40 Million Token Liquidity Standstill: How Do Project Teams 'Eat' During a Bear Market?

Most projects are still finding their footing. But those that have gotten it right—projects with revenue, strategy, and trust—have the opportunity to become the much-needed "cathedrals" of the industry, providing a long-term, stable benchmark.

Original Article Title: When Tokens Burn

Original Article Author: @desh_saurabh, Decentralised.Co

Original Article Translation: Deep Tide TechFlow

Zero-Sum Attention Game

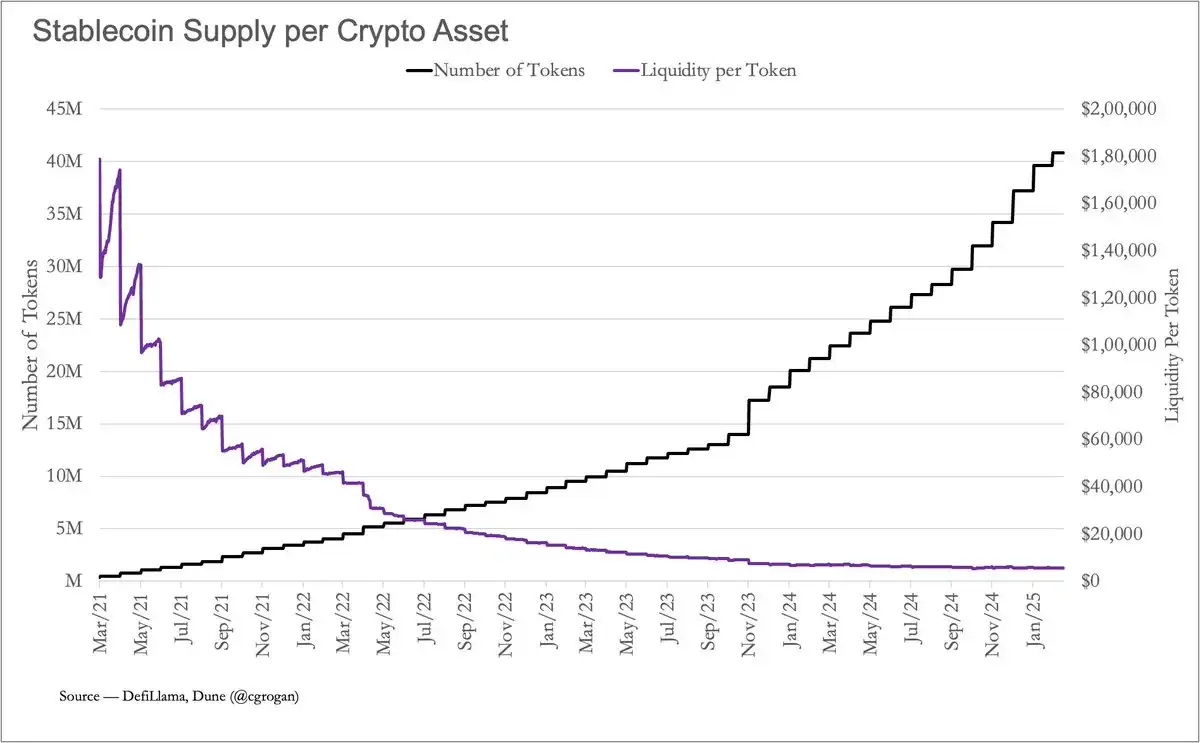

In 2021, each cryptocurrency asset had an average of around $1.8 million in stablecoin liquidity. However, by March 2025, this number had plummeted to just $5,500.

This chart visually demonstrates the decline in averages, while also reflecting the zero-sum nature of attention in today's crypto space. Despite the number of tokens skyrocketing to over 40,000 assets, stablecoin liquidity (as a rough measure of capital) has remained stagnant. The result is brutal—less capital per project, weaker communities, and rapidly declining user engagement.

In this environment, fleeting attention is no longer a channel for growth but a burden. Without the support of cash flow, this attention swiftly shifts, showing no mercy.

Income as the Anchor of Development

Most projects still build communities in the same way as they did in 2021: create a Discord channel, offer airdrop incentives, and hope users will "GM" (Good Morning) long enough to generate interest. However, once the airdrop ends, users quickly depart. This outcome is not surprising as they have no reason to stay.

At this point, the role of income becomes apparent—it is not just a financial metric but also a critical proof of project relevance. A product that can generate income implies demand. Demand supports valuation, and valuation, in turn, gives the token gravity.

While income may not be the ultimate goal for every project, without income, most tokens simply cannot survive long enough to become foundational assets.

It is important to note that some projects' positioning is vastly different from other parts of the industry. Take Ethereum, for example; it does not need additional income as it already has a mature and sticky ecosystem. Validator rewards come from an inflation of about 2.8% annually, but with EIP-1559's fee burn mechanism, this inflation can be offset. As long as burn and revenue can balance, ETH holders can avoid dilution risk.

However, for new projects, they do not have such a luxury. When only 20% of the tokens are in circulation and you are still struggling to find product-market fit, you are essentially like a startup. You need to make a profit and prove that you have the ability to sustain profitability in order to survive.

Protocol Lifecycle: From Explorer to Giant

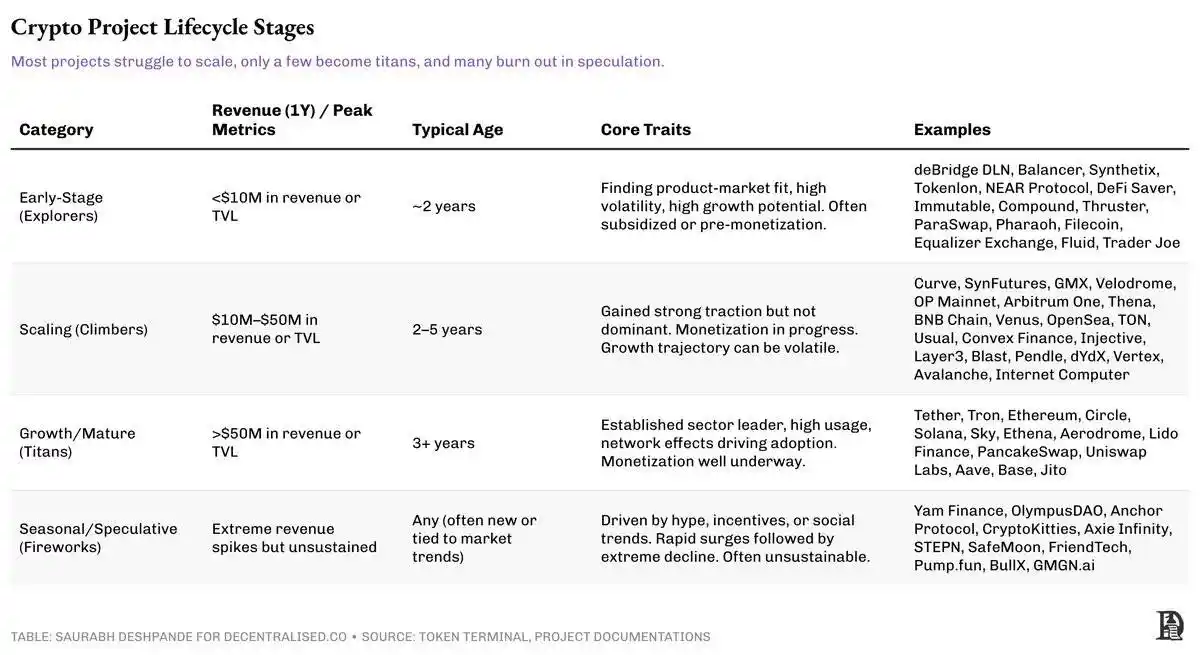

Similar to traditional companies, crypto projects go through different stages of maturity. At each stage, the relationship between the project and revenue—whether to reinvest or distribute revenue—undergoes significant changes.

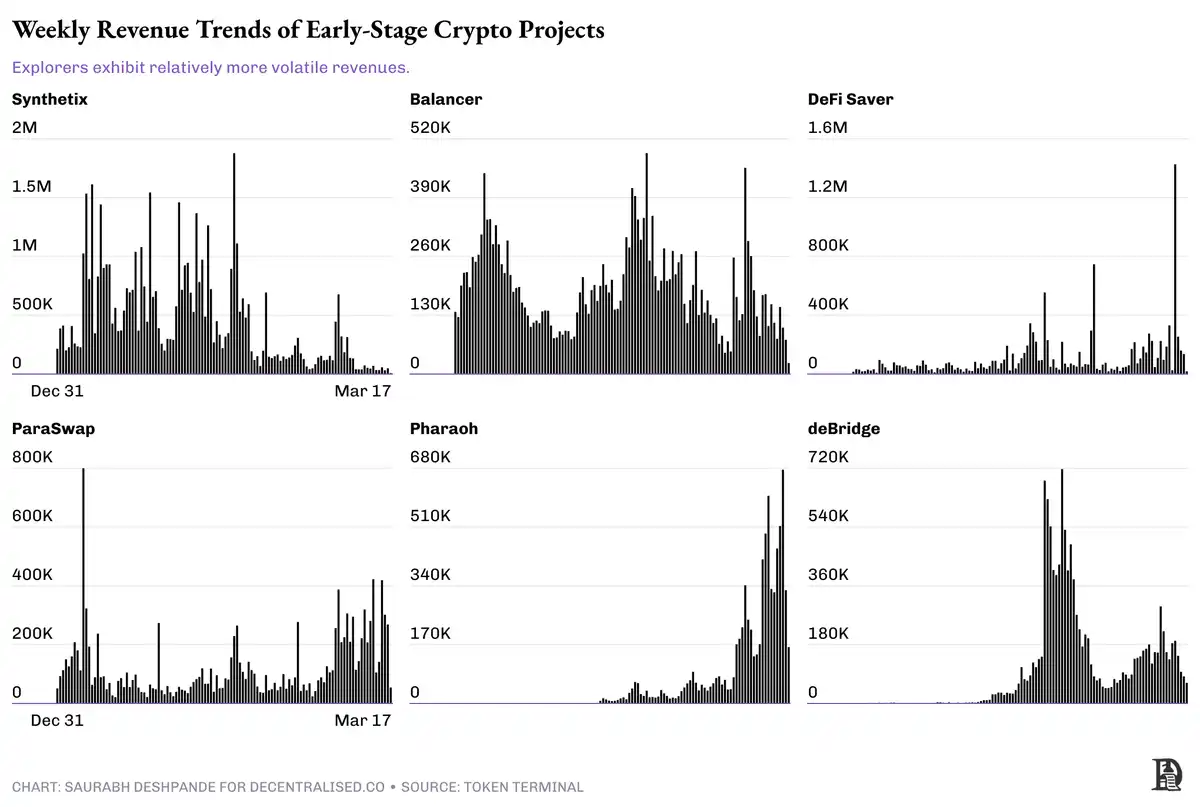

Explorer: Prioritizing Survival

These are early-stage projects, usually with centralized governance, a fragile ecosystem, and a focus on experimentation rather than monetization. Even if there is revenue, it is often volatile and unsustainable, reflecting more market speculation than user loyalty. Many projects rely on incentives, grants, or venture capital to sustain themselves.

For example, projects like Synthetix and Balancer have been around for about 5 years. Their weekly revenue ranges from $100,000 to $1 million, with occasional spikes during peak activity. This significant volatility is a typical feature of this stage, not a sign of failure but a manifestation of volatility. The key is whether these teams can translate the experiment into a reliable use case.

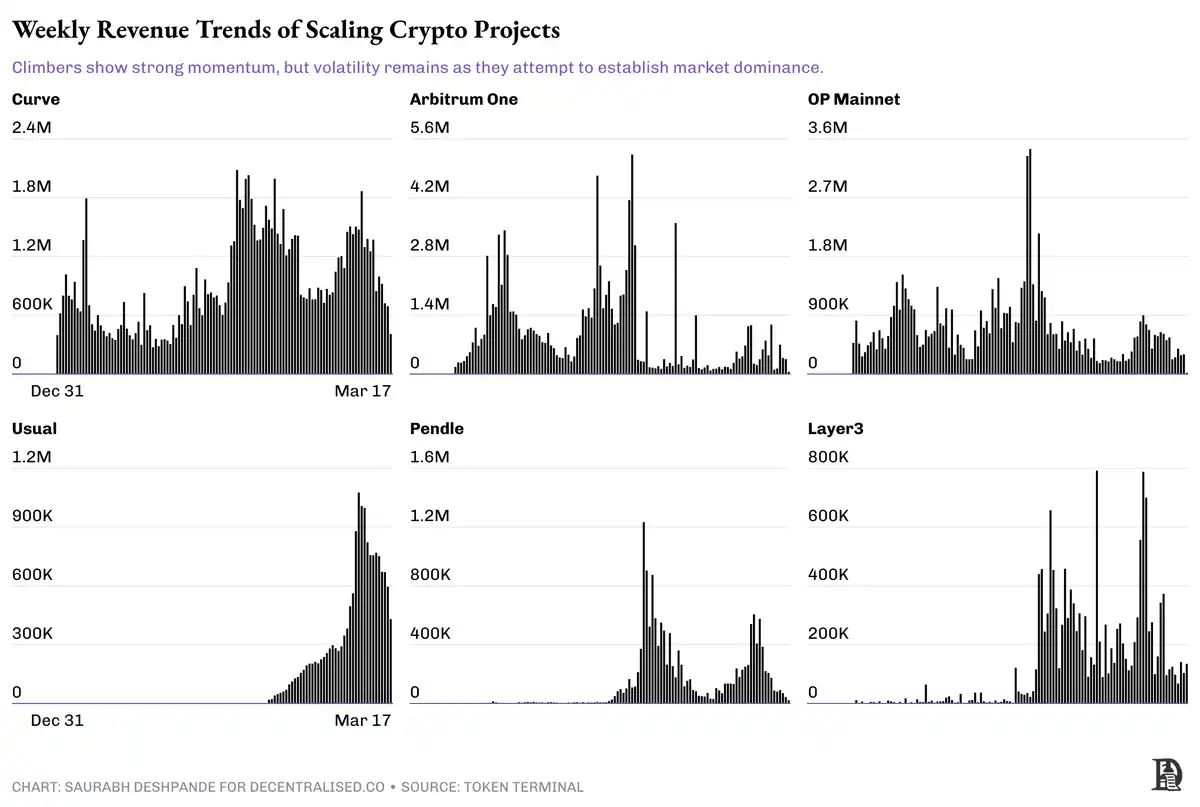

Climber: Gaining Traction but Still Unstable

Climbers are projects in the advanced stage, with annual revenue between $10 million and $50 million, gradually moving away from a token issuance-driven growth model. Their governance structures are maturing, shifting their focus from mere user acquisition to long-term user retention. Unlike Explorers, Climbers' revenue has already proven demand across different cycles, not solely driven by one-off hype. Additionally, they are undergoing structural evolution—from centralized teams to community-driven governance and diversifying revenue streams.

What sets Climbers apart is their flexibility. They have accumulated enough trust to experiment with revenue distribution—some projects are starting revenue sharing or buyback programs. However, they also face the risk of losing momentum, especially in cases of overexpansion or failure to deepen moats. While Explorers' primary task is survival, Climbers must make strategic trade-offs: choosing between growth and consolidation, revenue distribution or reinvestment, focusing on core business or diversifying.

The vulnerability at this stage is not about volatility, but about the stakes becoming visibly real.

These projects face the toughest decision: if they allocate revenue too early, it could hinder growth; but if they wait too long, token holders may lose interest.

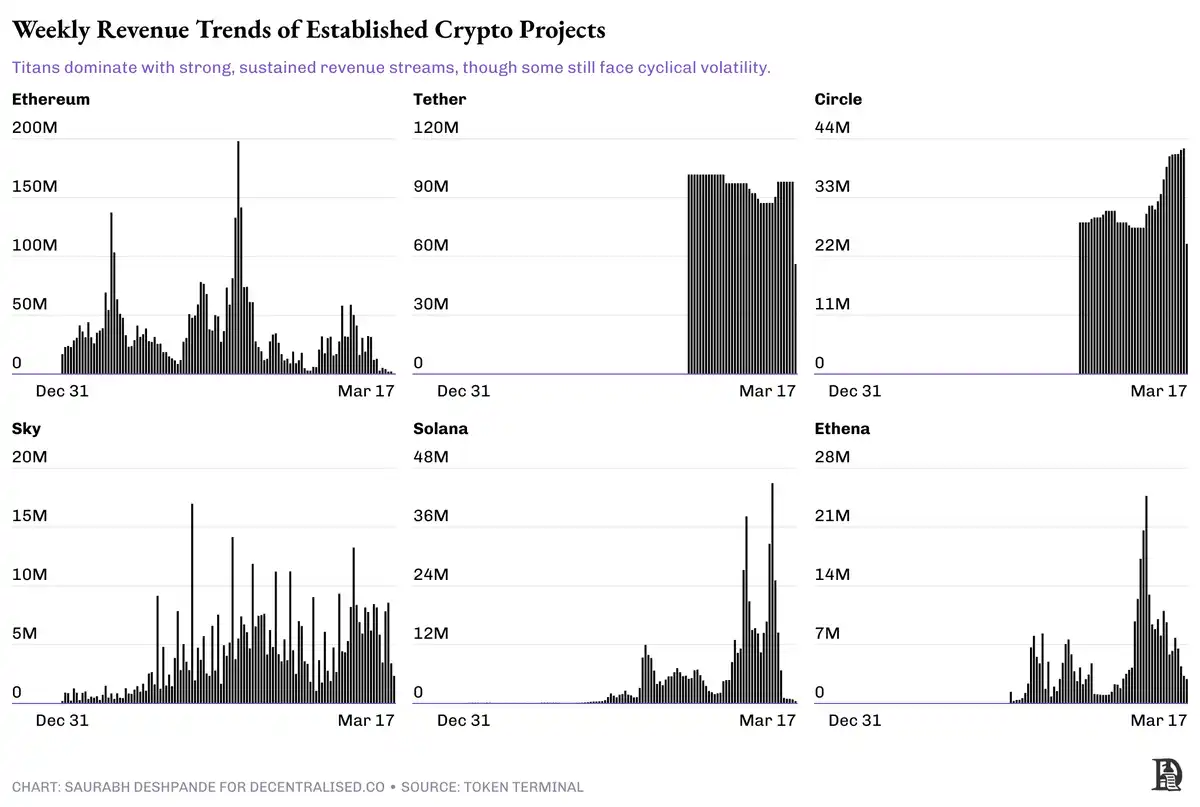

Titans: Ready to Allocate

Projects like Aave, Uniswap, and Hyperliquid have already crossed the threshold. They can generate stable income, have decentralized governance, and benefit from strong network effects. These projects no longer rely on an inflationary tokenomics model, having a solid user base and a market-proven business model.

These titans typically do not try to "do it all." Aave focuses on the lending market, Uniswap leads in spot trading, and Hyperliquid is building an execution-centric DeFi stack. Their strength comes from defensible market positioning and operational discipline.

Most titans are leaders in their respective fields. Their efforts are usually focused on "growing the pie" — driving overall market growth rather than just expanding their own market share.

These projects are the kind that can easily conduct buybacks and still sustain operations for years. While they are not completely immune to volatility, they have enough resilience to cope with market uncertainty.

Seasonal Players: Flashy but Lacking Foundation

Seasonal players are the most prominent yet fragile type. Their revenue may rival or even surpass the titans in a short time, but this revenue is mainly driven by hype, speculation, or short-lived social trends.

For example, projects like FriendTech and PumpFun can create massive engagement and trading volume in a short time, but they rarely can convert these into long-term user retention or sustained business growth.

These projects are not inherently bad. Some may pivot and evolve, but most are merely reliant on short-term games of market momentum rather than building lasting infrastructure.

Lessons from the Public Markets

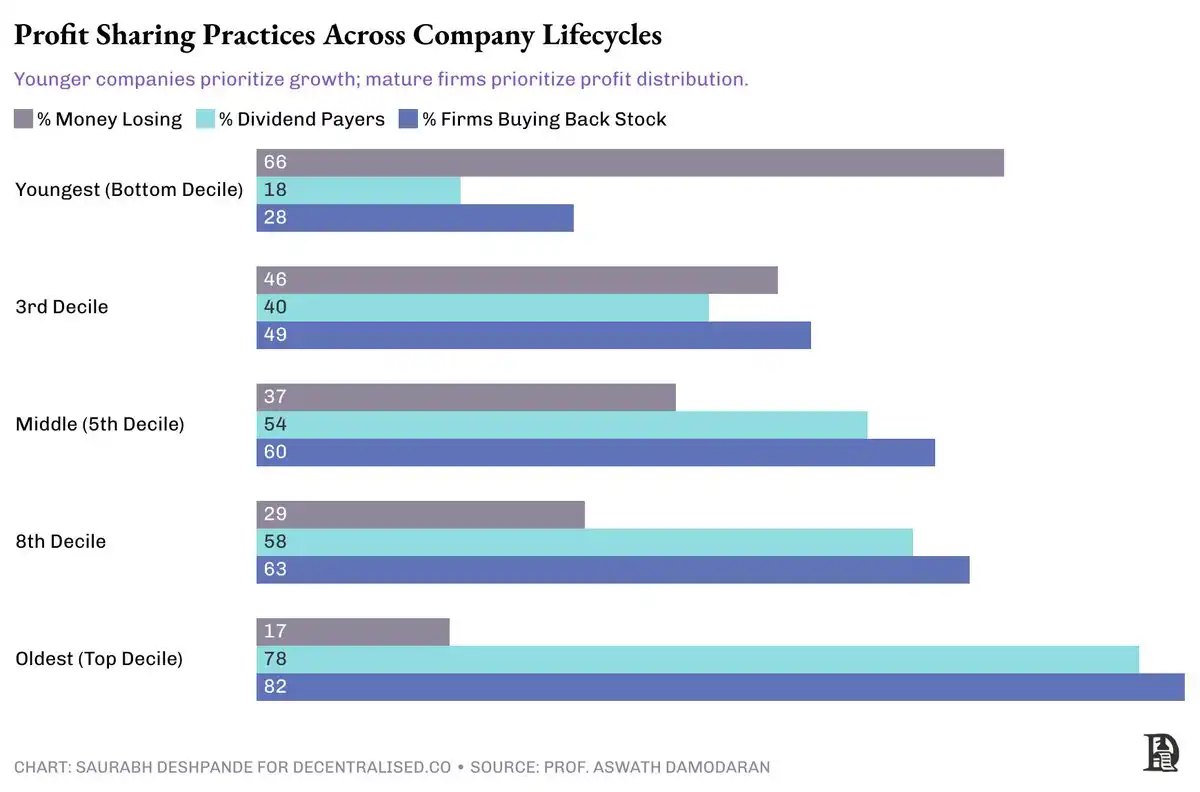

The public stock market provides a helpful analogy. Young companies usually reinvest free cash flow for scale, while mature companies distribute profits through dividends or stock buybacks.

The chart below illustrates how companies distribute profits. As companies grow, the number of companies engaging in dividends and buybacks increases.

Cryptocurrency projects can learn from each other. Giants should focus on profit distribution, while explorers should emphasize retention and compounding growth. However, not every project clearly identifies which stage it belongs to.

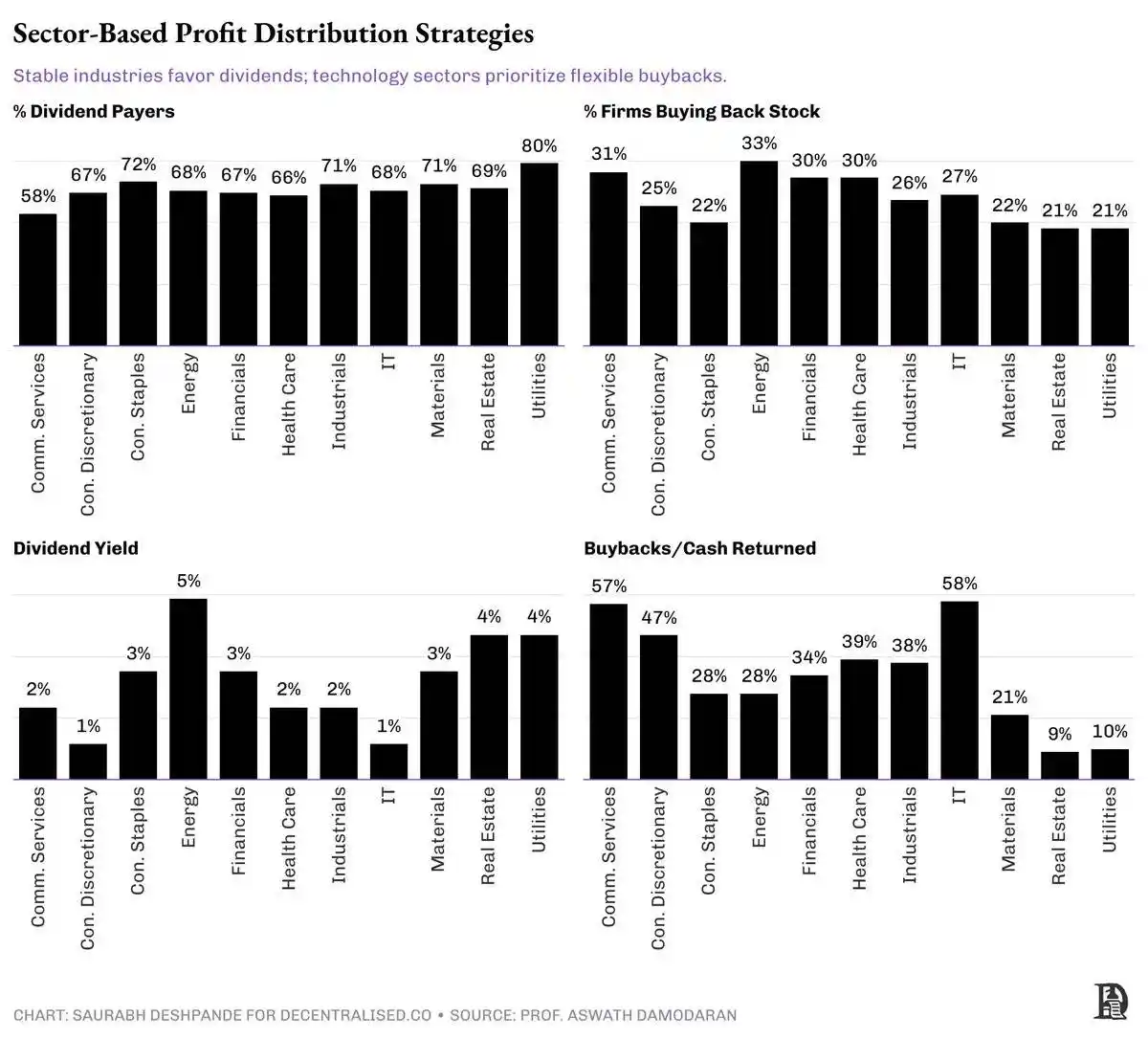

Industry characteristics are also crucial. Projects similar to utilities (e.g., stablecoins) are more like consumer staples: stable and suitable for dividends. This is because these companies have existed for a long time, and demand patterns are largely predictable. Companies often do not deviate from forward-looking guidance or trends. Predictability allows them to consistently share profits with shareholders.

On the other hand, high-growth DeFi projects are more like the tech industry—where a flexible buyback plan is the preferred value distribution method. Tech companies usually experience higher seasonal fluctuations. In most cases, their demand is not as predictable as in some more traditional industries. This unpredictability makes buybacks the preferred way to share value.

If a quarter or year performs exceptionally well? Distribute value through share buybacks.

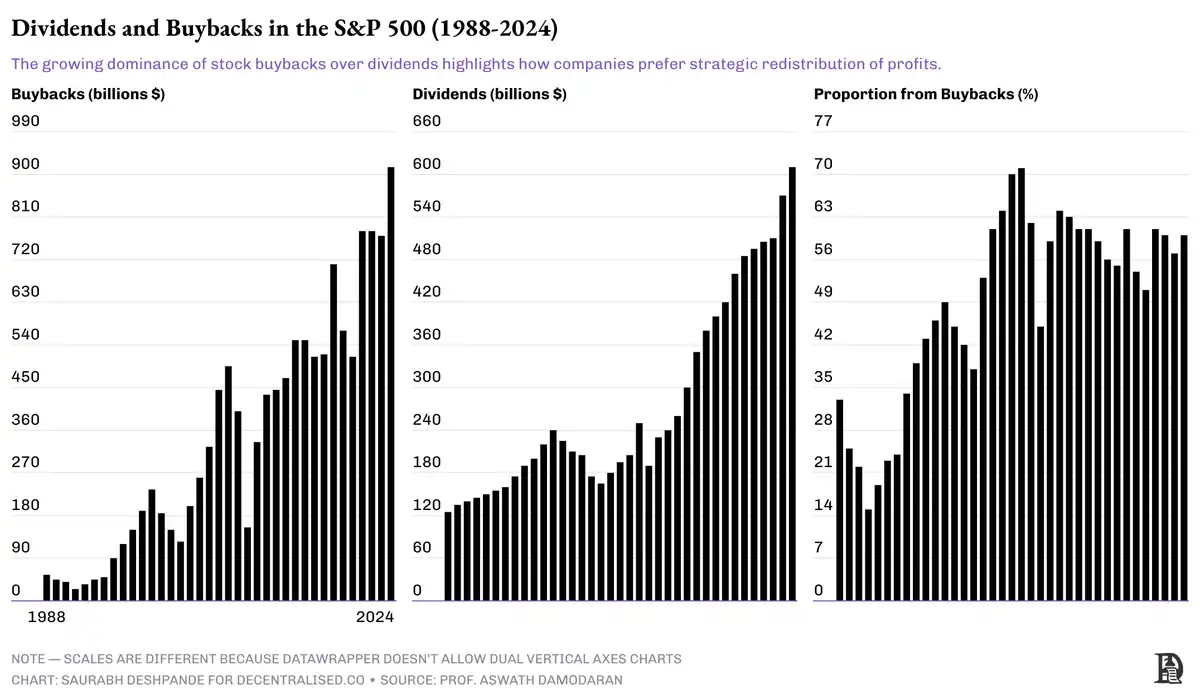

Comparison of Dividends and Buybacks

Dividends have stickiness. Once a dividend payment is committed, the market expects consistency. In contrast, buybacks are more flexible, allowing teams to adjust the timing of value distribution based on market cycles or when the token is undervalued. From a distribution of around 20% of profits in the 1990s to about 60% in 2024, buybacks have grown rapidly over the past few decades. In dollar terms, the scale of buybacks has exceeded dividends since 1999.

However, buybacks also have some downsides. Improper communication or unreasonable pricing can transfer value from long-term holders to short-term traders. Additionally, governance mechanisms need to be very tight as management typically has key performance indicators (KPIs) such as increasing earnings per share (EPS). When a company buys back shares using profits from outstanding shares, it reduces the denominator, artificially inflating EPS data.

Dividends and buybacks each have their appropriate use cases. However, without proper governance, buybacks can quietly benefit insiders at the community's expense.

Three key elements of a good buyback:

· Strong asset reserve

· Well-thought-out valuation logic

· Transparent reporting mechanism

If a project lacks these conditions, it may still need to be in the reinvestment stage rather than engaging in buybacks or dividends.

Current Revenue Distribution Practices of Leading Projects

@JupiterExchange clearly stated during their token launch that they do not directly share revenue. After achieving a 10x user growth and having enough funds to sustain years of operation, they introduced the "Litterbox Trust" — an escrowless buyback mechanism that currently holds around $9.7 million worth of JUP tokens.

@aave holds over $95 million in asset reserves and through a structured plan called "Buy and Distribute," they allocate $1 million weekly for buybacks. This plan was introduced after months of community dialogue.

@HyperliquidX goes a step further, with 54% of its revenue allocated to buybacks and 46% to liquidity provider incentives (LPs). To date, they have repurchased over $250 million worth of HYPE tokens, all supported by non-venture capital funds.

What do these projects have in common? They all ensure a solid financial foundation before implementing buyback plans.

The Missing Piece: Investor Relations (IR)

The crypto industry often talks about transparency, yet most projects only disclose data when it suits their narrative.

Investor Relations (IR) should be a core infrastructure. Projects need to share not only revenue but also expenses, fund reserves (runway), asset reserve strategy, and buyback execution status. Only then can confidence in long-term development be established.

The goal here is not to claim that a particular value distribution method is the only correct one but to acknowledge that the distribution method should align with the project's maturity. And in the crypto space, truly mature projects are still rare.

Most projects are still finding their footing. But those that get it right — with revenue, strategy, and trust — have the opportunity to become the much-needed "cathedrals" (long-term robust benchmarks) of this industry.

Strong investor relations act as a moat. They can build trust, mitigate panic during market downturns, and sustain ongoing institutional capital participation.

Ideal IR practices may include:

· Quarterly revenue and expense reports

· Real-time asset reserve dashboard

· Public records of buyback execution

· Clear token distribution and unlocking schedule

· On-chain Verification of Grants, Salaries, and Operational Expenses

If we want tokens to be seen as real assets, they need to start communicating more like real companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Markets Gain On Euro Data, Eyes on Trump’s Speech

Michael Saylor Doubles Down: "Don’t Be A Fool. Buy Bitcoin"

$1.63 Billion Lost: Crypto Suffers Brutal Start to 2025

Bitcoin Today 01/04/2025: Bitcoin Returns to $84K as Altcoins Rise Over 3%