Bitcoin's Supply On Exchanges Continues Getting Lighter and Lighter

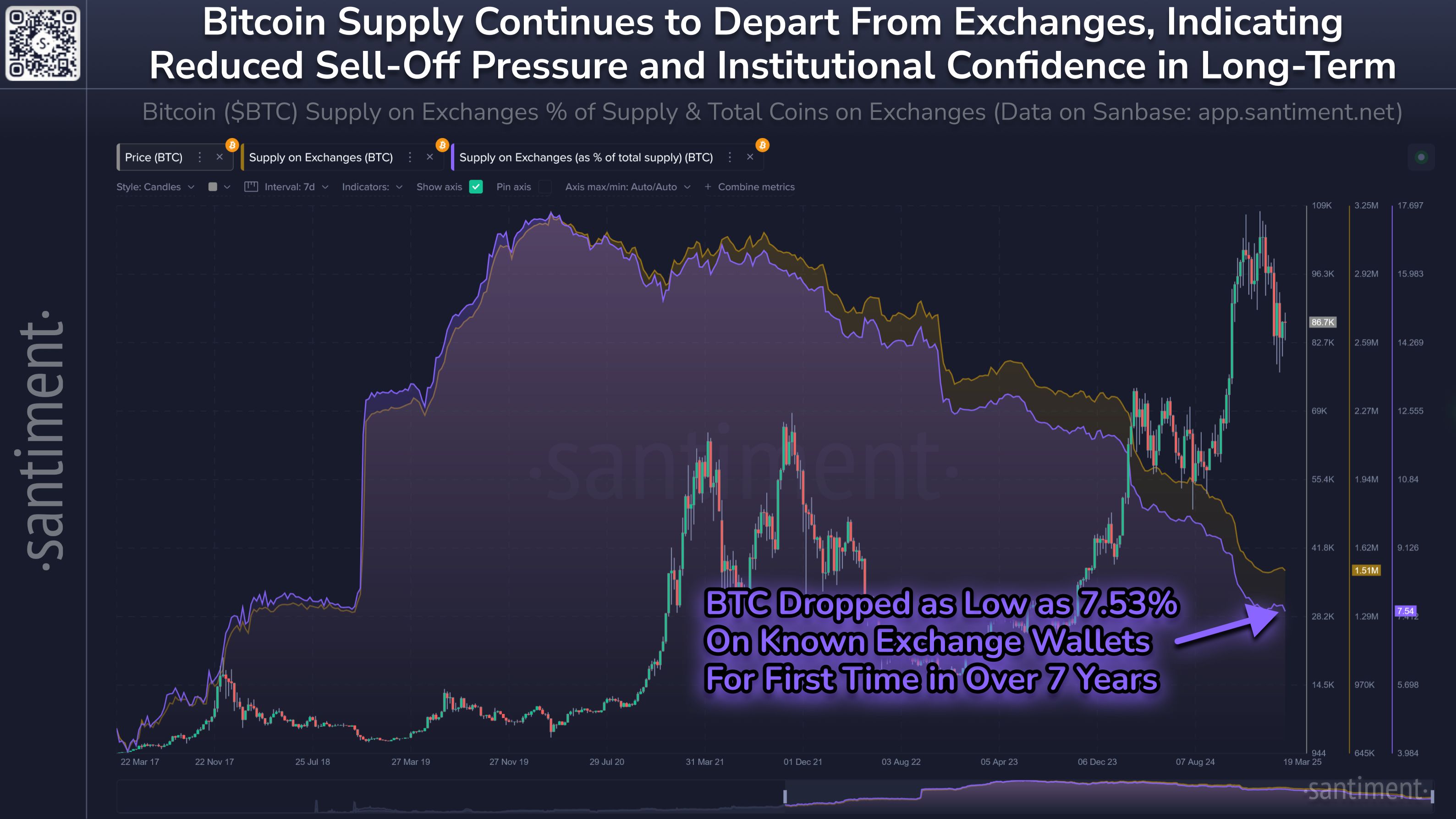

💸 Bitcoin's ratio of supply on exchanges has officially dropped to as low as 7.53%, the lowest since February 20, 2018. The 7-year milestone reflects a continued trend of investors of crypto's top asset feeling comfortable 'hodling' for the long-term, regardless of short-term price volatility and fluctuations.

📉 When $BTC's exchange supply declines, it typically suggests a decrease in short-term sell pressure. Coins held off exchanges are often stored in cold wallets, indicating that holders have less immediate intent to trade or liquidate. This shift reduces the available supply for spot selling, which can act as a buffer against sudden price drops during volatile market conditions. Over time, lower exchange balances have historically coincided with bullish conditions.

🏦 Additionally, the diminishing exchange supply signals growing interest from institutions and long-term custodial solutions. With more BTC moving into self-custody or secure institutional storage, it's evident that market participants are treating Bitcoin more as a store of value than a speculative trading asset. This behavioral shift promotes market stability and maturity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC proposes temporary crypto rules to address challenges

Blackrock sees $84B inflows in Q1 2025

US President Donald Trump Signs Bill to Kill IRS DeFi Rule

Biden-era IRS rule required DeFi platforms to report user data and crypto sales; Trump repealed it before its 2027 start.

$600M Wave Incoming: 3 Powerful Forces That Could Send XRP Soaring in 2025