JASMY and QNT Approaching Falling Wedge Resistance – Are Breakouts on Horizon?

Date: Fri, February 14, 2025 | 10:53 AM GMT

The cryptocurrency market has been in a correction phase following the November rally, but signs of an altcoins recovery are emerging. Bitcoin dominance has dropped by 2.12% over the past 7 days, now sitting at 60.58%, suggesting that altcoins might be gearing up for a rebound.

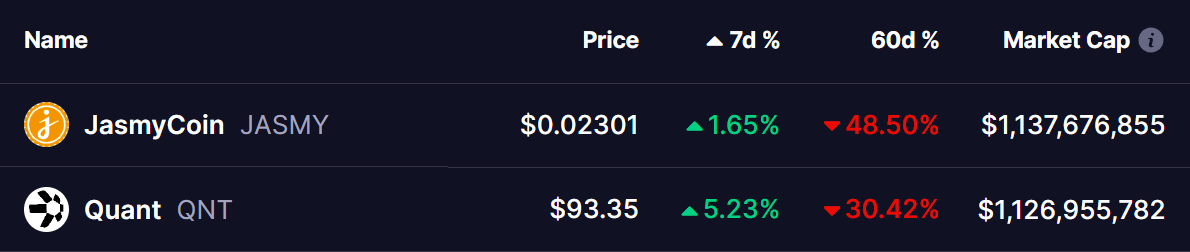

Following this, JasmyCoin (JASMY) and Quant (QNT) are turning green in weekly performance after experiencing deep corrections of 48% and 30% over the past two months.

Source: Coinmarketcap

Source: Coinmarketcap

Both tokens are approaching key resistance levels within their falling wedge patterns—a classic bullish formation that often leads to breakouts.

JasmyCoin (JASMY)

JASMY has been stuck in a falling wedge since December 6, when it got rejected at $0.059. The price plunged to $0.018, testing the lower trendline of the wedge, but it has since started to recover.

JasmyCoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

JasmyCoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

Now, JASMY is trading at $0.023 and inching closer to the upper trendline of the wedge. If the price manages to break above this resistance and confirm support on a retest, a strong rally could follow. The next major obstacle will be the 200-day simple moving average (SMA). A successful breakout could push JASMY toward $0.03467, marking a potential 50% gain from its current price.

The MACD indicator is flashing early signs of a bullish crossover, suggesting that buying pressure is starting to build.

Quant (QNT)

Similar to JASMY, Quant (QNT) has also been forming a falling wedge pattern after facing strong rejection from its December 7 high of $171. The correction brought QNT all the way down to $73, where it found support at the lower trendline of the wedge.

Quant (QNT) Daily Chart/Coinsprobe (Source: Tradingview)

Quant (QNT) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, QNT is recovering and trading around $93.50. With the MACD indicator shifting toward a bullish crossover, momentum appears to be favoring buyers.

If QNT breaks above resistance and confirms it as support, the next major hurdle will be the 25-day SMA. A successful breakout could push the price up to $115, offering a potential 22% upside.

What’s Next?

With JASMY and QNT nearing crucial breakout levels, traders should keep a close eye on their price action in the coming days. A breakout from the falling wedge pattern could trigger a strong rally, but overall market conditions, including Bitcoin dominance and Ethereum’s price movement, will play a key role in determining whether altcoins can sustain their recovery.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.

Market Moves: LINK Coin Faces Challenges as Tariff Uncertainty Looms

In Brief Market uncertainty continues to impact altcoin prices significantly. LINK Coin faces critical price thresholds that could determine its future direction. The macroeconomic landscape heavily influences investor sentiment in cryptocurrency markets.