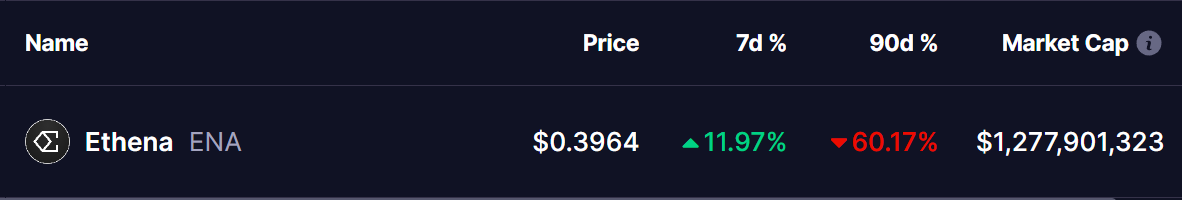

Is Ethena (ENA) Gearing Up for Reversal? Cup and Handle Pattern Signals an Upside Move

Date: Thu, March 20, 2025 | 02:15 PM GMT

The crypto market is showing early signs of a rebound as Ethereum (ETH) has bounced back from last week’s low of $1,774 and is now trading above $2,000—a promising shift after a choppy start to March. As sentiment gradually improves, altcoins like Ethena (ENA) are beginning to stir as well.

Source: Coinmarketcap

Source: Coinmarketcap

ENA has taken a heavy hit over the past few months, but with impressive weekly gains and ongoing price action, it suggests that a recovery may be underway.

Cup and Handle Pattern: A Bullish Signal?

On the daily chart, ENA is forming a classic cup and handle pattern, a well-known bullish continuation pattern that often precedes a strong breakout.

After facing rejection at $1.07 on December 2, ENA retraced to its critical support zone of $0.33. While ENA has shown resilience at this support, it has bounced strongly above $0.39, forming the handle portion of the pattern.

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

If ENA follows through with this structure, it could rally back toward the neckline around $1.26, which represents a potential 215% upside from its current levels.

The 50-day Simple Moving Average (SMA) is currently acting as an intermediate resistance. A break above this level would confirm the bullish recovery rally, with further resistance at the neckline of the pattern ($1.26). If ENA successfully breaks above this key resistance, it could signal the start of a strong uptrend.

The MACD indicator is also showing early bullish signs. The MACD line is attempting a crossover above the signal line, which could indicate growing momentum for a breakout. Additionally, the histogram is turning positive, further reinforcing the bullish outlook.

What’s Ahead?

If ENA maintains its current trajectory and breaks above the neckline, traders may witness a significant surge in price, potentially targeting the $1.50–$2.00 range in the coming months. However, failure to break above the neckline .could lead to further consolidation or a retest of lower support levels.

As always, traders should exercise caution, keeping an eye on broader market sentiment and key resistance zones before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mantra CEO Breaks Silence After Historic OM Crash

How Many Bitcoins Can The U.S. Government Actually Buy?

Expert Says XRP Case Win Won’t Guarantee Price Surge—Here’s Why

FIL Price Forecast: Explosive Growth Likely After Filecoin (FIL) v1.32.2 Upgrade