Litecoin Going For Breakout, Open Interest, Social Activity Surge

Litecoin rising wedge channel keeps an eye on the upper trendline anticipating breakout. Highest LTC social activity share crossing 1.9% as LTC futures open interest soars to a 4-year high with $758 Million. LTC cumulative short liquidation leverage over long liquidation leverage.

Litecoin price Resistance formed multiple times around $137–$140, aligning with previous rejection points.

The lower trendline showed support near $130, preventing further downside.

A breakout above $140 could drive bullish momentum toward $150 or beyond, but rejection risks reversal to $120.

Volume remained moderate at 2.01M, indicating cautious participation.

The pattern historically leads to breakdowns, yet LTC’s recent strength suggested potential divergence.

Bullish wedge channel | Source: Crypto TA King/x

Bullish wedge channel | Source: Crypto TA King/x

If buyers sustain momentum, the next attempt at $140 may succeed. Failure to hold $130 could confirm trend exhaustion, accelerating declines.

Traders watched for confirmation signals before positioning aggressively.

Highest LTC Social Activity Share

LTC social activity share also crossed 1.9%, reaching its highest recorded level. Social dominance rose 0.35% to 1.45%, reflecting heightened interest.

LTC price surged 104.52%, touching $136.17, indicating strong correlation with social buzz.

Trading volume spiked 595.4% to $1.63B, supporting increased engagement. If social dominance continues rising, LTC could break resistance at $140, attracting more buyers.

Litecoin social activity source: LunarCrush Analytics/X

Litecoin social activity source: LunarCrush Analytics/X

Market cap climbed confirming capital inflow indicating sustained social traction could fuel bullish momentum.

A decline below 1.5% social dominance could weaken sentiment, leading to price consolidation near $130.

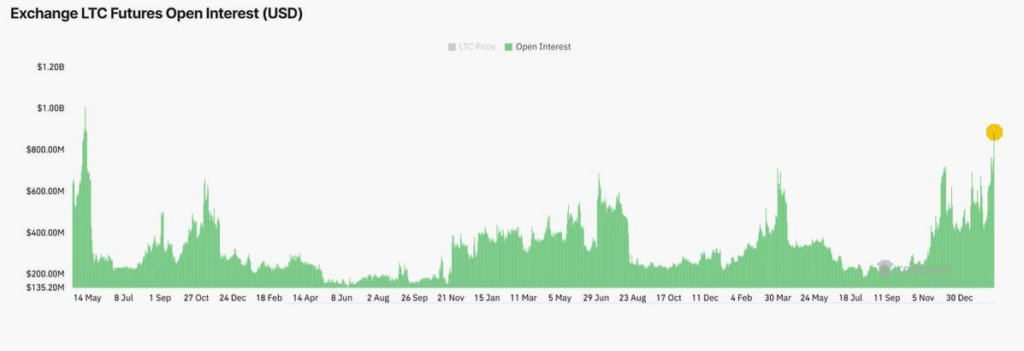

Litecoin Futures Open Interest Soars to a 4-year High

Additionally, Litecoin futures open interest soared to a 4-year high of $758 million, reflecting strong speculative interest.

This surge indicated increased market activity and potential price volatility. LTC price reached $136.17, rising 104.52%, supported by high leverage.

Trading volume spiked 595.4% to $1.63B, confirming active participation. Market cap climbed $5.3B to $10.29B, reinforcing capital inflows.

The consistent open interest growth signaled rising demand. Increased futures exposure suggested traders anticipated further LTC price movement, likely testing $140 resistance.

Exchange LTC futures open interest source: Coinglass

Exchange LTC futures open interest source: Coinglass

If open interest remains high, LTC could extend gains past $150. However, excessive leverage might trigger liquidations, forcing a correction toward $130.

Sustained open interest growth indicated confidence in LTC’s trajectory.

Traders monitored funding rates and liquidation levels to gauge potential breakouts or pullbacks in the coming sessions.

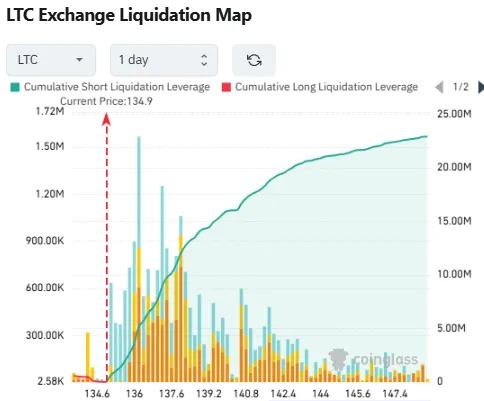

LTC Cumulative short Over Long Liquidation Leverage

Litecoin’s higher cumulative short liquidations over long liquidations, indicating a short squeeze. LTC reached $134.9, triggering 1.72M in short liquidations.

Short positions faced aggressive liquidations near $134.6–$137, forcing traders to buy back, fueling upward momentum.

Long liquidations remained significantly lower, reducing immediate downside pressure. This short squeeze contributed to LTC’s 104.52% rally, lifting the price to $136.17.

LTC exchange liquidation map | Source: Coinglass

LTC exchange liquidation map | Source: Coinglass

Market cap increased $5.3B to $10.29B, reinforcing demand strength. Open interest hit $758M, signaling continued speculative interest in LTC futures.

If shorts keep liquidating, LTC could surpass $140, attracting more buyers. However, failing to hold $134 might encourage new short positions.

A sustained imbalance in liquidation pressure could push LTC toward $150. Traders watched liquidation clusters to assess upcoming volatility and price strength.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stock market extends crash after S&P 500′s worst week since September

Share link:In this post: Stock futures dropped Sunday night after a brutal week where the S&P 500 lost 3.10%, the Dow fell 2.37%, and the Nasdaq dropped 3.45% amid economic uncertainty and tariff talks. Investors are bracing for key inflation reports this week, with CPI data on Wednesday and PPI on Thursday, which could impact Federal Reserve policy. Bitcoin crashed over 5% after Trump signed an order creating a US strategic Bitcoin reserve, disappointing investors expecting a bigger government buy-in.

Polkadot Faces Key Support Test as Bears Extend Market Control

XRP vs Dogecoin: Which Crypto Will Lead the Next Bull Run?

Will PEPE Coin Crash to Zero? Or Is a Rebound Coming?