Bitget Daily Digest (March 18) | Base's weekly contract deployment hits new high, WLFI expands strategic reserve

远山洞见2025/03/18 09:13

By:远山洞见

Today's preview

1.The U.S. February industrial production (IP) will be released today, with the previous value at 0.50%.

2.The U.S. import price index for February will be released today, with the previous value at 0.30%.

3.Initia will close its wallet extension services at 3:00 AM (UTC) today and urges users to migrate their testnet data promptly.

4.The deadline for submitting applications to the Sui Foundation's SuiNS RFP program is today, March 17, 2025, at 3:59 PM (UTC+8).

5.Babylon Foundation has extended its airdrop registration deadline to March 19.

Key market highlights

1.Trump's "reciprocal tariff plan" is set to take effect. Kevin Hassett, director of the U.S. National Economic Council, stated that the market will face uncertainty until April 2. While the White House insists the new tariff policy will create a fairer trade environment, investor concerns have caused the SP 500 index to drop more than 10% from its peak. As one Wall Street analyst put it, "Any day the president doesn't talk about tariffs is a good day for the market."

With ongoing pressure on corporate and consumer confidence, the financial market's volatility could persist beyond April.

2.Aave's community is divided over whether the Horizon project should issue a new token. Aave Labs' proposed token allocation would only see 15% to the Aave DAO, sparking opposition from holders who claim it would dilute the value of $AAVE. Marc Zeller, a community representative, argued that this move is part of Aave Labs' negotiation strategy.

Under sustained pressure, Aave founder Stani Kulechov clarified that there would be no new token and reassured the community that Aave would continue with only the $AAVE token.

3.The Trump family's crypto project, WLFI, has completed a $550 million token sale, with $390 million going to Donald Trump and his partner company, DT Marks DEFI LLC, accounting for 75% of the net proceeds. Token buyers are currently unable to resell or receive profit distributions, and market reactions have been mixed.

WLFI also announced the addition of $BTC, $ETH, $TRX, $LINK, $SUI, and $ONDO to its strategic reserve to support innovative projects and expand the DeFi ecosystem. With 85,000 identity-verified (KYC) investors involved, WLFI's capital structure is taking shape, and the market is closely watching its next moves.

Market overview

1.BTC experiences short-term fluctuations while the market sees an overall increase. X on TON leads the top gainers, with $MUBARAK maintaining strong momentum, and $BNX showing significant growth on the BSC chain. The new token $OIK is among the biggest losers.

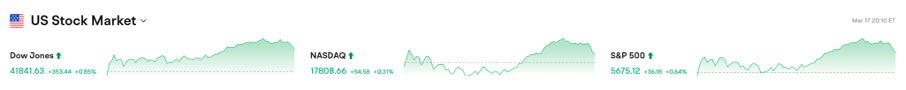

2.U.S. Stocks have seen a two-day rebound, but Tesla dropped nearly 5%, Nvidia fell by almost 2%, quantum computing stock ARQQ surged 57%, and the Chinese concept stock index gained 4%, with Baidu up 9%.

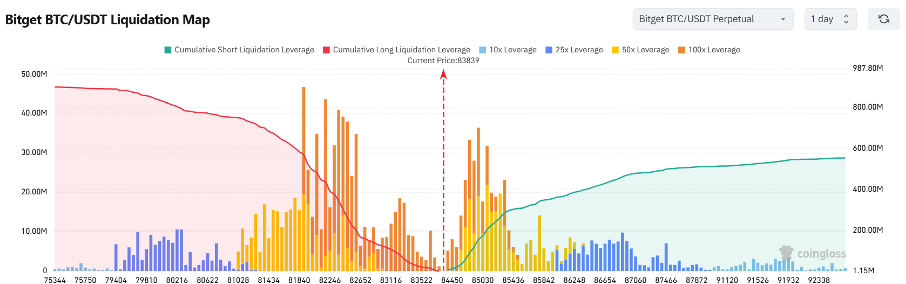

3.According to Bitget data, currently standing at 83,839 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 82,839 USDT could trigger

over $141 million in cumulative long-position liquidations. Conversely, a rise to 84,839 USDT could lead to

more than $90 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

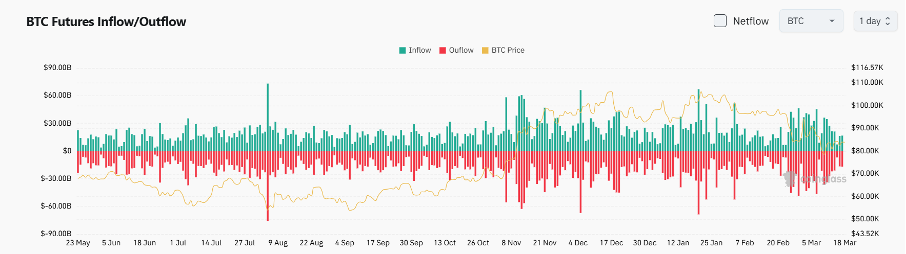

4.Over the past 24 hours, the BTC spot market recorded $16.7 billion in inflows and $16.9 billion in outflows, resulting in a

net outflow of $200 million.

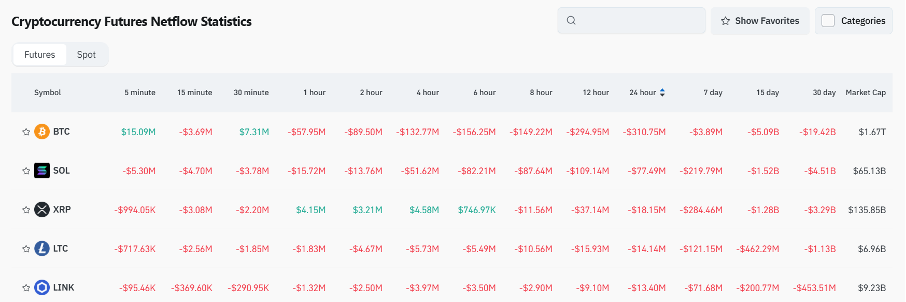

5.In the last 24 hours, $BTC, $SOL, $XRP, $LTC, and $LINK led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Standard Chartered slashes Ethereum year-end price target to $4000

Read the full article here:

https://www.coindesk.com

IntoTheBlock: Significant support for ETH just under $1900, with growing capitulation risk if ETH slips below this range

News updates

1.President Trump has announced Federal Reserve Governor Michelle Bowman as vice chair for supervision at the central bank.

2.The Governor of France's central bank believes that Trump's embrace of cryptocurrency could invite a financial crisis.

3.A Brazilian lawmaker has introduced a bill allowing salary payments in Bitcoin.

4.Hong Kong Legislative Council member Johnny Ng Kit-chong revealed that the Hong Kong fiat-backed stablecoin bill is under review and that the region plans to introduce legislation for OTC and custody licenses by the end of the year.

Project updates

1.WLFI has added BTC, ETH, TRX, LINK, SUI, and ONDO to its strategic reserve.

2.TRON's revenue exceeded $2 billion last year, marking a 116% year-on-year increase.

3.Canary has filed its S-1 document for the SUI ETF.

4.Hashdex has submitted amendments to its crypto index ETF, adding SOL, XRP, ADA, and other tokens.

5.Jupiter has repurchased over $7.5 million of JUP tokens in just one month.

6.Base network's weekly contract deployment exceeded 11 million, setting a new record.

7.pump.fun saw its protocol fee revenue hit a four-month low yesterday.

8.Base, Solana, and Noble were the top three chains in terms of cross-chain bridge net inflows last week.

9.ai16z Founder: ElizaOS v2 1.0.0 is currently in development and will soon release a beta version for testing.

10.Bitget Wallet has upgraded its MEV protection feature, now supporting multiple chains including Solana, BNB, and others.

Highlights on X

@ai_9684xtpa: Why are large holders of $mubarak "diamond hands"? Liquidity is key

The front-runners of $mubarak are not holding onto their positions just out of "faith"; the insufficient liquidity pools make it difficult to absorb large sell-offs. Currently, $mubarak's market capitalization is $134 million with a 24-hour trading volume of $88.1 million, but its liquidity pool depth is only $4.48 million, representing just 5% of the trading volume. This means even the top address would face significant slippage losses if attempting to sell at market price. For example, the top address holds 13 million tokens (approximately $1.618 million). If sold at market price, the BNB in the liquidity pool is insufficient to support it, potentially leading to losses exceeding $500,000. As a result, large holders are temporarily unable to sell large amounts and must seek better liquidity or OTC trading. The so-called "diamond hands" are not just about belief but also due to the liquidity situation, which plays a crucial role in the memecoin market's fund dynamics.

@jason_chen998: The key to Bitcoin's globalization: IMF's stance will determine the future growth curve

After ETFs and strategic reserves, whether Bitcoin can initiate its second growth curve in mainstream global countries depends largely on the stance of the International Monetary Fund (IMF). Even South Korea, with high cryptocurrency acceptance, paused its Bitcoin reserve plans due to IMF guidelines. The IMF has even pressured El Salvador to halt Bitcoin-related operations, threatening to impact a $1.4 billion financing deal. Controlling trillions in funds and influencing global country ratings, the IMF forces many nations to slow or halt their Bitcoin strategies. Therefore, if the IMF loosens its stance on Bitcoin in the future, it could signal a major breakthrough in Bitcoin's global legitimacy, expanding its influence beyond the U.S. and into the global sovereign asset system — a potential "nuclear bomb" market catalyst. The market should closely monitor IMF policy changes, as they could become the biggest variable in Bitcoin's next wave of globalization.

@CryptoPainter_X: The essence of bull and bear cycles: Price inertia, emotional volatility, and market rationalization

The rise and fall of the market are driven by human nature's tendency to seek profit and avoid harm, resulting in price inertia. In bull markets, rational investors sell at reasonable prices, but inertia drives prices even higher. In bear markets, rational investors buy in, but prices can still fall due to inertia. Speculators profit from irrational market behavior, with the key being collective emotional judgment: mass buy orders and new coin hype indicate overvaluation, while massive sell-offs and silence suggest undervaluation. Currently, the reasonable fluctuation range for BTC is between $37,300 and $67,500. With market institutionalization, price inertia may weaken, and the decline in a bear market may shrink to 40%-50%. It may be difficult to see BTC below $30,000 again.

@lijiuer1: What's next for Mubarak? CZ's avatar choice could be the key variable

Mubarak's rebound is largely influenced by CZ's personal movements, with expectations for it to eventually be listed. If listed, it may follow a similar pattern to $TST — rising first and then crashing. The liquidity pool is shallow, and the choice of CZ's avatar could determine Mubarak's next move. If the avatar aligns with related elements, there may be room for further growth; otherwise, it could follow $TST’s path. Additionally, Solana ecosystem players are shifting to the BNB chain, increasing on-chain activity, which is boosting $BNB. Established assets with strong communities, such as $KOMA, $BANANA, and $714, show resilience, making BNB ecosystem-based avatar concepts a short-term opportunity.

4

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Crypto Whale Nets $10 Million in Profit on 40x Leverage Bitcoin Short

The investor shorted 6,210 BTC at an entry price of $84,043 per Bitcoin, using borrowed funds to increase the size of the position.

CryptoNews•2025/03/18 16:55

On-chain Activity Collapse: Is Ethereum In Danger?

Cointribune•2025/03/18 15:33

Canary Capital Apply for SUI ETF Registration with the SEC

Portalcripto•2025/03/18 13:44

Ripple Accelerates RLUSD Issuance After Dubai License, Doubling Supply in Two Months

Portalcripto•2025/03/18 13:44

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$81,595.8

-3.09%

Ethereum

ETH

$1,880.5

-2.60%

Tether USDt

USDT

$0.9999

-0.00%

XRP

XRP

$2.23

-5.21%

BNB

BNB

$631.5

+0.46%

Solana

SOL

$123.21

-3.91%

USDC

USDC

$0.9998

-0.02%

Dogecoin

DOGE

$0.1638

-6.02%

Cardano

ADA

$0.6859

-5.28%

TRON

TRX

$0.2250

+2.52%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now