Key Market Intelligence for March 28th, how much did you miss?

1. On-chain Funds: $3.2B USD inflow to Base today; $3.2B USD outflow from Ethereum 2. Largest Price Swings: $SAFE, $MUBARAK 3. Top News: Current mainstream CEX, DEX funding rates indicate the market is still in a bearish trend

Featured News

1.Current mainstream CEX, DEX funding rates indicate the market is still bearish

2.Berachain ecosystem DeFi protocol TVL reaches $3.351 billion, with a weekly growth rate of 15.76%

5.Ethereum has a total of $2.268 billion potential liquidation amount in the $1,800 range

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

$HYPER: Today, the discussion about Hyperliquid is centered around a major event: due to abnormal market activity, the JELLY token was forcibly delisted. A trader's self-liquidation caused Hyperliquid's treasury to bear a huge short position in JELLY, resulting in massive unrealized losses. The event escalated further, with accusations against major exchanges including Binance and OKX of market manipulation, ultimately leading to a forced settlement at a price favorable to Hyperliquid. This event has sparked widespread discussions on decentralization, risk management, and the competitive landscape between centralized and decentralized exchanges.

$JELLYJELLY: Today, discussions about JELLYJELLY mainly revolve around its delisting by Hyperliquid after being listed on Binance and OKX. This operation triggered a severe short squeeze. A trader's self-liquidation led Hyperliquid to bear a significant short position, followed by a community-driven price surge that could result in the treasury of Hyperliquid being liquidated. Many have likened this event to the GameStop short squeeze and speculate that Binance may have deliberately targeted its competitor in this event. This event highlights the high risks of low-liquidity tokens and the importance for decentralized exchanges to strengthen risk controls.

$BNKR: Discussion about BNKR on Twitter has heated up significantly due to its innovative integration of social platform with AI smart agents (such as @bankrbot). The token has recently introduced a fee-sharing mechanism, allowing users to earn rewards by staking the token, sparking market interest. Furthermore, despite being in a consolidation phase, BNKR's market cap and price remain relatively stable, demonstrating strong growth potential. The community is also actively involved in BNKR-related staking requests and discussions, exploring its positioning in the emerging DeFAI (Decentralized Finance + AI) ecosystem.

$PEPE: PEPE has become one of the market's focal points today, with its price resurgence attracting widespread attention and many investors bullish on its future upside potential. The coin's recent market activity has seen a significant uptick, particularly notable on mainstream exchanges like Binance, and is seen as a key driver of the overall memecoin market sentiment. Discussions also mention PEPE's correlation with popular memecoins such as DOGE and SHIB, as well as various trading strategies being explored. Many are optimistic about PEPE's future trajectory.

Featured Articles

1. "$Ghibli Hits New Market Cap High, Ghibli 'Shadow CEOs' on Edge""

We need a new mechanism where people can directly contribute their data and creativity and receive fair rewards based on their originality and the extent to which they expand the model's capabilities. As discussed by fellow enthusiasts in Jason's comments section, there is a need for a "traceability mechanism" and "incentive mechanism" around creativity, all built on a blockchain infrastructure to gain recognition aligned with the legitimacy of the traditional system, much like stablecoins operate now.

2. "'Green Bull Chain' Eclipse TGE Approaching, Is Ethereum's New Savior Coming?"

Hailed as Solana on Ethereum, the 'bull-chain' Eclipse gathered over 1,000 participants in its recent Discord community AMA, revealing the TGE token's ticker as $ES, hinting at Eclipse's TGE launch nearing. This article will provide a preliminary introduction to what this green 'bull-chain' is and how it's rising among the myriad of Layer2 solutions.

On-chain Data

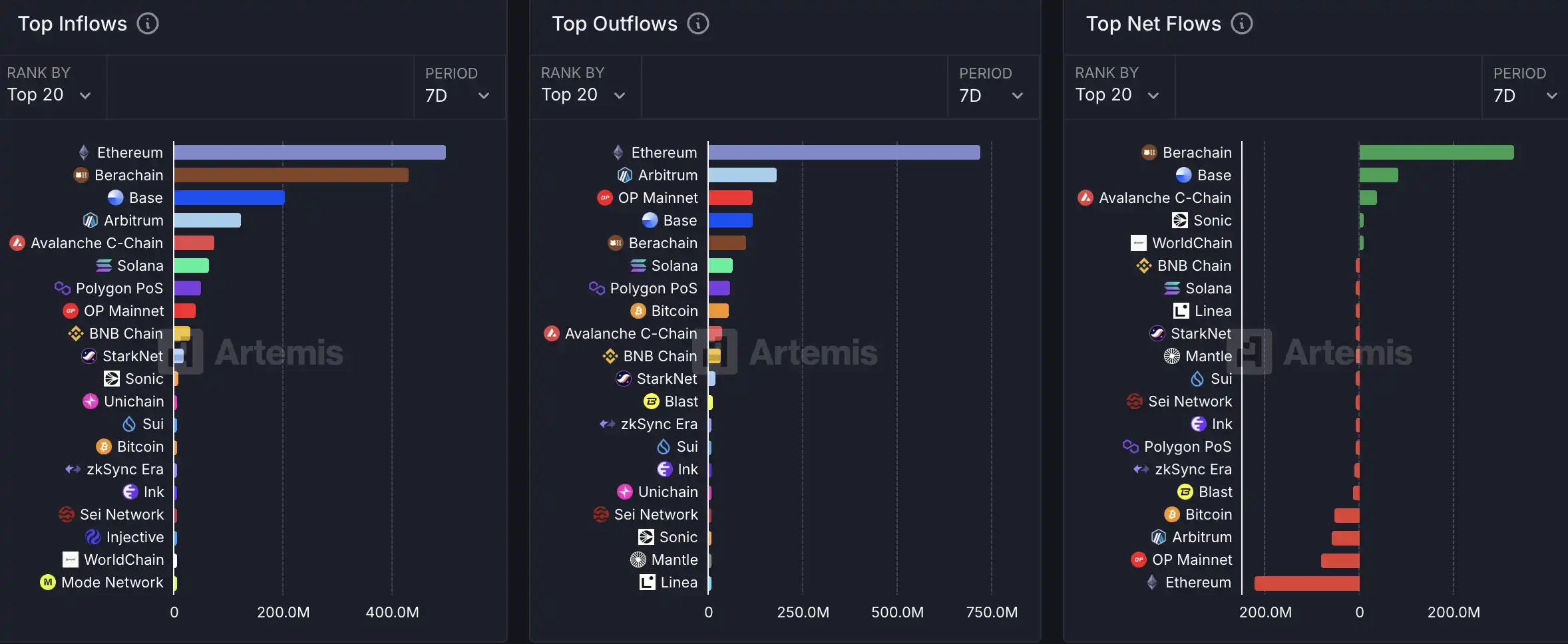

On-chain Fund Flow for the Week of March 28

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

zkLend Exploiter Claims to Lose $9.6M Stolen Funds to Phishing Scam

The hacker responsible for the $9.6 million exploit of zkLend claims to have lost a significant amount of the stolen funds to a phishing scam that mimicked Tornado Cash.

SpaceX Launches First Manned Mission to Orbit Earth’s Poles, Led by Crypto Entrepreneur

Elon Musk’s SpaceX has embarked on a groundbreaking mission, sending four private astronauts on the first-ever human spaceflight to orbit the North and South Poles.

Bitcoin Mining Shifts to Cleaner Energy as Coal Use Declines

Bitcoin mining has shifted towards cleaner energy sources over the past 13 years.

AUSTRAC Cracks Down on Crypto ATM Providers Over Compliance Concerns

AUSTRAC, Australia’s financial intelligence agency, has raised significant concerns regarding the growing risks associated with crypto ATMs, particularly regarding operators failing to implement proper anti-money laundering (AML) and counter-terrorism financing (CTF) protocols.