Bitcoin (BTC) Whales Accumulating While Retail Investors Are Retreating: CryptoQuant CEO

Date: Sun, Jan 26, 2025, 06:03 PM GMT

In the cryptocurrency market, November 2024 was a historic month for Bitcoin (BTC). The price surged from $67,000 to a new all-time high of $99,000, driven largely by the victory of Donald Trump in the U.S. elections and his pro-crypto rhetoric.

However, after touching the $99K milestone, Bitcoin underwent a significant correction. The recent inauguration of Donald Trump and the speculated establishment of a Bitcoin Strategic Reserve have reignited market optimism, propelling BTC to a new all-time high above $109,000 and currently trading at $105K.

Source: Coinmarketcap

Source: Coinmarketcap

As Bitcoin continues to climb, on-chain data analyzed by Julio Moreno , CryptoQuant’s Head of Research, and shared by the platform’s founder and CEO, Ki Young Ju, highlights intriguing investor behavior.

Diverging Investor Behavior

According to latest report , Bitcoin investor activity has taken an interesting turn. When Bitcoin hit its $99K all-time high in November 2024, retail investors holding less than 1 BTC (non-wholecoiners) began to sell their holdings. This is reflected in the decline of non-wholecoiner holdings (blue line on the chart) from 1.75M BTC to approximately 1.69M BTC as of now.

BTC Holdings Chart/Source: @ki_young_ju (X)

BTC Holdings Chart/Source: @ki_young_ju (X)

In contrast, wholecoiners (investors holding ≥1 BTC) displayed a starkly different approach. Their holdings (pink line on the chart) surged from approx. 16.25M BTC to over 16.38M BTC during the same period. This indicates that larger investors, often considered “smart money,” have been taking advantage of the price corrections to accumulate more Bitcoin.

A Transfer of BTC From Weak Hands to Strong Hands

The price of Bitcoin (black line on the chart) has remained resilient, supported by the consistent accumulation from larger holders. This behavior illustrates a classic market pattern where Bitcoin moves from “weaker hands” (retail investors selling off during corrections) to “stronger hands” (institutional investors and whales accumulating). Historically, such patterns have often preceded significant price rallies.

What’s Ahead?

The accumulation by whales and smart money points to a promising outlook for Bitcoin. With Donald Trump’s pro-crypto administration making major strides for the industry and speculation surrounding a Bitcoin Strategic Reserve, the stage appears set for further bullish momentum.

If accumulation continues at this pace, Bitcoin could consolidate before making its next significant price move, potentially targeting $120,000 or beyond in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

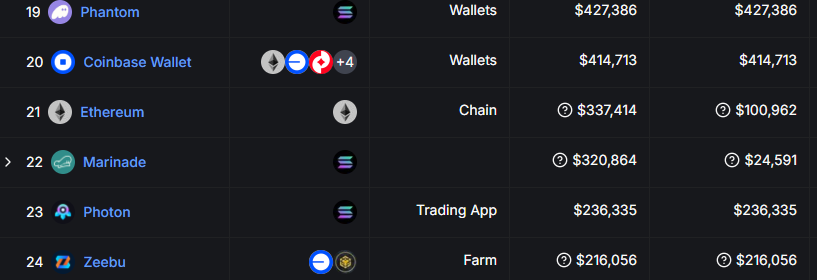

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.