Top 5 Celebrity Memecoin Scandals You Need to Know About

Memecoins often make headlines for their volatility and hype. However, when celebrities get involved, the stakes become even higher—and so does the potential for heavy losses. This article dives into some of the wildest memecoin scandals led by celebrities, highlighting their pump-and-dump tactics, insider trading, and the impact on unsuspecting investors.

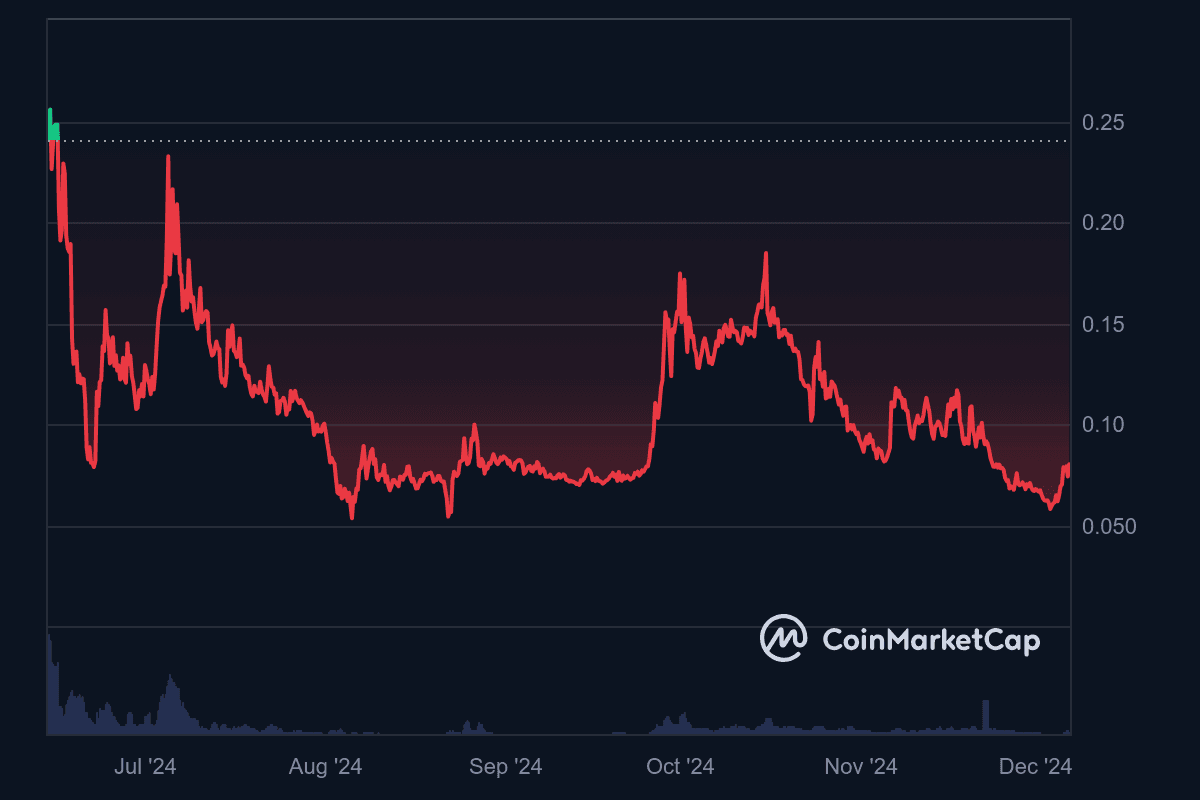

Andrew Tate and the Rise (and Fall) of $DADDY

Andrew Tate’s $DADDY token was promoted as a revolutionary memecoin, but the reality was far from it. Insiders reportedly bought 30% of the supply before Tate even mentioned it on X. While the token experienced pumps and dumps, it never recovered its initial price, leaving investors in the lurch.

Jack Doherty’s Live Stream Disaster

YouTuber Jack Doherty jumped on the memecoin bandwagon, hyping up his project during a live stream. Many of his followers bought into the token, only for Jack to sell all his holdings shortly after. This move crashed the coin’s value, causing massive losses for his community. To make matters worse, Jack deleted all his promotional posts about the token, leaving investors angry and confused.

Jason Derulo’s $JASON Drama

Pop star Jason Derulo entered the crypto scene with $JASON, but the venture turned sour fast. After the token’s price plummeted by 70%, Jason blamed a collaborator named Sahil for scamming him. Despite promising to stay loyal to his community, Jason never mentioned the token again, leaving investors feeling abandoned.

Hawk Tuah Girl’s $HAWK Catastrophe

Hawk Tuah Girl launched $HAWK, but the project was doomed from the start. Insiders sniped 97% of the supply and dumped it for profit, causing the token’s value to crash instantly. Although Hawk Tuah Girl hosted a Twitter Space to address the FUD, she went silent afterward, further frustrating her community.

Sean Kingston’s $KING and Legal Trouble

Singer Sean Kingston launched $KING, which initially hit a market cap of $4 million before crashing to just $400k in minutes. The scandal took a darker turn when it was revealed that both Sean and his mother are facing potential prison sentences for fraud related to the token.

Conclusion: A Cautionary Tale for Investors

Celebrity-backed memecoins might seem exciting, but these cases highlight the risks of investing in tokens promoted by public figures. From insider trading to pump-and-dump schemes, these scandals have left countless investors out of pocket. Always do your research, and remember—hype doesn’t guarantee legitimacy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ENS founder reports phishing scam that fools users with fake subpoena

10000000AIDOGEUSDT now launched for futures trading and trading bots

Bitget Launches WCT On-chain Earn With 4.78% APR

deBridge Foundation opens DBR token airdrop and LFG Treasury token collection