Fuel Network (FUEL) Faces Potential Decline Post-Airdrop Amid Altcoin Market Volatility

-

The crypto market faces significant volatility as several altcoins experience drastic price changes, highlighting investor sentiment shifts.

-

The recent price drops prompt discussions around market dynamics, particularly the implications of token generation events and profit-taking strategies.

-

As highlighted by COINOTAG, “The current market conditions are a reflection of not only speculative trading but also the impact of new token releases.”

This article delves into the latest trends in the crypto market, focusing on the fluctuations of Fuel Network, Akuma Inu, and Pudgy Penguins, providing insights into their market behavior.

Understanding the Crypto Downturn: Fuel Network (FUEL)

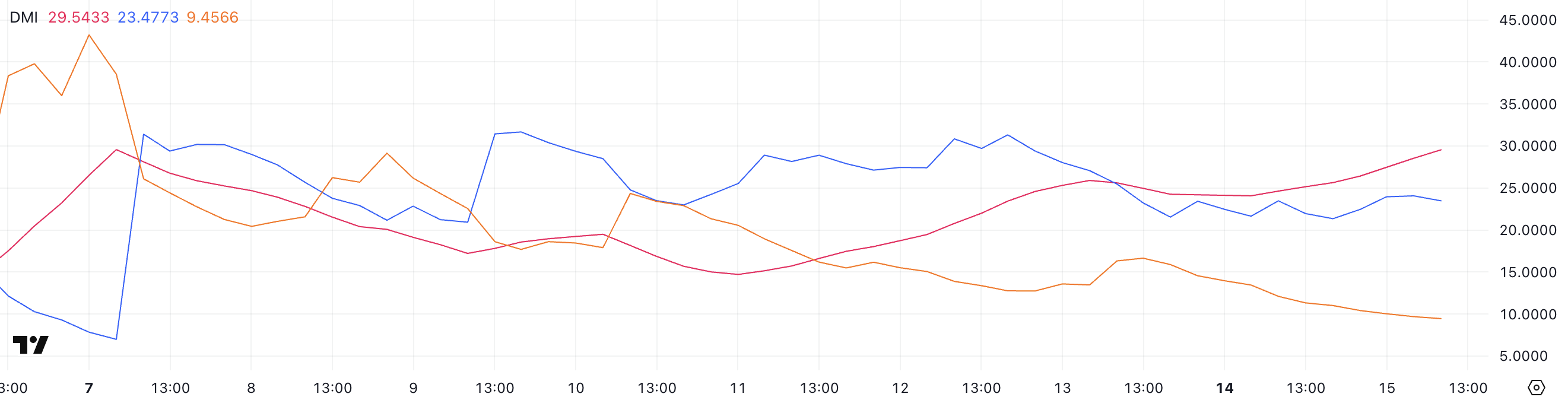

Fuel Network (FUEL) has recently made headlines with its Token Generation Event (TGE), yet it faces a dramatic price decline of 30.5% from its opening figure of $0.069 to its current value of $0.046. This substantial drop can be attributed to heightened market volatility triggered by a combination of profit-taking and general sell-off trends in the altcoin sector.

Fuel Network is designed as an Optimistic rollup that aims to enhance transaction throughput on the Ethereum network. The declining price may also reflect investor concerns regarding increased sell pressure following the announced airdrop of 10% of its total supply. Currently, the market capitalization of FUEL stands at approximately $163.52 million, indicating potential for recovery should investor confidence improve.

Fuel Network Price Chart. Source: TradingView

Akuma Inu (AKUMA): A Surging Meme Coin

Akuma Inu (AKUMA), a meme-based cryptocurrency on the Base network, has made a notable impression with a striking 53.6% price increase to $0.00023 within a single day. This surge can mainly be attributed to the growing interest and buying pressure from investors eager to take part in the meme coin wave.

Despite this impressive climb, market volatility poses risks, especially if a significant number of current holders choose to realize profits. Should profit-taking commence, analysts suggest the price could revert to levels below $0.00020. The trend underscores the delicate balance in crypto investments where excitement often leads to rapid fluctuations.

Akuma Inu Price Chart. Source: CoinGecko

Pudgy Penguins (PENGU): Challenges Ahead

Pudgy Penguins (PENGU), associated with the popular NFT collection, has also been in the spotlight due to an airdrop. However, it witnessed a 5.5% decline in its market price, bringing it to $0.032. Investor sentiment appears to be cautious, and unless there is a significant boost in liquidity, analysts predict the altcoin could slide to around $0.026.

In the fluctuating landscape of cryptocurrencies, the Pudgy Penguins remain in a delicate phase, with potential resistance levels observed at $0.040 if liquidity conditions improve.

Pudgy Penguins 1-Hour Analysis. Source: TradingView

Conclusion

The recent performance of Fuel Network, Akuma Inu, and Pudgy Penguins underscores the unpredictable nature of the cryptocurrency market. Each altcoin faces unique challenges and potential recovery paths. Investors should remain vigilant, as market conditions can shift rapidly, influencing pricing and trading volume. Continuous monitoring and strategic planning will be crucial for navigating this volatile landscape. Stay informed and explore the dynamics of these trending cryptocurrencies to make informed investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Recent Surge Towards $90,000 Faces Possible Pullback Amid Tariff Uncertainty

Solana’s Recent 20% Surge Suggests Potential to Test Key Resistance Levels Amid Rising DEX Activity

Bitcoin trader sees gold 'blow-off top' as XAU nears new $3.3K record

Bitcoin is in no mood to copy gold's bull run yet, but on the horizon is a "terminal" end to the record XAU/USD winning streak, a trader predicts.