Bitget Daily Digest (March 12) | SEC delays approval of $ADA, $DOGE, and other ETFs, Mt.Gox transfers $930 million in BTC

远山洞见2025/03/12 09:10

By:远山洞见

Today's preview

1.The U.S. February unadjusted CPI YoY will be released today, with the previous value at 3.00%.

2.The U.S. February seasonally adjusted CPI MoM will be released today, with the previous value at 0.50%.

3.Aptos (APT) is set to unlock approximately 11.3 million tokens today, valued at around $70 million.

4.Internet Computer (ICP) will unlock about 2.5 million tokens, worth approximately $16.5 million.

Key market highlights

1.The U.S. Securities and Exchange Commission (SEC) has

postponed its decision on several spot ETFs, including Grayscale's ADA and DOGE ETFs, Canary's XRP ETF, Solana and Litecoin spot ETFs, and VanEck's Solana ETF, maintaining a cautious stance. Meanwhile,

the U.S. House of Representatives has voted to repeal the IRS rule requiring decentralized exchanges (DeFi) to report sales proceeds and transaction dates. This move may fuel speculation around leading projects in the DeFi space.

2.GoPlus Security has unveiled a buyback and compensation program,

allocating 4.34 million USDT over 90 days for GPS token buybacks. The buyback will be conducted through limit orders and small incremental purchases to minimize market volatility, with all repurchased tokens set to be burned. Additionally, GoPlus is offering $2 million in compensation. Meanwhile,

StarkWare has announced plans to establish a "strategic Bitcoin reserve," gradually increasing BTC holdings in its treasury to advance the Starknet Layer-2 expansion initiative.

3.Mt. Gox has transferred $930 million in BTC to a new address, raising speculation about the start of creditor repayments. This move follows last week's internal asset reshuffling worth $1 billion and a $15 million transfer to custody provider BitGo, indicating an acceleration in fund movements. The market is closely watching whether Mt. Gox will speed up repayments ahead of the October 31 deadline, amid concerns over potential sell-off pressure once the locked BTC is released.

4.Ukraine has agreed to a 30-day ceasefire proposal from the U.S., with President Donald Trump urging Russian President Vladimir Putin to approve the deal to facilitate peace talks. Meanwhile, U.S. stock markets remain volatile due to concerns over tariffs and a potential recession, with the S&P 500 dropping 10% from its February peak.

Trump downplayed market fluctuations, asserting that the U.S. economy is not headed for a recession and emphasizing the need for economic rebuilding.

Market overview

1.$BTC is experiencing short-term fluctuations with an upward trend, while the broader market sees a rally. BANANA, a TG Bot token, surged to the top of the leaderboard, and the CMC Altcoin Season Index shows signs of a recovery.

2.All three major U.S. stock indices closed lower, with the Dow dropping over 1% and the S&P 500 briefly entering a technical correction.Meanwhile, Chinese stocks saw gains, and the offshore yuan strengthened past the 7.23 mark against the U.S. dollar.

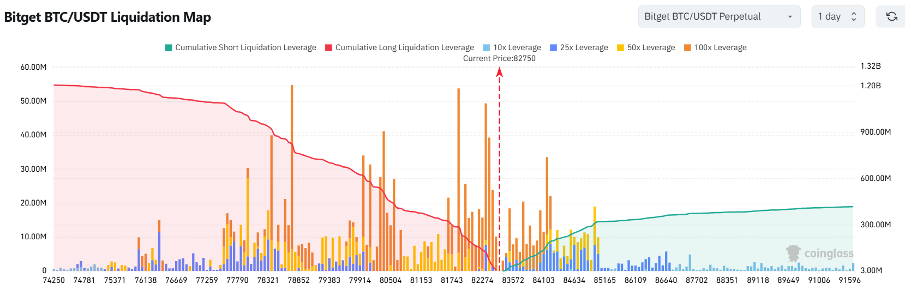

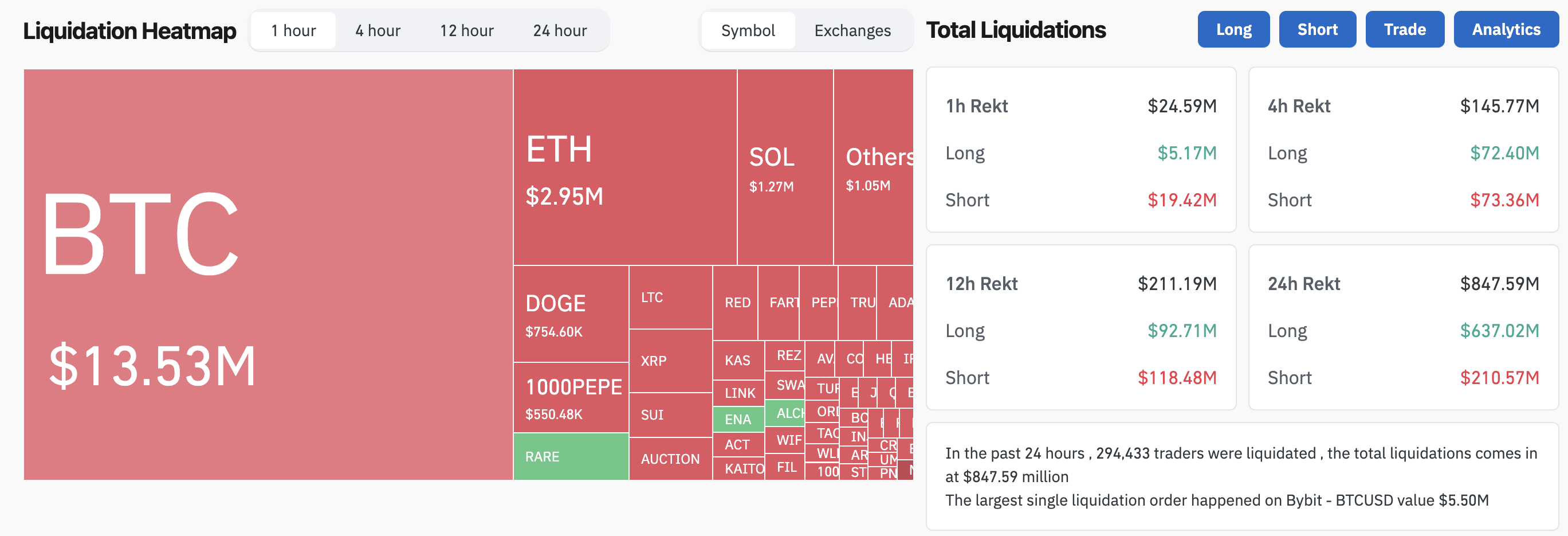

3.Currently standing at 82,750 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,750 USDT could trigger

over $300 million in cumulative long-position liquidations. Conversely, a rise to 83,750 USDT could lead to

more than $70 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

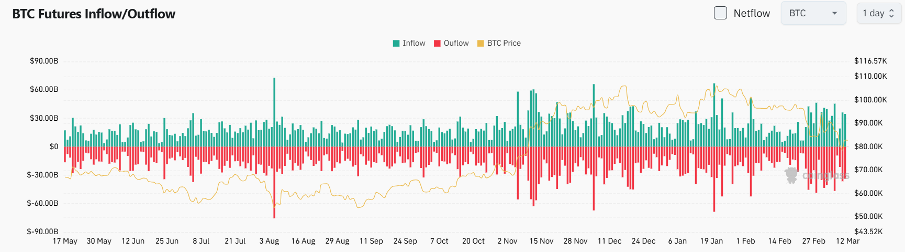

4.Over the past 24 hours, the BTC spot market recorded $34.6 billion in inflows and $33.8 billion in outflows, resulting in a

net outflow of $800 million.

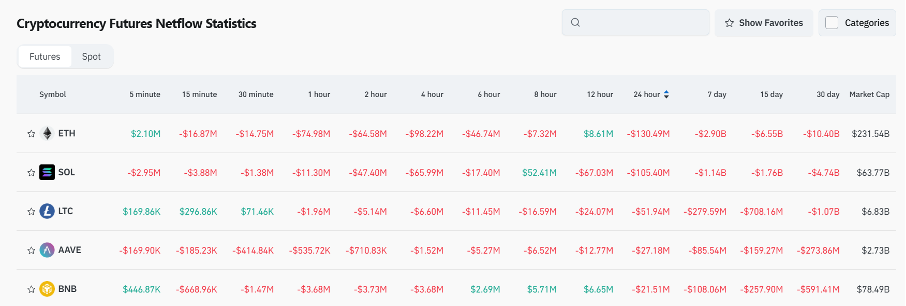

5.In the last 24 hours, $ETH, $SOL, $LTC, $AAVE, and $BNB led in

net outflows in futures trading, signaling potential trading opportunities.

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $219 million, while the cumulative inflows amount to $35.556 billion, with total holdings at $90.331 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $9.7519 million, with cumulative inflows of $2.652 billion and total holdings of $6.83 billion. Both saw substantial outflows compared to the previous day.

Institutional insights

Matrixport: Stablecoin inflows are slowing, pushing the market into a consolidation phase. Bitcoin's next move requires caution.

Read the full article here:

https://x.com/Matrixport_CN/status/1899339506513506568

Bitwise: Now is a good time to buy the dip. Global liquidity is gradually picking up.

CryptoQuant: Whales have accumulated over 65,000 BTC in the past 30 days.

Read the full article here:

https://x.com/cryptoquant_com/status/1899464577966018585

News updates

1.The U.S. House of Representatives passes a bill repealing the IRS DeFi broker rule.

2.A Texas lawmaker has proposed capping the state government's Bitcoin purchases at $250 million.

3.Hong Kong's Securities and Futures Commission (SFC) has released a regulatory roadmap for the city's virtual asset market.

4.Russian-backed hacking group Dark Storm claims responsibility for a DDoS attack on X.

Project updates

1.The Jupiter community has voted to approve the "2030 Lock-in" proposal, locking up its co-founder Meow's 280 million JUP tokens until 2030.

2.StarkWare has established a strategic Bitcoin reserve.

3.GoPlus will buy back 4.34 million USDT worth of GPS tokens over the next 90 days and allocate an additional $2 million for user compensation.

4.Fidelity has filed a proposal to allow staking in its Ethereum ETF.

5.Bitget has released its February Transparency Report, with an average daily trading volume of $20 billion.

6.Tomo Connect partners with Tron and adds SDK support.

7.Offchain Labs, the core development team behind Arbitrum, has launched a strategic ARB buyback plan.

8.Axelar Foundation discloses a $30 million AXL token sale to expand its interoperability protocol.

9.SEC delays approval of DOGE, XRP, LTC, SOL, and ADA spot ETFs.

10.The SIMD-228 upgrade plan for Solana has been approved.

Highlights on X

Arthur Hayes: Be patient for the real opportunities at BTC's bottom

The market is still in a correction phase, and BTC may find a bottom around $70,000. A 36% pullback from the $110,000 high would be a normal occurrence in a bull market. For the real opportunity to emerge, U.S. stocks need to enter a free-fall mode, and TradFi must face a major liquidity crisis. Only when the U.S. Federal Reserve, People's Bank of China, European Central Bank, and Bank of Japan all start injecting liquidity will the market truly take off. That will be the best time to go all-in. Aggressive traders might try to catch the bottom, but a more conservative approach would be to wait for central banks to ease policies before scaling in. This will not perfectly time the bottom, but it avoids the psychological toll of prolonged sideways movements and unrealized losses.

@MetaHunter168: Crypto survival guide — How to level up efficiently

To succeed in crypto without unnecessary detours, focus on three things: picking the right track, building a profitable model, and increasing influence on X to construct your own resource network. Choose a high-growth sector with long-term potential that aligns with your strengths — free airdrops and memecoins are beginner-friendly options. Then, develop a stable profitable model and refine your market strategy. Use X as your digital business card to increase visibility, boost credibility, and discover new opportunities. As your influence grows, you'll gain access to higher-level circles and premium resources, accelerating your progress up the ladder. Master these three steps, and you're on the path to success in crypto. The real fun lies in the constant evolution and level-ups.

Crypto_Painter: Surviving high-risk — Guide to short-term futures trading

Short-term futures trading is not about luck, but about strict risk management and discipline. You should always set take-profit and stop-loss targets before each trade. A lower return is acceptable as long as the win rate is high. Trend analysis has limited value for short-term trades, while volatility indicators like Bollinger Bands and RSI work better. Your leverage should match your risk tolerance, and trade frequency must be controlled. If you lose two trades in a row, pause for 24 hours. If you win five in a row, also take a break. Short-term trades should also ignore market noise and macroeconomic data and stick to independent analysis. When your profit ratio exceeds 50%, make sure to withdraw some. If losses exceed 50%, you may supplement funds with previous profits to mitigate risks and prevent revenge trading. Keep trading records for review, but keep them private to maintain mental stability and focus. At its core, short-term trading is a probability game governed by rules. Success comes from timing entries and managing risks, not starting at short-term wins and losses.

@Michael_Liu93: Finding the right entry point — Comparing fundamentals and market sentiment

A good buying opportunity isn't just about how much an asset has dropped, but about how today’s fundamentals and sentiment compare to past conditions at the same price level. For example, when evaluating whether SOL at $120–$130 is worth buying, I look at the market conditions in August and September last year and ask myself: Was on-chain activity then healthier than now? Was the macro environment more favorable than today? Were there more bullish signals? If conditions were better back then but you didn't buy, then it makes even less sense to buy now. If today's conditions are better, then it's worth considering. In the crypto world, a price drop is never the sole reason to buy. Best entry points can only be found in comparison of relative value and market condition.

3

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Pi Network Under Pressure: Will Pi Coin Hold or Plunge Below $1?

CryptoNewsFlash•2025/03/12 12:22

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Coinotag•2025/03/12 07:55

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty

Coinotag•2025/03/12 07:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$82,317.05

+2.13%

Ethereum

ETH

$1,878.77

-0.32%

Tether USDt

USDT

$0.9998

-0.02%

XRP

XRP

$2.18

+3.75%

BNB

BNB

$555.14

+1.47%

Solana

SOL

$125.24

+2.70%

USDC

USDC

$0.9998

-0.03%

Cardano

ADA

$0.7327

+2.22%

Dogecoin

DOGE

$0.1659

+4.71%

TRON

TRX

$0.2211

-1.92%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now