Nearly 40% of High Net-Worth Individuals in the US Want to Buy Bitcoin

Grayscale's survey reveals that while wealthy investors are increasingly investing in crypto, many see it as a financial tool rather than a tech innovation, highlighting a divide.

According to a new survey from Grayscale, 26% of US investors with over $1 million in investible assets own crypto, and 38% are planning to invest. Interest is growing due to economic concerns for older participants, while younger ones cite the normalization of crypto as an asset class.

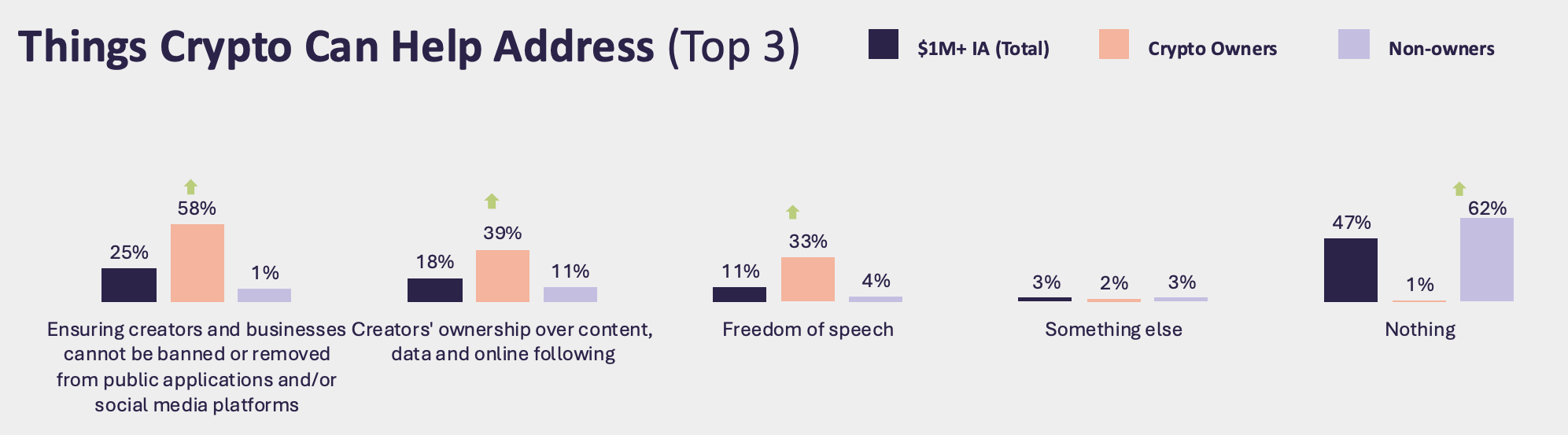

However, nearly half of these wealthy respondents do not believe that crypto has any use cases outside investment. This highlights a growing divide in the community, as some fear a loss of technological innovation.

Wealthy Investors Want to Buy Crypto

Today, asset management firm Grayscale published a report claiming that high-net-worth investors are getting interested in crypto.

“It’s exciting to witness the momentum shift in crypto as more investors begin to recognize the value of digital assets. Remarkably, 38% of high-net-worth investors believe their investment portfolio will include crypto in the future,” Grayscale CEO Peter Mintzberg claimed on social media.

Grayscale conducted an extensive survey of wealthy Americans to assess their crypto attitudes and purchasing habits. It revealed a growing affinity in several key metrics.

For example, it claims that 26% of investors with over $1 million in investable assets own crypto, more than the general population.

These investors are curious about crypto for different reasons bifurcated by age group. Nearly 78% of wealthy crypto-owning respondents over the age of 50 like it due to the economic climate. This reflects the old argument that Bitcoin is an inflation hedge.

Meanwhile, their younger counterparts consider it a normal investment option, unrelated to these concerns.

“Over a third (36%) of these high-net-worth investors are paying closer attention to Bitcoin and other crypto assets due to geopolitical tensions, inflation, and a weakening US dollar,” Grayscale study claims.

However, this survey also exposed a few holes in traditional crypto narratives. For instance, the backlash to President Trump’s recent Crypto Summit highlights a growing divide in the community.

Can crypto build a new economic future, or is it only a way to get more fiat currency? These investors strongly prefer crypto for the latter purpose.

Wealthy Investors Think Crypto Can Address Nothing. Source:

Grayscale

Wealthy Investors Think Crypto Can Address Nothing. Source:

Grayscale

Granted, this sample may not be fully representative. Grayscale’s survey polled 5,368 adults, all of whom planned to vote in the last US Presidential election.

In short, this survey reflects a positive and negative outlook for the industry, depending on perspective. On one hand, wealthy investors may pour huge amounts of money into crypto in the near future, especially in the event of economic turmoil.

However, this inflow of capital may not do much to build novel technologies. Most investors have yet to see the use case of crypto beyond investment purposes.

Ultimately, future projects will need to balance both concerns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Daily Digest (March 14) | Putin agrees to 30-day ceasefire, Base ecosystem gains attention with AI narratives

Stellar (XLM) Seeks Momentum for Breakout as Key Resistance at $0.309 Approaches

Cardano (ADA) May Be Approaching a Key Price Turning Point Amid Weakening Downtrend

POPCAT Faces Consolidation Challenges Amid Weak Investor Sentiment and Resistance at $0.203