Largest altcoin liquidation since 2021 hits amid crypto market selloff

Altcoins led a cryptocurrency market-wide selloff with $1.58 billion in liquidations, as ether, solana and cardano prices dropped sharply.Ether’s funding rate has dropped to multi-week lows, signaling a potential unwind of excessive leverage, which analysts suggest could pave the way for more sustainable price action.

The cryptocurrency market experienced a major deleveraging event over the past 24 hours, with altcoins bearing the brunt of the selloff and total liquidations reaching levels not seen in years.

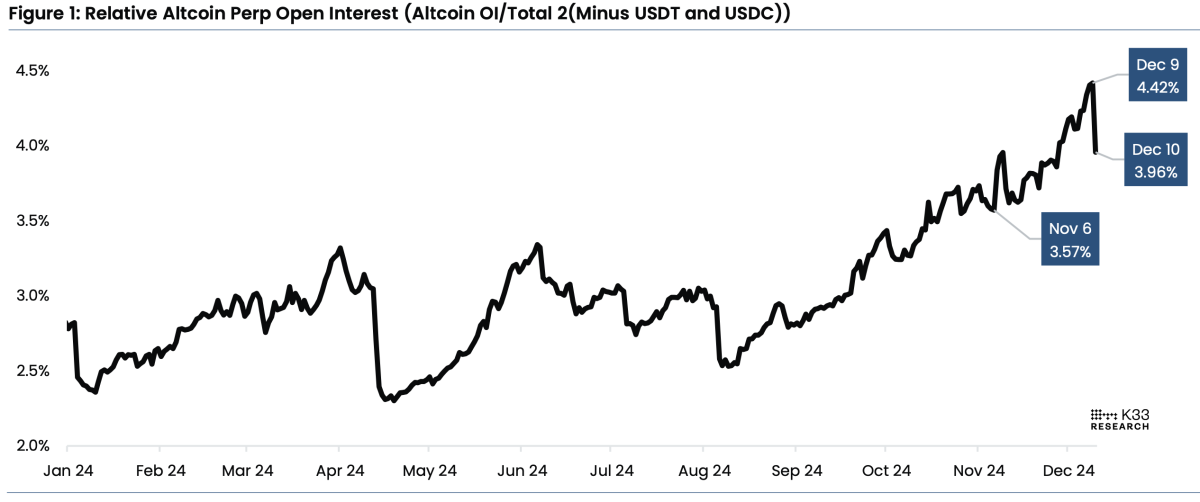

According to K33 Research, altcoin open interest relative to the total altcoin market cap surged from 3.57% to 4.42% on Monday, leading to soaring funding rates. However, this leverage buildup unraveled sharply, falling back to 3.96% after cascading liquidations triggered a widespread selloff.

"Yesterday's altcoin leverage wipeout was potentially the largest daily long liquidation event since May 19, 2021, and liquidations saw altcoin leverage fall by $12.8 billion, the largest daily reduction in altcoin open interest ever," K33 Head of Research Vetle Lunde said in a report on Tuesday. "We note that cascading liquidations were a frequent feature of the 2021 bull market and are seemingly back on the menu as we near the end of 2024."

Altcoin perpetual futures open interest sees the largest daily reduction ever. Image: K33 Research.

Major altcoins, including ether, solana and cardano, suffered sharp declines over the past 24 hours, falling 5%, 6%, and 11%, respectively. The cryptocurrency market-wide drop saw significant liquidations, with $1.58 billion in total liquidations, according to data from Coinglass.

Most of these were long liquidations, totaling $1.39 billion, as prices plunged across the board. Altcoins bore the brunt of the selloff, with ether alone seeing over $200 million in long liquidations. Meanwhile, bitcoin recorded $135 million in long liquidations but rebounded quickly, finding support near the $95,000 level before consolidating around the $97,000 level.

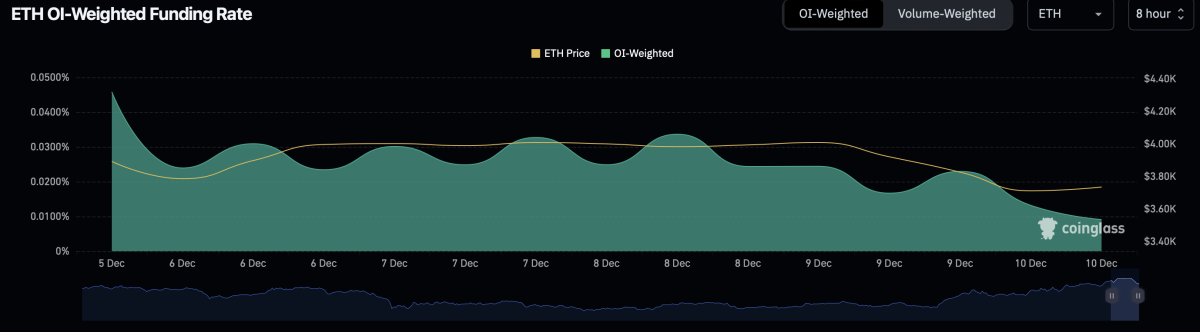

Ether's open-interest-weighted futures funding rate has dropped significantly over the past 24 hours, falling from 0.0229% to 0.0091%—a multi-week low, according to Coinglass . Analysts at CryptoQuant noted that such a decline mirrors conditions seen in January 2024, when ether rallied before experiencing a pullback late in the month.

Analysts at Bitfinex echoed this sentiment, highlighting that falling funding rates often signal the removal of leverage from the market. This process could lead to healthier, more sustainable price action.

"If funding rates begin to decline further, it would signal that excessive long leverage is starting to unwind, potentially leading to a more balanced market as price forms a base," Bitfinex analysts told The Block.

Bitfinex analysts said that conversely, a re-acceleration in funding rates could suggest that additional risk is being added to the long side, which might indicate renewed speculative demand or an increasing reliance on leverage.

ETF inflows support bullish mid-term outlook

“As Bitcoin consolidates above $100,000, the mid-term outlook remains bullish, and with normalising funding rates and slowing sell-side pressure, further upward momentum is likely, provided ETF inflows continue," Bitfinex analysts said.

The Bitfinex analysts also noted that funding rates across altcoins have stabilized to more sustainable levels. Annualized funding rates are now below 30% for altcoins and under 15% for bitcoin and ether, levels typically observed during bull market runs.

Despite the recent market dip, analysts remain optimistic about the mid-term outlook for bitcoin and ether, pointing to continued inflows into spot Bitcoin and Ethereum ETFs . These funds have posted eight consecutive days of net inflows, suggesting institutional demand remains strong.

Last week, crypto investment products recorded their largest-ever weekly inflows, surpassing $3.85 billion, according to CoinShares. This pushed year-to-date (YTD) net inflows to $41 billion and drove total assets under management (AuM) to a record high of over $165 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US spot Bitcoin ETFs saw a net inflow of $380.06 million yesterday

USDC circulation on Solana exceeds 10 billion

US spot Bitcoin ETFs saw net inflows of $3.033 billion this week