XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

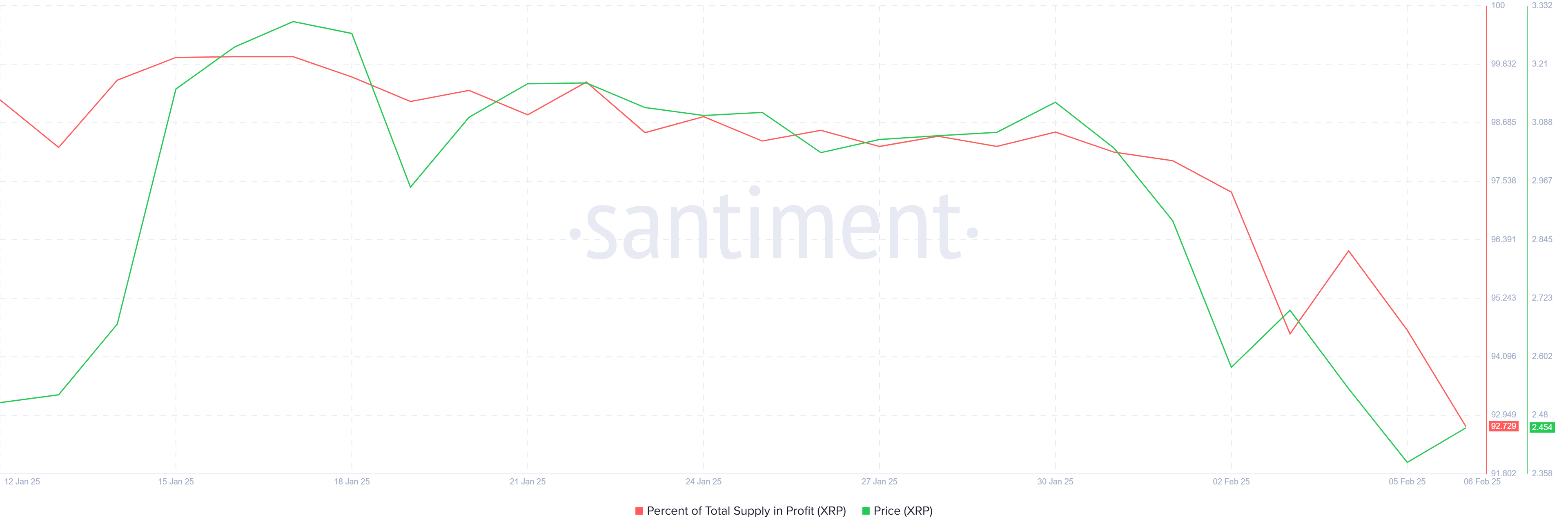

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

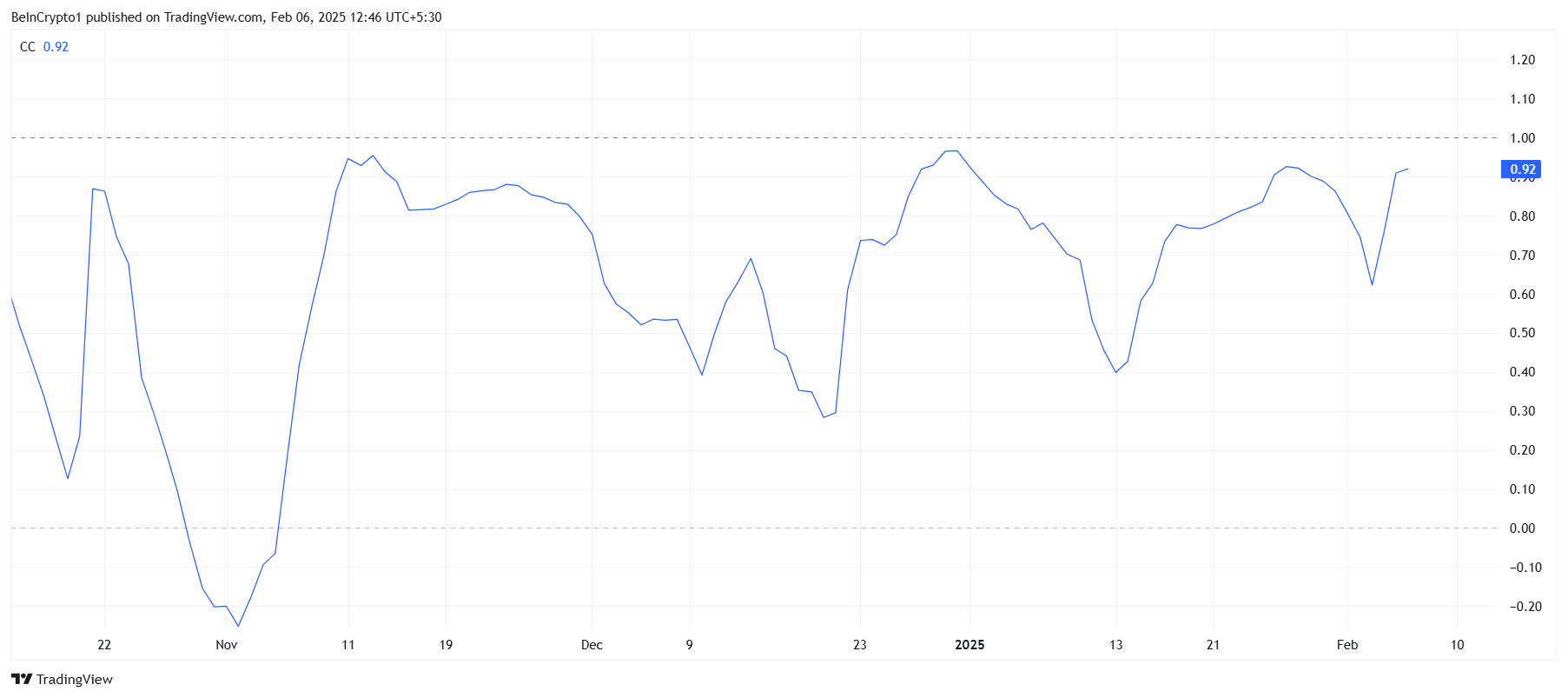

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News: 150-Year Market Cycle Signals No BTC Bull Run Until 2026—Here’s Why

Under pressure, Trump’s crypto czar divests his $200M+ crypto holdings

David Sacks divested over $200 million in digital-asset holdings to avoid conflicts of interest. Senator Elizabeth Warren criticized Sacks, questioning his crypto holdings. Sacks’ divestment details were revealed shortly before Warren’s letter requesting crypto ownership clarification.

Smart Contract Risks Could Be Global Finance’s Ticking Time Bomb, Warns Movement Labs Co-Founder

Cooper Scanlon emphasizes the serious vulnerabilities in blockchain infrastructure, especially Ethereum, highlighting the growing threat to global finance and calling for secure innovations like Move programming.

VIPBitget VIP Weekly Research Insights

Over the past month, the cryptocurrency market has faced a downturn due to multiple factors. Global macroeconomic uncertainties, such as shifts in U.S. economic policies and the impact of tariffs, have heightened market anxiety. Meanwhile, the recent White House crypto summit failed to deliver any significant positive news for the crypto market, further dampening investor confidence. Additionally, fluctuations in market sentiment have led to capital outflows, exacerbating price declines. In this volatile environment, selecting stable and secure passive-income products is more crucial than ever. Bitget offers solutions that not only provide high-yield fixed-term products but also flexible options for users who need liquidity. Furthermore, with the added security of the Protection Fund, investors can earn steady returns even amidst market volatility.