Cardano (ADA), and Filecooin (FIL) shows that the prediction is already in play. As shown below, FTM is up 47% against BTC, FIL is up 64%, and ADA has outperformed it by 144% in the last 30 days.

Altcoins vs Bitcoin Performance. Source:

TradingView

Altcoins vs Bitcoin Performance. Source:

TradingView

Benjamin Cowen, the founder of IntoTheCryptoverse, is another analyst who shares this sentiment. According to Cowen, altcoins might continue to outpace Bitcoin even in 2025.

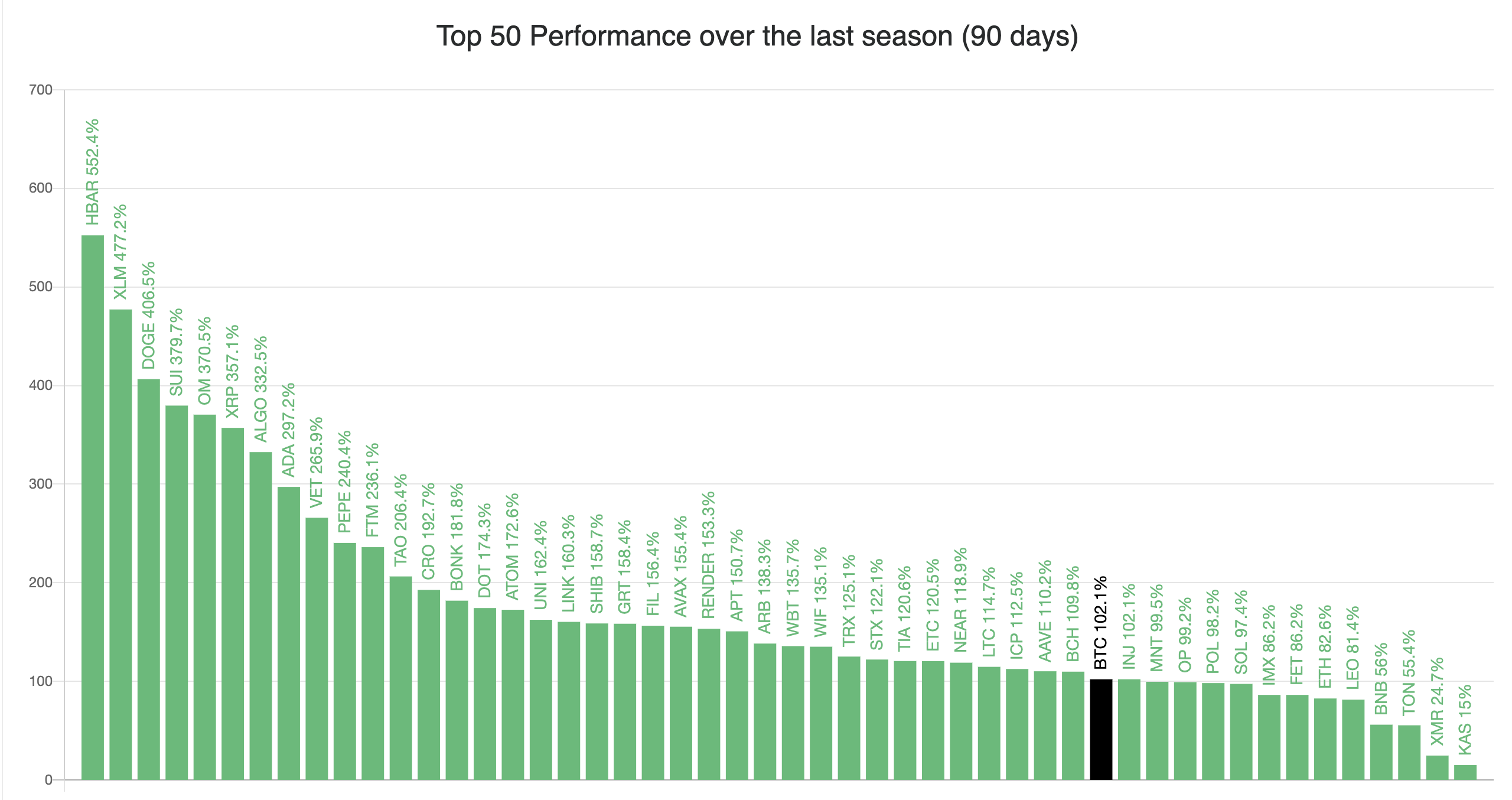

Furthermore, the Altcoin Season Index further supports the altcoin resurgence. This index evaluates the performance of the top 50 cryptocurrencies relative to Bitcoin (BTC) within a 90-day window. Altcoin season is confirmed when at least 75% of these assets outperform BTC.

Recently, BeInCrypto reported that 38 out of the top 50 altcoins had surpassed BTC’s performance, though that number has slightly declined to 36. However, such pullbacks are historically typical and do not negate the broader narrative that altcoin season is confirmed.

Altcoin Season Index. Source:

Blockchaincenter

Altcoin Season Index. Source:

Blockchaincenter

TOTAL3 Seems Ready to Continue Rally

From a technical perspective, the TOTAL3 chart — a measure of the market capitalization of all altcoins excluding Ethereum (ETH) — offers valuable insights into the ongoing altcoin season.

Currently, TOTAL3 has climbed to $1.08 trillion, signaling strength in the broader altcoin market. Additionally, the Parabolic Stop and Reverse (SAR) indicator, a tool for identifying support or resistance levels, is positioned below the market value.

TOTAL3 Daily Analysis. Source:

TradingView

TOTAL3 Daily Analysis. Source:

TradingView

This setup suggests bullish momentum, with the altcoin market likely to continue rising. However, a surge in Bitcoin’s price and a resurgence in BTC dominance could temporarily stall this altcoin season’s progress.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Structure Legislation Will Boost Bitcoin: Satoshi Act Co-Founder Dennis

With market structure legislation picking up steam, states and global players are discreetly preparing for a future that incorporates Bitcoin, identifying a major shift in policy and investment trends.

SOL Strategies and Pudgy Penguins Launch PENGU Validator on Solana Network

SOL Strategies and Pudgy Penguins team up to launch a dedicated Solana validator, blending NFT culture with institutional-grade staking infrastructure.

Mantra CEO Breaks Silence After Historic OM Crash

How Many Bitcoins Can The U.S. Government Actually Buy?