U.S. Moves $10M In Seized Crypto, Ethereum Price Eyes $6K Breakout

U.S. moves $10M in seized ETH and BTC wallets. Ethereum open interest exceeds $22B amid whale accumulation. Pectra upgrade and ETF buzz fuel $6K ETH breakout hopes.

Blockchain data shows that the U.S. government transferred over $10 million in seized Bitcoin and Ethereum on Mar. 27.

The move comes weeks after President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve.

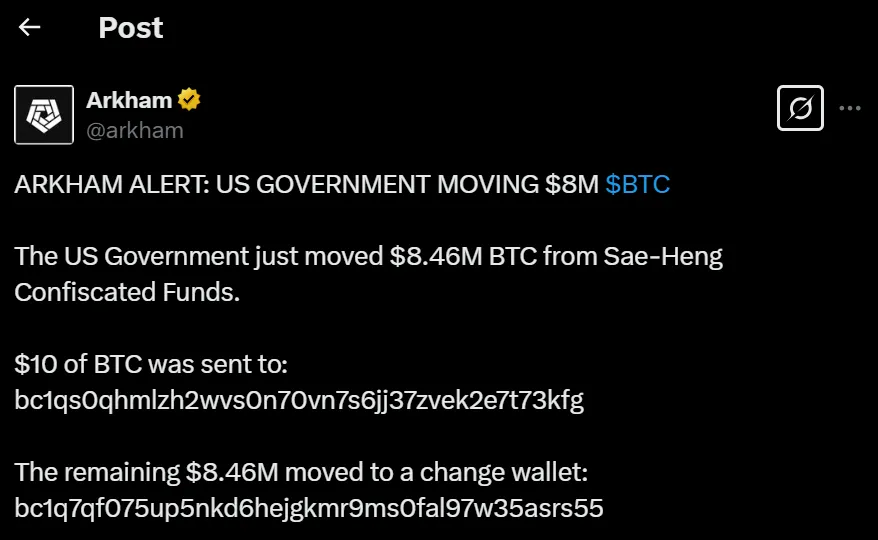

Source: Arkham/X

Source: Arkham/X

According to Arkham Intelligence, a wallet tied to U.S. authorities moved $8.46 million in Bitcoin and $1.77 million in Ethereum from confiscated funds linked to Thai national Wanpadet Sae-Heng.

The transactions follow smaller test transfers of $10 in Bitcoin and $1 in Ethereum. The BTC was divided between two wallets, with most of the funds routed to a change address.

ETH was consolidated into a separate address ten minutes after the initial test transaction.

Trump’s Bitcoin Reserve Plan Reshapes Crypto Asset Policy

Trump’s March 6 executive order directed federal agencies to compile a full report of their digital asset holdings.

The Treasury Secretary now has authority to determine strategies for managing these holdings, including potential sales or additions to the reserve.

The move also created a new asset category—the Strategic Bitcoin Reserve—which will store confiscated Bitcoin as a long-term national asset. These funds will be distinct from the broader U.S. Digital Asset Stockpile.

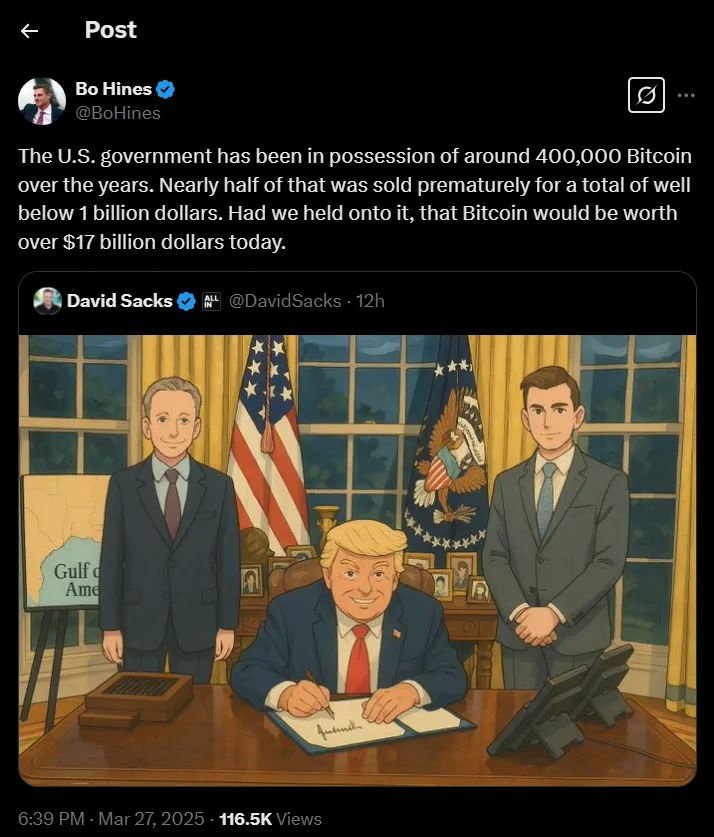

Source: Bo Hines/X

Source: Bo Hines/X

Trump’s crypto advisor, Bo Hines, criticized past asset sales, claiming the U.S. prematurely sold nearly 200,000 Bitcoin for under $1 billion. He posted on X,

“Bitcoin would be worth over $17 billion today.”

Trump’s AI and crypto czar, David Sacks echoed the criticism, calling for improved asset management under the new order. The U.S. currently holds 198,012 BTC valued at over $17 billion.

Ethereum Price: Open Interest Surges Past $22B as Bulls Position for April

As of Mar. 27, ETH traded at $2,065, down 2% on the day but maintaining key support above $2,000.

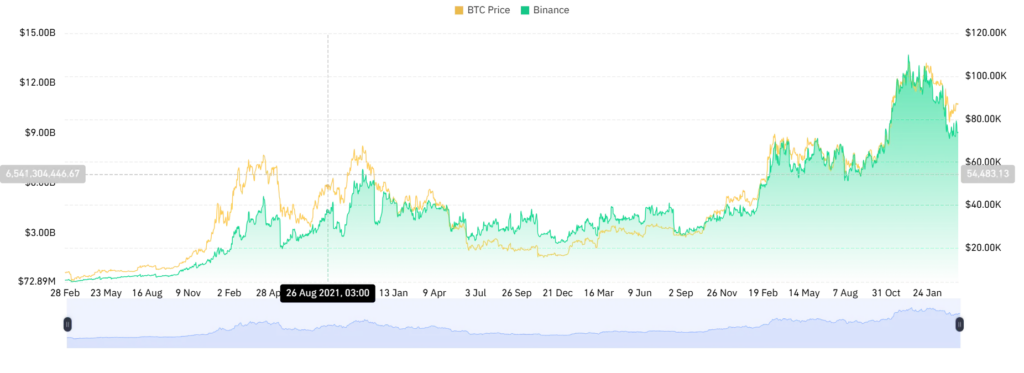

Binance BTC Futures Open Interest (USD). Source: Coinglass

Binance BTC Futures Open Interest (USD). Source: Coinglass

Data from CoinGlass showed ETH open interest climbed to 10.84 million ETH—worth around $22.03 billion. This marks a 2.61% increase in the past 24 hours, reflecting renewed confidence in Ethereum’s near-term prospects.

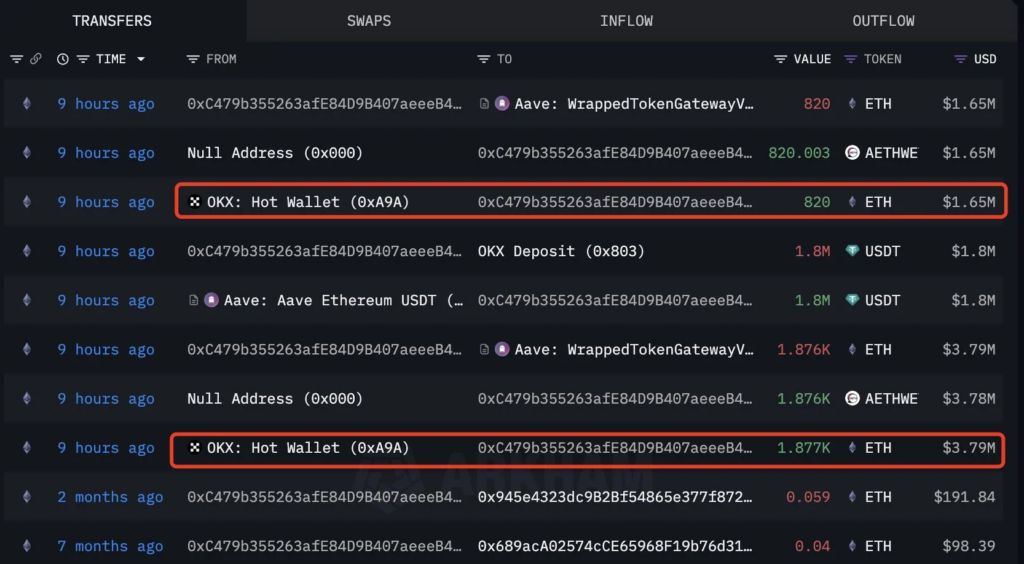

Source: Lookonchain/X

Source: Lookonchain/X

According to Lookonchain, whales withdrew nearly 16,000 ETH—worth $32 million—from exchanges following a successful testnet deployment of the Pectra upgrade. This accumulation trend has become a focal point for bullish traders.

Trading volume also rose by 14.5% to $12.65 billion, further confirming active market participation.

Pectra Upgrade and ETF Buzz Fuel Breakout Hopes

Ethereum’s upcoming Pectra upgrade, tentatively scheduled for Apr. 30, is another key catalyst. The upgrade will introduce smart wallet features, gasless transactions, and support for token payments beyond ETH.

According to Ethereum developer Terence, the upgrade is on track unless modified at the next dev meeting. The Hoodi testnet deployment succeeded, triggering large ETH withdrawals by whales.

Source: Crypto Patel/X

Source: Crypto Patel/X

Crypto Patel identified a macro breakout pattern forming around Ethereum price’s consolidation zone. Michaël van de Poppe added,

“Really looking forward to the speed of the breakout above $2,150.”

ETH/USD 4-hour price chart. Source: Michaël van de Poppe/X

ETH/USD 4-hour price chart. Source: Michaël van de Poppe/X

Meanwhile, a new Ethereum exchange-traded fund (ETF) proposal from Bitwise, filed via the New York Stock Exchange, aims to include staking, which could increase institutional demand.

Resistance at $2,100 Remains a Hurdle For Ethereum Price

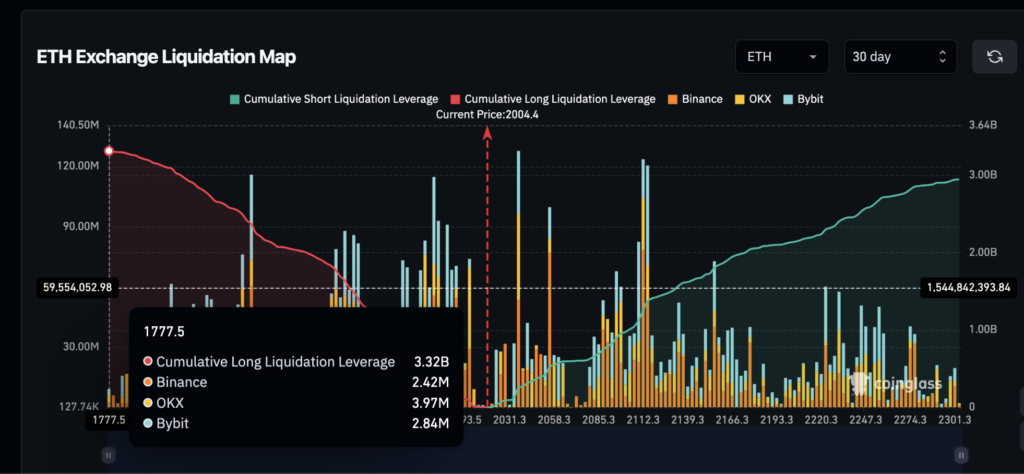

Despite rising interest, Ethereum faces heavy resistance around $2,100. CoinGlass liquidation data shows a $1.25 billion short cluster at that level.

Ethereum Open Interest, March 2025 | Source: Coinglass

Ethereum Open Interest, March 2025 | Source: Coinglass

ETH bulls currently hold $3.3 billion in long positions versus $2.95 billion in shorts. Analysts said a decisive break above $2,110 could trigger a rally toward the $2,500 zone.

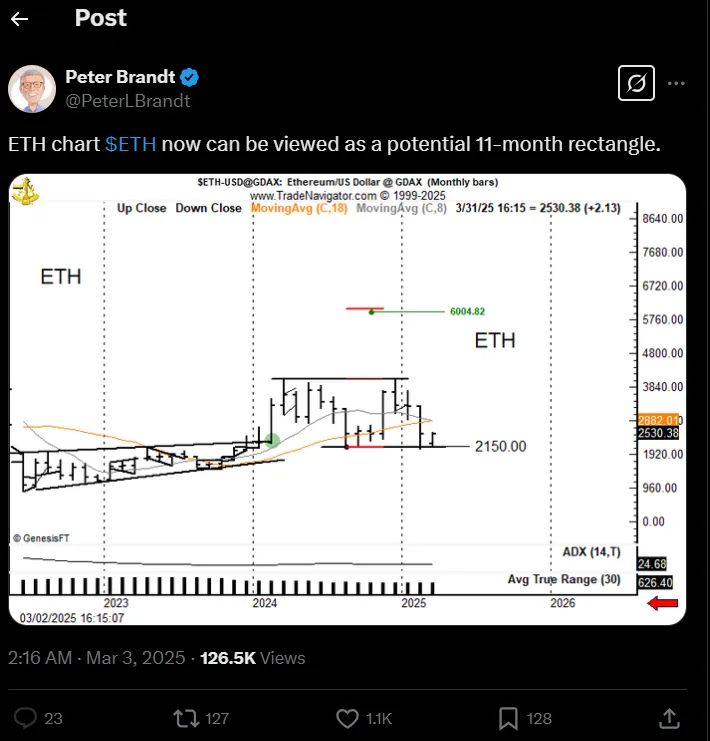

Peter Brandt eyes 11-month rectangle on ETH. Source: X

Peter Brandt eyes 11-month rectangle on ETH. Source: X

Veteran trader Peter Brandt maintained a $6,000 ETH target, contingent on holding the $2,150 support zone.

Seized Crypto Now a Strategic Asset Under Trump

While Ethereum price fights for momentum, the U.S. government’s latest crypto transfers have sparked renewed scrutiny.

The U.S. Marshals Service, tasked with managing seized assets, now operates under heightened expectations following Trump’s directive.

The executive order mandates a full review of federal crypto holdings within 30 days. As regulators finalize their frameworks, the market continues to price in the implications.

With 198,012 Bitcoin valued above $17 billion, the United States has become a major crypto stakeholder.

Markets are now watching closely as regulators align with Trump’s evolving digital asset policy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE Whale Moves $5M to FalconX After Huge Gains

A whale with $12M in AAVE profits just deposited $5M worth to FalconX, continuing strategic moves after months of inactivity.$12M in Profits and Still Holding StrongWhat This Means for AAVE and FalconX

USDC Treasury Mints $250 Million on Solana Blockchain

zkLend Exploiter Claims to Lose $9.6M Stolen Funds to Phishing Scam

The hacker responsible for the $9.6 million exploit of zkLend claims to have lost a significant amount of the stolen funds to a phishing scam that mimicked Tornado Cash.

SpaceX Launches First Manned Mission to Orbit Earth’s Poles, Led by Crypto Entrepreneur

Elon Musk’s SpaceX has embarked on a groundbreaking mission, sending four private astronauts on the first-ever human spaceflight to orbit the North and South Poles.