Walrus Foundation raises $140 million to bolster the decentralized data storage protocol Walrus

Quick Take Standard Crypto led the fundraising, with further support from a16z crypto, Electric Capital, Creditcoin, Lvna Capital, Protagonist, Franklin Templeton Digital Assets and other investors. The Walrus Foundation oversees the growth and development of Walrus, a Sui-based decentralized data storage platform initially developed by Mysten Labs.

The web3 data storage infrastructure organization Walrus Foundation raised $140 million from a private token sale.

The venture firm Standard Crypto led the financing, which included additional support from a16z crypto , Electric Capital, Creditcoin, Lvna Capital, Protagonist, Franklin Templeton Digital Assets, Karatage, RW3 Ventures, Comma3 Ventures and The Raptor Group, according to a company release .

The Walrus Foundation oversees the development of the Sui-based decentralized data storage platform Walrus, which lets store items such as images, videos and PDFs. Under the hood, Walrus deploys its utility token WAL to run a delegated proof-of-stake mechanism that operates its storage nodes while preventing Sybil attacks.

The Walrus Foundation plans to use its financing to continue developing Walrus, which is expected to launch on mainnet on March 27.

"This investment is a significant milestone to redefine decentralized storage," Managing Executive Rebecca Simmonds said in a statement. "By leveraging Sui’s unique architecture, we’re making storing data programmable, interactive and secure."

Walrus was initially developed by Mysten Labs , the same creator of the Layer 1 blockchain Sui . The platform's token , WAL, maintains a total supply of 5 billion with a circulating supply of 1.25 billion. Sixty percent of WAL tokens will go to the community, with initial token unlocks scheduled for March, according to Walrus's tokenomics roadmap .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP forecasted to reach $43.94 by 2030 amid market shifts

Bitcoin surges past $80,000 amid tariff policy shift

AAVE surges 13% as buyback proposal approved by tokenholders

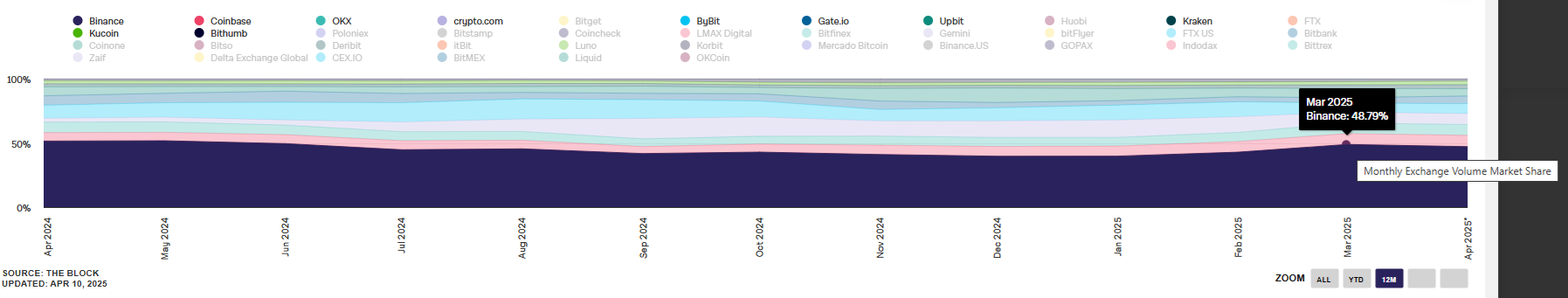

Crypto derivatives remains resilient in March as spot trading took bigger hits

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.