Fed Meeting This Week: What to Expect from Bitcoin?

- Expectation of maintaining interest rates.

- Focus on the effects of Trump's tariff policies.

- The next Fed meeting (FOMC) will be on March 18 and 19.

As we approach this week’s Federal Reserve meeting, the market is expecting the US central bank to keep interest rates steady. However, investors and financial analysts are keeping a close eye on any potential deviation from this forecast, which could have significant effects on cryptocurrency markets, especially Bitcoin.

In the United States, the next FOMC (Federal Open Market Committee) meeting will be held on March 18 and 19.

Currently, futures for major US indices are showing mixed performance. While S&P 500 futures showed a recovery, Dow Jones Industrial Average futures registered a slight decline. Meanwhile, Nasdaq 100 futures rose slightly. In the cryptocurrency space, Bitcoin remained stable, with the price hovering around $82.993,92, without major changes in the last 24 hours.

US Treasury Secretary Scott Bessent has expressed a relatively calm view of recent market volatility, stressing that “corrections are healthy” and that there are “no guarantees” against a possible recession. His remarks come as the market anticipates the Fed keeping interest rates unchanged.

However, if the Fed opts to hike rates, we could see Bitcoin fall below $80.000, as investments in riskier assets such as cryptocurrencies tend to be less attractive in higher interest rate scenarios.

On the other hand, a possible reduction in interest rates could boost Bitcoin to reclaim the $90.000 level. Lower interest rates tend to devalue fiat currency and encourage investment in alternative assets, such as Bitcoin, increasing its attractiveness.

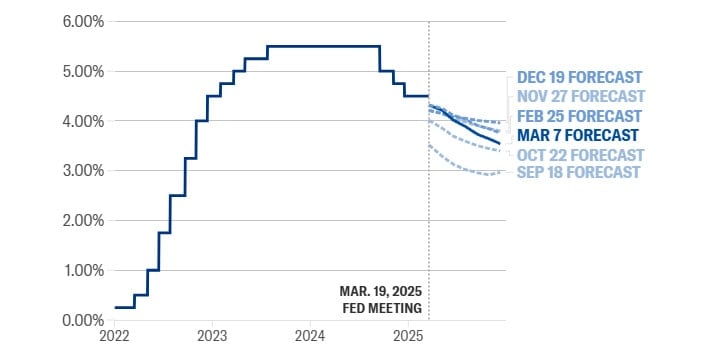

In addition, investors are eagerly awaiting the “dot plot,” a chart that reveals individual Fed policymakers’ projections of future interest rates. The last update of that chart indicated an expectation of two rate cuts this year, with the adjustment influenced by Trump’s expected economic policies.

As Trump’s new policies, including an aggressive series of tariffs, begin to take effect, there is growing uncertainty about how the Fed will adjust its outlook for economic growth and inflation. Former Kansas City Fed President Esther George said central bank policymakers may be more concerned about modeling the impact of these tariffs on economic growth.

Market reactions already reflect these uncertainties, with a significant drop in the last month, followed by a partial recovery. Markets are anticipating up to three rate cuts over the course of the year, highlighting ongoing concerns that the president’s policies could suppress economic growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin may hit a wall at $84K if bullish conditions don’t pick up: CryptoQuant

Bitcoin could face resistance around $84,000, but if it breaks through, the next major hurdle sits at $96,000, according to CryptoQuant.

PEPE Mirrors Its Past Bottom – Will RSI Divergence Spark Another Rebound Rally?

Is Kaspa (KAS) Gearing Up for a Bullish Reversal? This Fractal Says Yes!