Can XRP Rebound to $2.30 or Face a Further Fall Below $2.00?

- XRP drops 4.69% to $2.15 amid high volatility and weak buying pressure.

- Analyst warns of a $1.20 drop if the $2.05 neckline breaks in a bearish setup.

- Whale activity slows as XRP lacks catalysts and faces an uncertain outlook.

XRP is trading at $2.15 after falling 4.69% in the past 24 hours. The price ranged between $2.14 and $2.27 during the day, showing notable volatility. Despite a 43% surge in trading volume to $4.25 billion, the token failed to recover. XRP’s market cap currently stands at $126 billion.

The recent downtrend follows an earlier rally when XRP hit a high of $3.40 in January after a 500% surge in late 2024. Since then, the token has dropped by 35%. Macroeconomic concerns, including tariff threats from U.S. President Donald Trump and rising inflation, have intensified pressure on risk assets like cryptocurrencies. Also, the on-chain activity has weakened, and the growing supply of XRP adds further strain.

Whale Exit and Weak Catalysts Keep XRP Under Pressure

Despite the U.S. Securities and Exchange Commission (SEC) dropping its appeal against Ripple, XRP failed to rally. The market had largely priced in the SEC’s decision, especially as the agency’s new leadership continues to close cases involving crypto firms.

With few positive catalysts in sight, XRP’s outlook remains uncertain. Whale investors have also reduced their presence, as seen in declining large transaction activity. Current transaction levels are returning to pre-election figures, suggesting weakened market confidence.

The lack of strong fundamentals or institutional interest may limit short-term gains. If market sentiment does not improve, XRP could remain under selling pressure through the next cycle.

XRP Charts Show Bearish Signals With Key Support at $2.05

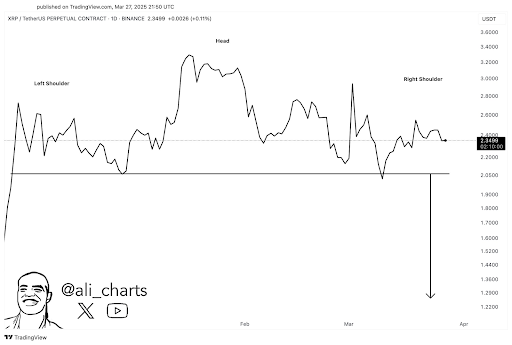

Technical indicators suggest a bearish trend may continue. Crypto analyst Ali identified a head-and-shoulders pattern on XRP’s chart, with the neckline around $2.05. A break below this level could trigger a sharp drop, potentially targeting $1.20. However, a move above $3.00 would invalidate this setup and could spark a bullish reversal.

Markets indicate weakening buyer strength because the RSI currently stands at 40.61 and is moving toward oversold levels. The bearish outlook receives backing from both the MACD indicators which show combined negative territory. The signal line provides additional support for ongoing downward movement as the MACD line continues to sit beneath it.

XRP needs to break below $2.12 support before traders can potentially target $2.00 as the following stop level. The support region would maintain its strength while an RSI recovery might trigger a price increase to $2.30. Resistance will maintain its strength at $2.25 until general market sentiment makes significant changes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI countersues Elon Musk over alleged takeover attempt

XRP forecasted to reach $43.94 by 2030 amid market shifts

ShareRing trials blockchain ID for Australian age verification

Justin Sun, Rand Paul, Brock Pierce and Karnika Yashwant join forces to power Liberland

Share link:In this post: Liberland celebrates 10 years with major names like Justin Sun, Rand Paul, and Brock Pierce joining its event. Justin Sun pledges TRON’s support, committing to help Liberland become EVM-compatible. Mr. KEY joins Liberland’s Congress, adding crypto credibility and championing the nation’s freedom-first philosophy.