ETH/BTC Pair Hits Lowest Since 2020: Will ETH Regain Strength Again?

- The ETH/BTC ratio has hit a new low recently, which was last seen in May 2020.

- The pair is currently at a lowest ratio of 0.022, suggesting Ethereum’s underperformance.

- Evidence shows market sentiments and recent regulatory developments driving the trend.

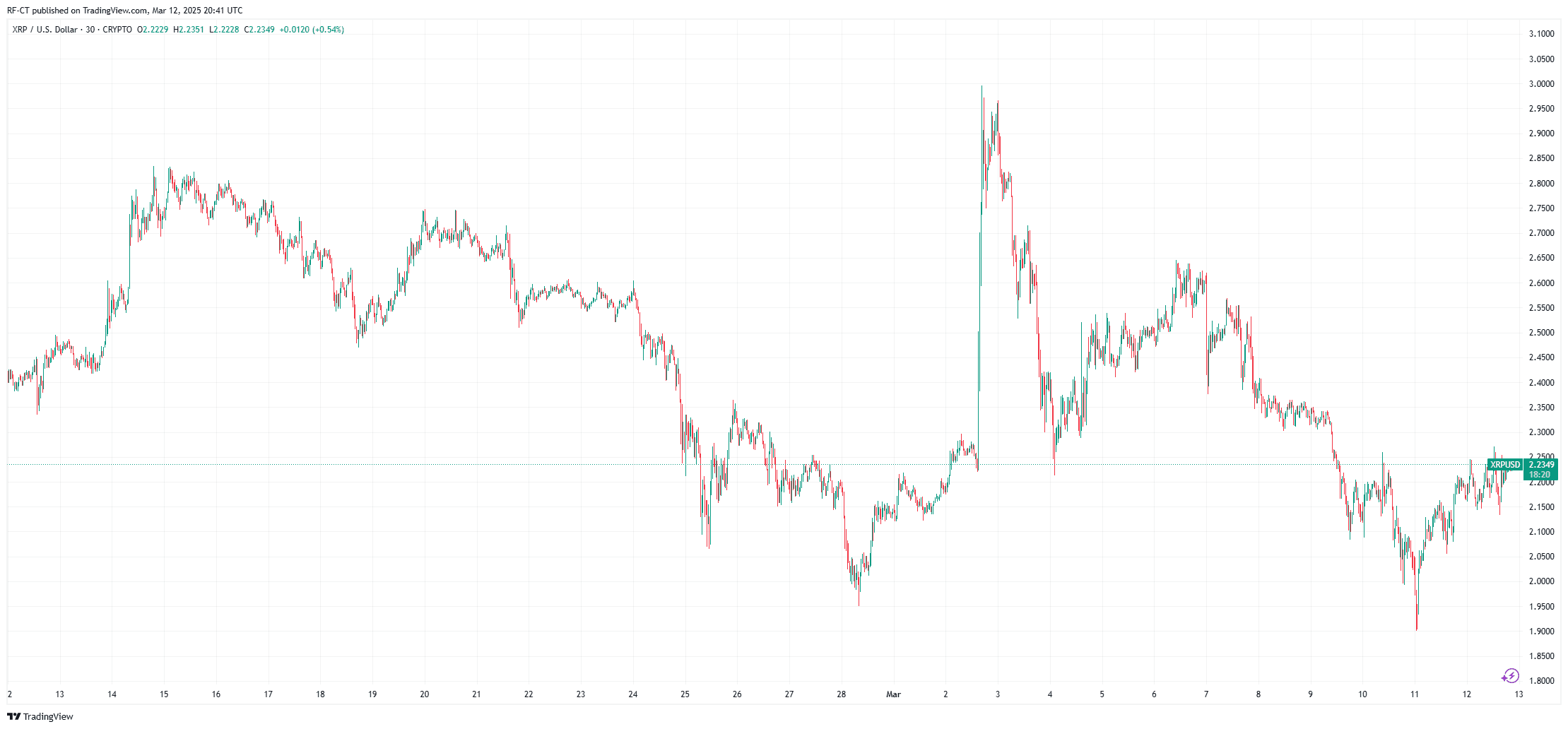

The broader crypto market has been facing an extremely volatile week with many coins hitting low levels. Bitcoin and Ethereum were one of these coins experiencing a sharp decline in values and triggering a market recession. As a result of this downturn, the ETH/BTC (Ethereum to Bitcoin) trading pair has hit its lowest point of 0.022 since May 2020. This decline underscores Ethereum’s underperformance compared to Bitcoin. Further, Bitcoin has been recovering since its drop to below $80,000 while Ethereum remains lagging alongside other altcoins.

The data from CoinMarketCap data shows a steep downward curve, suggesting several implications for the ETH price trajectory. Such a lower ratio often indicates market panic and results in the funds flowing into Bitcoin as it is seen as a safer asset.

Source: Trading View

According to sources, there could be several factors contributing to the observed decline in the ETH/BTC ratio. One such being the approval of Bitcoin spot ETFs leading to significant institutional inflows, boosting Bitcoin’s price. Kaiko research notes that Bitcoin CME futures open interest hit all-time highs, indicating strong institutional demand, while Ethereum futures remain relatively low at 7.3k contracts.

In addition to that, recent regulatory developments and market sentiments have leaned towards Bitcoin, especially with its increased recognition as a hedge against inflation and a national reserve asset. All these factors have contributed to a positive trajectory for Bitcoin and recovery from the recent downturn.

Related: Bitcoin Falls Below $80K as Crypto & S&P 500 Plunge

DefiLlama data shows that stablecoin inflows slowed in the past month, indicating a reduced capital rotation in ETH protocols. Other sources also highlighted that spot Ether ETFs registered an increased outflows of $176 million in the past month. This data indicates reduced institutional demand for ETH.

As per CoinMarketCap, ETH is currently trading at $1,890 with a market capitalization of $228.06 billion, with a decline of 29.35% over the past month. Meanwhile, Bitcoin has been gaining momentum and has surged to $83,819 from its lowest value of $80,000 since the past week.

Despite the ETH/BTC ratio hitting a low value, it could have significant implications as investors are optimistic on the long-term prospects since ETH is going through several fundamental changes. Ethereum’s upcoming Pectra upgrade 2025 with the aim of streamlining transactions and the introduction of smart wallets is expected to drive ETH to regain its gains.

The post ETH/BTC Pair Hits Lowest Since 2020: Will ETH Regain Strength Again? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is It the Right Time to Buy? These Altcoins Show Strong Potential

SEC vs. Ripple Case Nears Conclusion: Impact on XRP and Crypto Regulation

Pi Network Jumps 28% — Will the Surge Last?

Research Report | Space Nation Project Overview & OIK Market Analysis