Fidelity and Blackrock Drive $89 Million Into Bitcoin ETFs As Ether ETFs Lose Another $4 Million

Inflows Hit 10-Day Streak For Bitcoin ETFs While Ether ETFs Struggle with Continued Exits

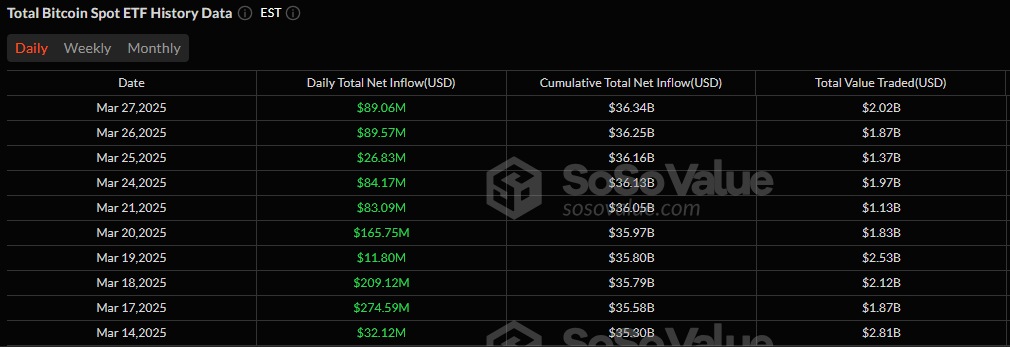

Bitcoin ETFs continued their upward trajectory, marking their tenth consecutive day of inflows with an $89.06 million boost.

Fidelity’s FBTC led the charge, contributing $97.14 million, while Blackrock’s IBIT added a modest $3.97 million. Despite these gains, outflows from Invesco’s BTCO ($6.95 million) and Wisdomtree’s BTCW ($5.09 million) partially offset the day’s total. Even so, total net assets for bitcoin ETFs climbed to $98.29 billion, maintaining their stronghold in the market.

Source: Sosovalue

Investor interest in bitcoin ETFs remained strong, with total trading volume surging to $2.02 billion. The momentum signals sustained confidence in BTC’s price stability and long-term potential.

Ether ETFs, on the other hand, faced continued selling pressure, with a $4.22 million outflow extending their downturn. Fidelity’s FETH saw a $2.01 million exit, while Vaneck’s ETHV lost $2.21 million. Trading volume stood at $142.47 million, with total net assets stabilizing at $6.8 billion.

As bitcoin ETFs maintain their winning streak, ether ETFs struggle to find support. With ten straight days of inflows, bitcoin continues to attract institutional capital, while ether’s recent trend suggests a lack of investor confidence in ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到[email protected],本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Coin Faces Price Drop as Community Discontent Grows

In Brief Pi Coin price fell below $0.70 amid decreased trading activity. Community expresses dissatisfaction despite high participation in the PiFest event. Market experts predict slow recovery without changes in current trends.

Circle’s Bold Move: Going Public to Strengthen its Market Position

In Brief Circle filed for an IPO to enhance its market position in the U.S. The company anticipates a revenue growth to $1.68 billion in 2024. Investor confidence is crucial as regulatory environments evolve positively.

Post meme-ism: Solana’s quiet pivot to utility

Solana may be in “recomposition” mode, as new protocols put usefulness ahead of mere virality

US equities, cryptocurrencies fall on Trump’s sweeping global tariffs

President Donald Trump announced a 10% levy on almost all goods and additional tariffs on so-called “worst offending” countries