Here’s what happened in crypto today

Today in crypto, a bill for the US to buy 1 million Bitcoin was re-submitted to Congress, the EU is scrutinizing OKX for a service that could’ve helped the Bybit hackers, and Ether could face further declines as ETF outflows and economic concerns pressure the market.

Lummis’ revamped BITCOIN Act wants US reserve to buy 1 million BTC

US Senator Cynthia Lummis’ reintroduced her BITCOIN Act on March 11 to allow the government to potentially hold more than 1 million Bitcoin

BTC$81,613in its newly established reserve.

The bill, the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act of 2025, was first introduced in a different form in July and would’ve seen the US buy 1 million BTC, split across buys of 200,000 BTC a year for five years.

The revamped bill opens the door for the US to acquire and hold in excess of 1 million BTC as long as it is acquired through lawful means other than direct purchase, such as civil or criminal forfeitures, gifts made to the US or transfers from federal agencies.

The refreshed bill also now sets a formal evaluation process for Bitcoin forked assets and airdropped assets in the reserve and directs the Secretary after the mandatory holding period to evaluate and retain the most valuable asset based on market capitalization while retaining the “dominant asset.”

US President Donald Trump signed an executive order to create a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” both of which will initially use crypto forfeited to the government.

EU watchdogs scrutinizing OKX over $100M in Bybit laundered funds: Report

European Union regulators are reportedly looking into a service offered by crypto exchange OKX that may have played a role in the laundering of $100 million in funds from the Bybit hack, according to Bloomberg.

A March 11 Bloomberg report citing people familiar with the matter claims that national watchdogs from the EU’s member states discussed the issue during a March 6 meeting hosted by the European Securities and Markets Authority’s Digital Finance Standing Committee. The issue appears to be OKX’s decentralized finance platform and wallet service.

On Jan. 27, OKX announced that it had secured a full Markets in Crypto-Assets (MiCA) license to operate across all EU member states under a unified regulatory framework. The question for EU regulators is whether two OKX services fall under the MiCA framework and, if so, whether the exchange could be penalized.

According to Bybit CEO Ben Zhou, nearly $100 million, or 40,233 Ether (ETH), from the $1.5 billion hack had been laundered through OKX’s Web3 proxy, with a portion of the funds now untraceable.

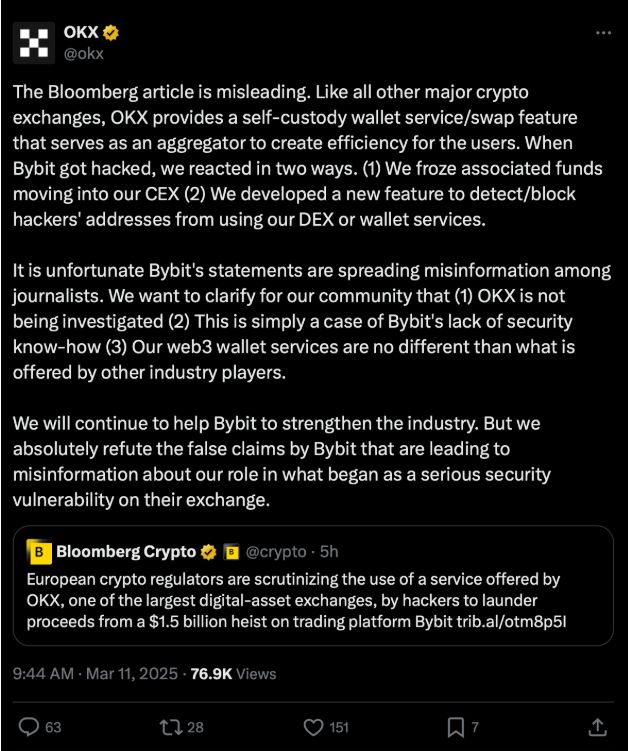

In a statement posted to X, OKX refuted the claim there were any ongoing investigations by the EU, adding that “Bybit’s statements are spreading misinformation” and defending its Web3 wallet services.

Source: OKX

Source: OKX

Ether risks correction to $1,800 as ETF outflows, tariff fears continue

Ether is struggling to reverse a near three-month downtrend as macroeconomic concerns and continued selling pressure from US Ether exchange-traded funds (ETFs) weigh on investor sentiment.

Ether

ETH$1,869has fallen by more than 53% since it began its downtrend on Dec. 16, 2024, after it had peaked above $4,100, TradingView data shows.

The downtrend has been fueled by global uncertainty around US import tariffs triggering trade war concerns and a lack of builder activity on the Ethereum network, according to Bitfinex analysts.

ETH/USD, 1-day chart, downtrend. Source: Cointelegraph/ TradingView

ETH/USD, 1-day chart, downtrend. Source: Cointelegraph/ TradingView

“A lack of new projects or builders moving to ETH, primarily due to high operating fees, is likely the principal reason behind the lackluster performance of ETH. [...] We believe that for ETH, $1,800 will be a strong level to watch,” the analysts told Cointelegraph.

“However, the current sell-off is not being seen solely in ETH, we have seen a marketwide correction as fears over the impact of tariffs hit all risk assets,” they added.

Crypto investors are also wary of an early bear market cycle that could break from the traditional four-year crypto market pattern.

Bitcoin is at risk of falling to $70,000 as cryptocurrencies and global financial markets undergo a “macro correction” while remaining in a bull market cycle, said Aurelie Barthere, principal research analyst at blockchain analytics firm Nansen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Team Stands Firm: ‘SHIB Is Our BTC’ as Market Faces Uncertainty

Arbitrum Devs Initiate ARB Buyback to Bolster Ecosystem Growth

Best Cryptos for Beginners? Qubetics Sells Over 499 Million Tokens, Monero’s Privacy and Kaspa’s Speed

Discover the best cryptos for beginners! Learn how Qubetics raised over $14.9 million, plus explore the privacy features of Monero and the speed of Kaspa.Qubetics – Revolutionizing Cross- Border TransactionsMonero – The Unmatched Leader in Privacy CoinsKaspa – A Fresh Take on Blockchain SpeedConclusion – Building a Strong Foundation in Crypto

Whales Withdraw $14.35M USDC After ETH Long Exit

8 whale wallets withdrew $14.35M USDC from Hyperliquid after closing ETH long positions for profit.Whales Take Profits on ETHMarket Impact & SpeculationsWhat’s Next for Ethereum?