Bitget Daily Digest|$AVA gets industry buzz, $ai16z surpasses $Turbo as top performer in the AI memecoin sector (December 13)

Market highlights

1. DeFi momentum: $AAVE's surge grabs attention as multiple metrics hit record highs. The WLFI project under the Trump family has invested $50 million to increase holdings in $ETH, $AAVE, and $LINK, further fueling the DeFi wave. Grayscale adds to the market momentum with the launch of Optimism ($OP) and Lido DAO ($LDO) trust funds.

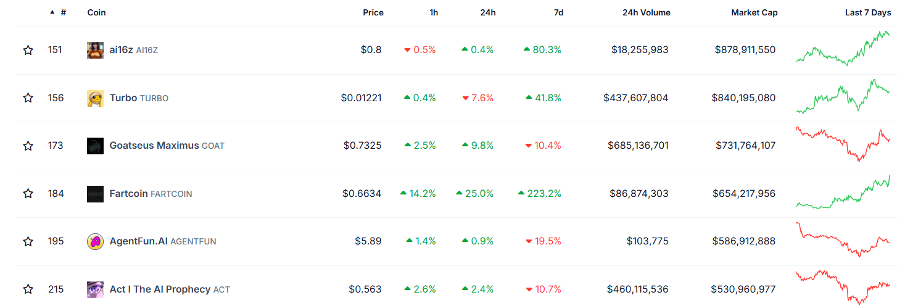

2. AI memecoin sector shifts: The AI memecoin space is undergoing significant changes. $VIRTUAL on Base reaches new highs, while $ai16z surpasses $Turbo to become the top memecoin by market cap. Meanwhile, $FARTCOIN rises rapidly, overtaking $ACT to secure fourth place behind $GOAT, signaling a dynamic reshuffling within the sector.

3. NFT market trends: Blue-chip NFTs, including Azuki and Doodles, show widespread gains. CryptoPunks maintain the top spot by market cap, followed by Pudgy Penguins and Bored Ape Yacht Club in third. OpenSea's X account fuels excitement by changing its profile picture to a Pudgy Penguins image, further boosting market sentiment.

4. Regulatory and market moves: Texas Republicans propose a bill to establish a Bitcoin strategic reserve. Former President Trump expresses support for crypto in an interview, emphasizing that the U.S. should lead in the crypto space. Tether mints an additional $1 billion USDT on Ethereum. Binance CEO CZ boosts $AVA, driving a 360% short-term surge after his endorsement on social media.

Market overview

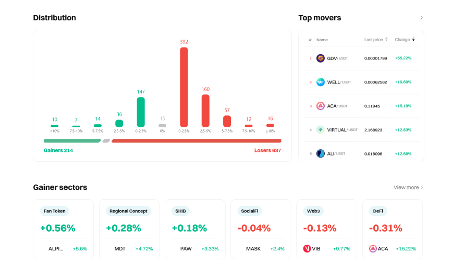

1. BTC and ETH experience high-level consolidation as the market faces overall pressure. Sector performance remains sluggish, with fan tokens being the only standout.

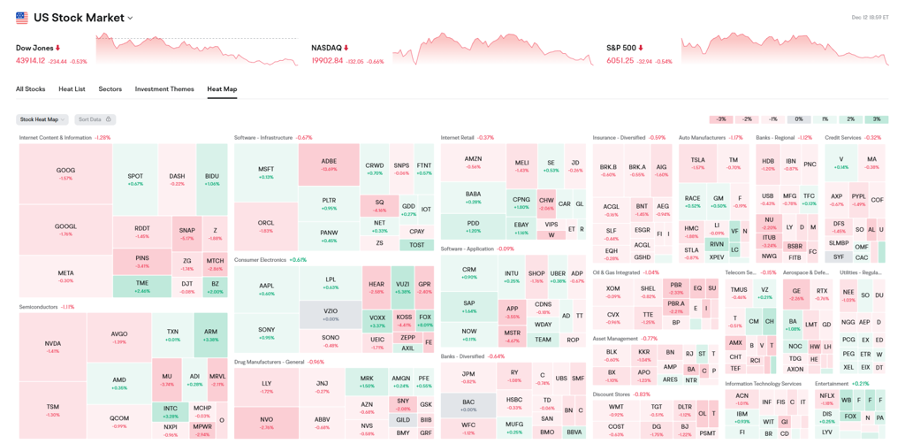

2. The NASDAQ pulls back from record highs, while the Dow extends its losing streak to six days. Meanwhile, Chinese concept stocks defy the trend with a rebound.

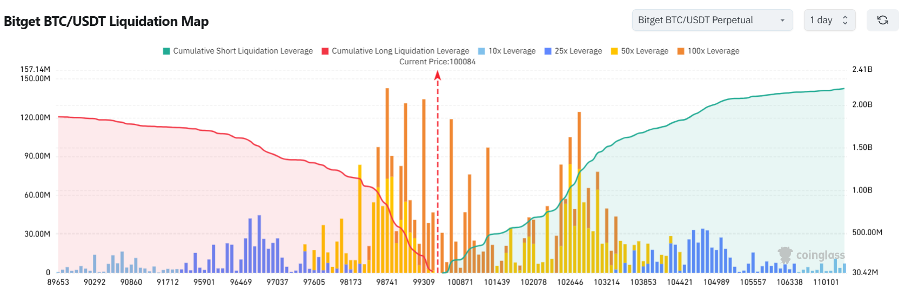

3. Currently standing at 100,084 USDT, Bitcoin is approaching a potential liquidation zone. A 1000-point drop to around 99,084 USDT could trigger over $463 million in cumulative long position liquidations. Conversely, a rise to 101,084 USDT could lead to more than $310 million in cumulative short position liquidations. Both long and short positions should exercise caution and manage leverage prudently to avoid large-scale liquidations.

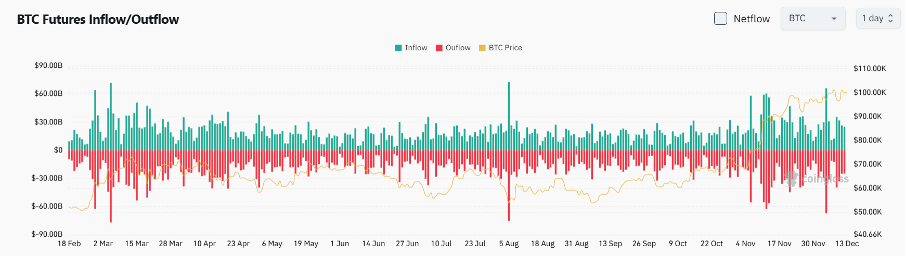

4. Over the past day, Bitcoin saw $4.34 billion in spot inflows and $4.46 billion in outflows, resulting in a net outflow of $120 million.

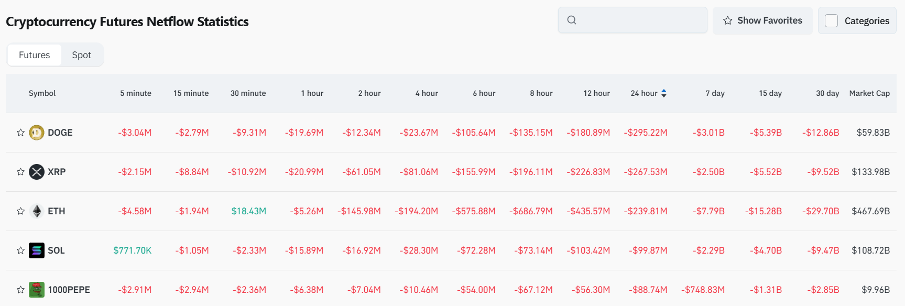

5. Over the last 24 hours, $DOGE, $XRP, $ETH, $SOL, and $PEPE have led in futures trading net outflows, signaling potential trading opportunities.

Highlights on X

1. s4mmy.moca: Trends and highlights in AI agents over the last 24 hours

The author states that the AI agent space has seen explosive developments over the last 24 hours:

- A ChatGPT API outage has paved the way for @grok's rise.

- @ropAIrito autonomously purchased a pizza, highlighting the potential of crypto payments.

- AIXBT gained fame by accurately predicting a 7x surge in $MANA.

- The first transaction between AI agents using $CHAOS has sparked discussions about a universal currency.

- Bully has become the first-ever AI agent ambassador.

These milestones signal the rapid evolution of AI agents toward autonomous trading and ecosystem expansion.

X post: https://x.com/S4mmyEth/status/1867160365760401457

2. starzq.eth: Virtuals vs ai16z – The ecosystem battle in the AI agent sectors

Virtuals and ai16z represent two distinct approaches: the closed, refined "Apple model" and the open, flexible "Android model." Virtuals Protocol utilizes a self-contained agent framework and launchpad mechanism to build a tightly integrated ecosystem, offering both efficiency and stability. ai16z, leveraging the open-source ELIZA framework, has attracted numerous contributors, making it a popular GitHub repository. However, it lacks a robust token economy to incentivize sustained development. The key to ai16z's future success lies in refining its token incentive mechanism to engage more developers and establish the world's largest open-source agent ecosystem. Much like Android's dominance in market share and Apple's lead in profitability, this ecosystem battle will shape the long-term dynamics of the AI Aaent sector.

X post: https://x.com/starzqeth/status/1867220482912887273

3. Michael Liu: Deep dive into memecoin narratives and trading strategies

Memecoin trading is fundamentally a "game of spread," where the narrative's value hinges on its "spreadability" and "emotional resonance." Narratives can be categorized into four types:

- Hotspot narratives (e.g., Pnut, Ban): These see rapid bursts of popularity but are short-lived, requiring quick profit-taking.

- Classic narratives (e.g., Pepe, Popcat): Highly recognizable and ideal for long-term holding.

- Original narratives (e.g., SPX, GOAT): Strongly adaptable but rely heavily on the team's operational capabilities.

- Derivative narratives (e.g., Brett, Andy): Driven by top performers and suitable for short-term strategies. Understanding the narrative logic behind the project owners is key to adjusting trading strategies and profiting in the memecoin market.

X post: https://x.com/Michael_Liu93/status/1866800767719575737

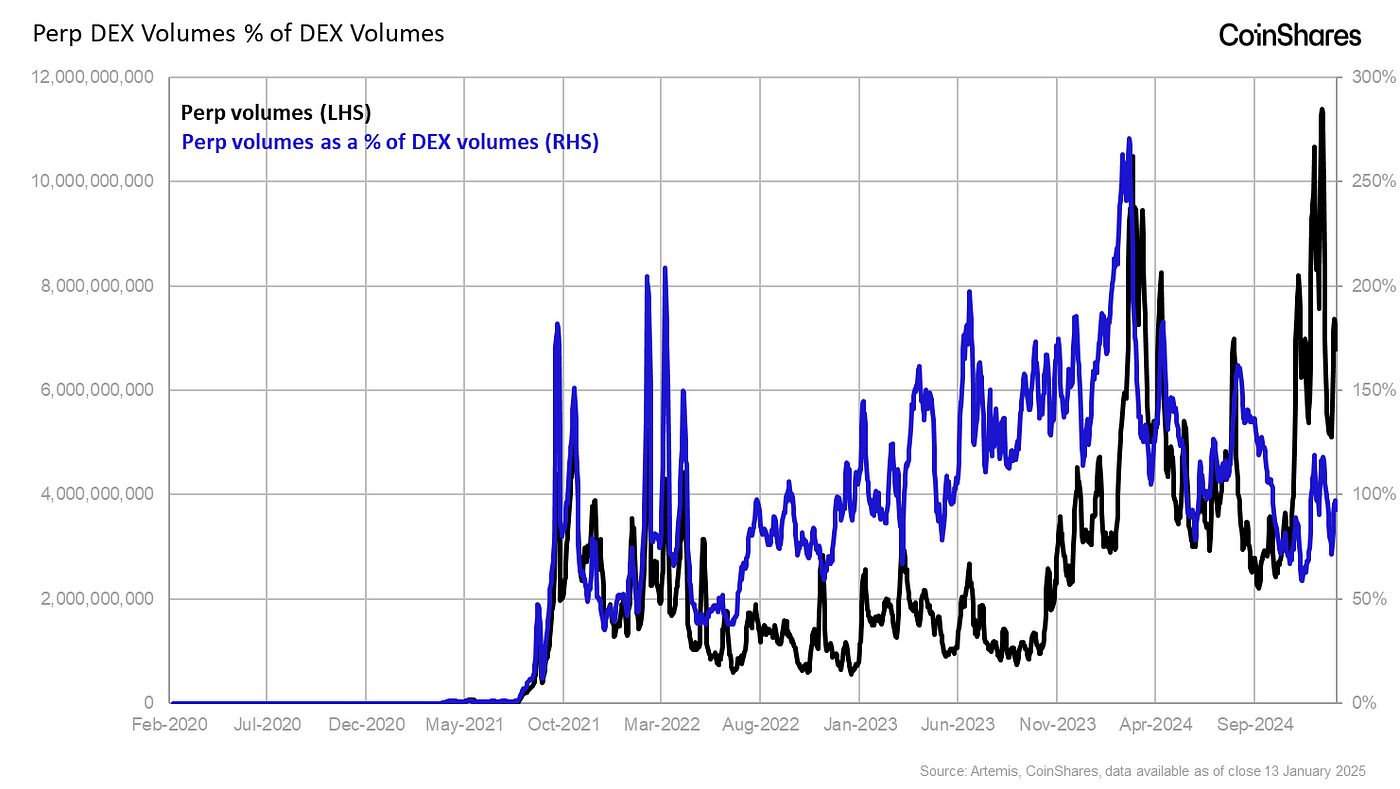

4. @benmo.eth: Who deserves the most attention in the DeFi derivatives sector?

Decentralized derivatives have the highest valuation ceiling among the seven DeFi sectors. The first-generation project SNX has faded, with its founder now focusing on Infinex. The third-generation project, GMX, once impressive, has struggled to break through during the bear market, and its V2 performance has been lackluster. The fourth-generation newcomer, Hype, has carved out new valuation opportunities with its transparent mechanisms and strong community backing. Meanwhile, the second-generation project, dYdX, is rebuilding market confidence through MegaVault. As its founder returns and liquidity gradually recovers, dYdX is attracting existing traders back to the platform. This sector continues to hold great potential and deserves ongoing attention.

X post: https://x.com/Super4DeFi/status/1867190766432584083

Institutional insights

1.CryptoQuant: Ethereum price could hit $5000 due to institutional demand.

Article: https://decrypt.co/296330/ethereum-could-hit-5k-institutional-demand-cryptoquant

2.Electric Capital: Solana surpasses Ethereum as the fastest growing crypto ecosystem in terms of new developers.

3.Co-founder of Syncracy Capital: Crypto x AI sector is expected to achieve 10x growth in market cap.

X post: https://x.com/HighCoinviction/status/1867100976869675468

4.Sygnum Bank: Bitcoin demand to surge in 2025; more entities to add Bitcoin into their portfolios.

Article: https://cointelegraph.com/news/2025-demand-shock-bitcoin-price-spike-sygnum

News updates

1. The Texas Republican representative submits a bill to establish a strategic Bitcoin reserve.

2. Donald Trump indicates cryptocurrency and AI will require more energy and promises significant progress in the crypto space.

3. BlackRock suggests that investing up to 2% of a multi-asset portfolio in Bitcoin is a reasonable range.

4. U.S. initial jobless claims unexpectedly rise; the probability of a 25-basis-point Fed rate cut in December slightly decreases to 96.7%.

5. Argentina president Milei announces a plan for free currency circulation next year, potentially including Bitcoin.

Project updates

1. Virtuals Protocol detects and is fixing a token pre-lock vulnerability; user funds remain secure.

2. Floki plans to allocate 35% of MONKY token supply to the Floki ecosystem.

3. jump.fun spends $400,000 on $JUMP buybacks on its first day.

4. Wintermute and DWF Labs serve as market makers for BSC memecoin MONKY.

5. The Aave community initiates an ARFC proposal to deploy Aave V3 on Linea.

6. Less than 1% of Microsoft shareholders vote in favor of Bitcoin investment proposals.

7. Babylon Cap-3 stakes over 11,000 BTC, with a total TVL of $3.52 billion.

8. Injective ecosystem trading platform, Helix, announces the launch of points program.

9. Lista DAO introduces Gauge voting and bribery markets as critical features for community decentralization and empowerment.

10. The Sequentia co-founder claims to have exploited a severe vulnerability, crashing 69% of Dogecoin nodes.

Token unlocks

Render (RENDER): Unlocking 490,000 RENDER, valued at $5.05 million, accounting for 0.1% of the circulating supply.

Axie (AXS): Unlocking 820,000 AXS, valued at $7.07 million, accounting for 0.5% of the circulating supply.

Recommended reads

From ICO to aICO: When AI becomes the sole founder of crypto projects

The era of ICOs and Launchpad is behind us. The future belongs to AICO (AI Initial Coin Offerings), where autonomous AI agents replace human founders, setting new standards for trust, efficiency, and governance.

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604416163

U.S. capital-backed tokens lead the rally: 18 token projects linked to BlackRock and other asset management giants

The recent altcoin season has been led by tokens in RWA and payment sectors, areas heavily backed by traditional financial giants. Tokens like Ondo, CRV, and ENA, closely associated with asset management giants like BlackRock, have shown impressive gains. During the broader market dip on the 10th and 11th, these tokens proved more resilient or rebounded faster. Sectors and projects supported by traditional finance giants and empowering traditional finance could become one of the most promising directions in this bull market.

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604416669

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Shows Bullish Signs as $0.2677 Target Comes into Focus

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

The Perpetual DEX Sector: A Great Leap Forward