AVAX and LDO Approach Key Resistance: Are Breakouts On The Horizon?

Date: Sun, Jan 26, 2025, 09:13 AM GMT

The cryptocurrency market has remained under bearish pressure over the past month, largely due to the increasing dominance of Bitcoin. BTC dominance has climbed from a December 4th low of 54.74% to the current level of 58.77%, causing significant declines in many altcoins .

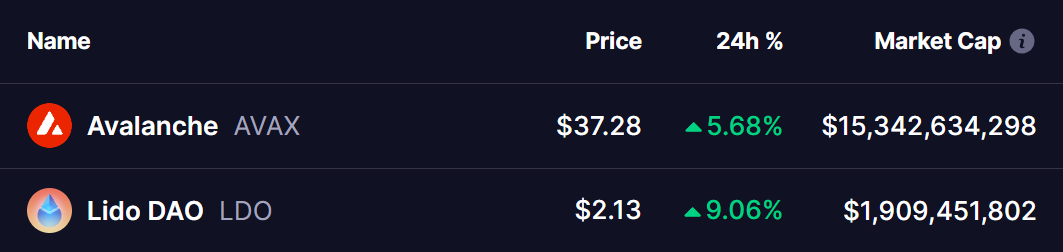

Despite the fluctuating market environment, Avalanche (AVAX) and Lido DAO (LDO) have shown promising signs of recovery today with the noticeable gains.

Source: Coinmarketcap

Source: Coinmarketcap

Both tokens are approaching key resistance levels that could define the next phase of their respective trends.

Avalanche (AVAX)

Avalanche is currently trading at $37.28, edging closer to the upper boundary of a descending trendline while facing resistance from the 25-day SMA (Simple Moving Average). Over the past few weeks, AVAX has consolidated within a descending triangle pattern. However, after bouncing strongly from the critical support zone at $33, the token has regained upward momentum.

Avalanche (AVAX) 1D Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) 1D Chart/Coinsprobe (Source: Tradingview)

This recent movement has brought AVAX to a critical juncture. A breakout above the descending trendline and a successful retest could potentially trigger a trend reversal. If confirmed, AVAX could target the following key resistance levels:

- $41.81

- $45.00

- $55.80

This represents potential gains of up to 50% from the current price level.

The MACD (Moving Average Convergence Divergence) indicator is gradually showing signs of a bullish crossover, indicating that momentum may favor the bulls. However, a rejection at this level could see AVAX revisiting the support zone near $33.

Lido DAO (LDO)

Lido DAO is trading at $2.13, moving within a long-term symmetrical triangle pattern. This consolidation phase has persisted since the bull run of 2021, with multiple rejections at the triangle’s descending resistance and bounces from its ascending support.

Lido DAO (LDO) 1D Chart/Coinsprobe (Source: Tradingview)

Lido DAO (LDO) 1D Chart/Coinsprobe (Source: Tradingview)

The most recent bounce occurred in late October 2024, from the $0.90 level. This push brought LDO closer to the descending resistance of the triangle.

A breakout above the resistance level, confirmed with a retest, could see LDO rally toward the following resistance levels:

- $2.48

- $3.70

This marks potential gains of up to 71% from the current price.

Currently, the 100-day SMA is acting as strong support for LDO, and the MACD is trending upward, suggesting growing bullish momentum. However, failure to break out could lead to further consolidation within the triangle.

Are Breakouts On The Horizon?

Both AVAX and LDO are at pivotal resistance levels that could define their next price movements. While technical indicators like the MACD are hinting at potential bullish breakouts, traders should remain cautious. A breakout needs confirmation with strong volume and retests to avoid false signals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always perform your own research and consult a professional before making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fartcoin Sees 22% Surge, Reaches Monthly Peak

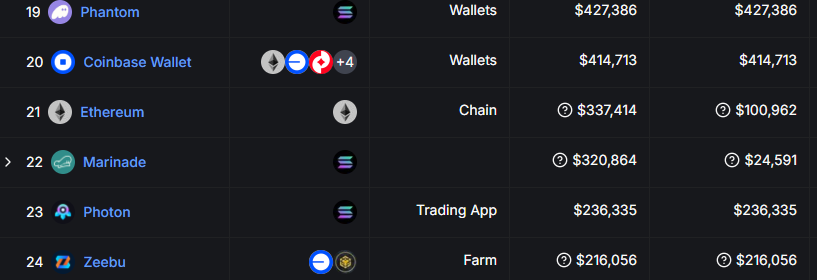

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.