Ethereum price teeters at key support and risks dropping to $1,500. With spiking ETH liquidations and whale moves, will bulls hold or fall?

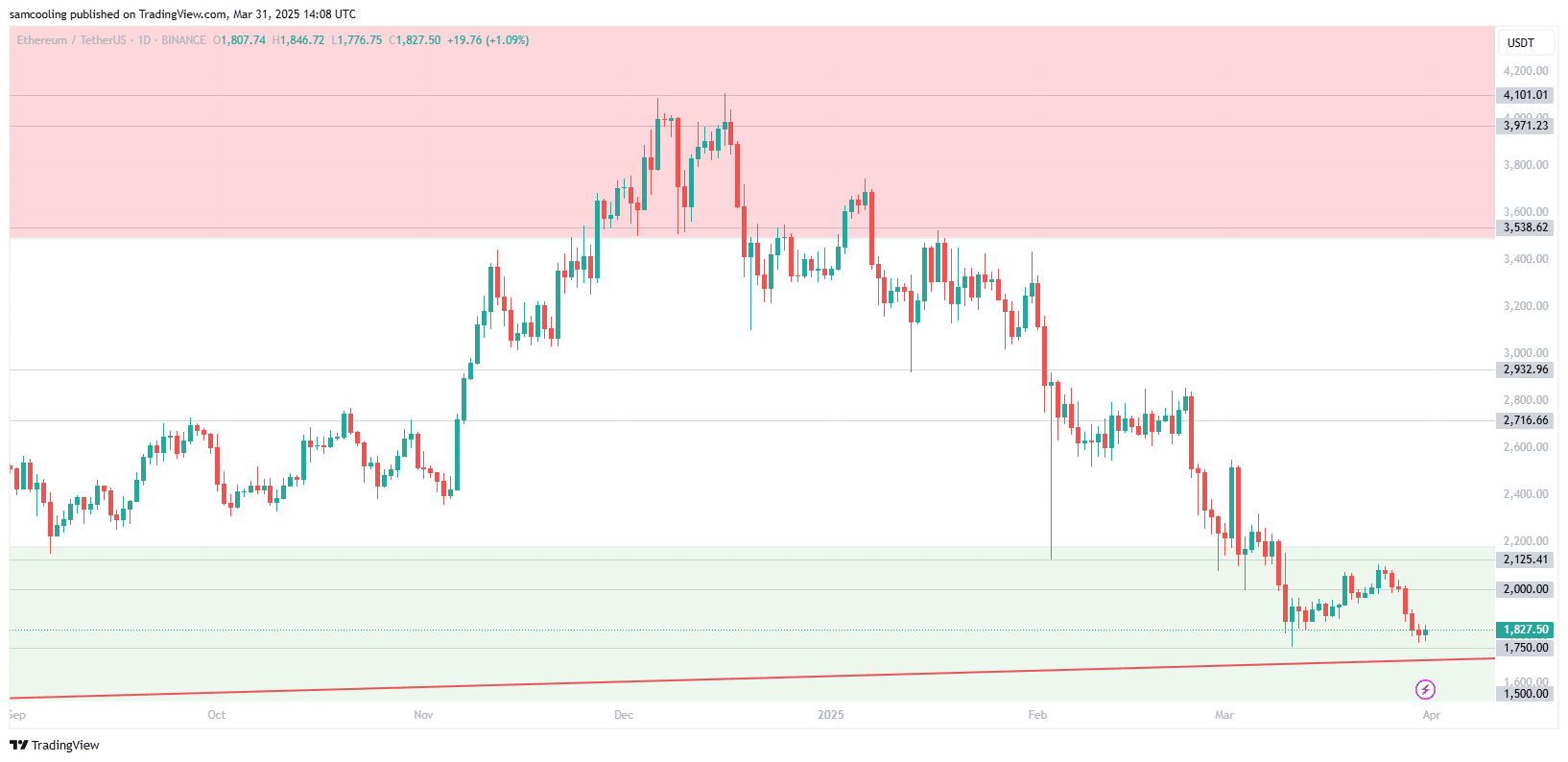

Ethereum price is under immense selling pressure and on the cusp of extending losses from the past three months, potentially ending Q1 2025 on a low note. When writing, the second most valuable coin is at a critical support level, retesting the zone between $1,700 and $1,800—an established double bottom.

( ETHUSDT )

Ethereum Price Drops As ETH Liquidations Spike Ahead of Trump Liberation Day

If prices crack below $1,700, Ethereum could march toward $1,500, extending losses well below the 2024 lows. This move would likely wash out more leveraged bets, looking at Coinglass data.

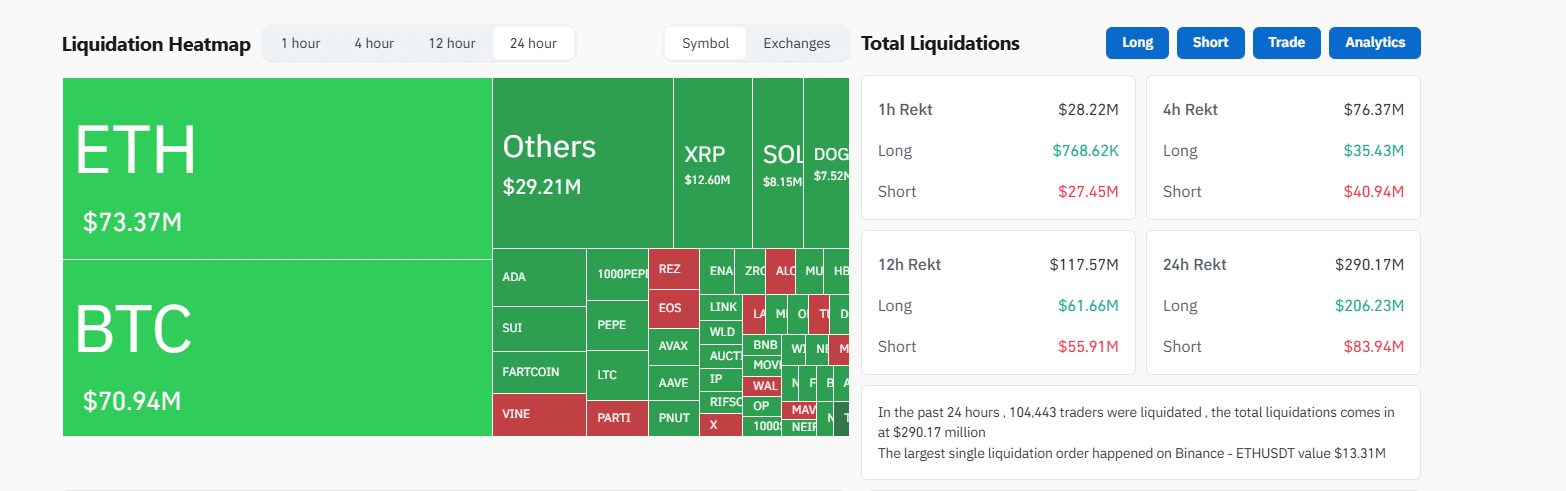

As of March 31, ETH liquidations outpaced those of Bitcoin and some of the best cryptos to buy , such as Solana and Cardano.

In the last 24 hours alone, $73 million of the $264 million in long liquidations were ETH longs. Over 101,000 traders have been liquidated in that period, with the largest single liquidation being an ETHUSD-long position on Binance, forcing the exchange to sell a $13.3 million long.

( Source )

ETH USD Support at $1,800: Will Bulls Hold On?

Glassnode data also shows that the Ethereum cost basis distribution offers little support at current rates between $1,700 and $1,800.

This preview suggests the Ethereum market is weak, and bulls may fail to defend the double bottom, leading to further losses.

Glassnode analysts note that addresses with an entry price of $1,800 are not committed and have shown no signs of re-entering, explaining why Ethereum crashed below $1,800 on March 30.

#Ethereum ’s Cost Basis Distribution shows limited support near current price. Weekly data reveals that addresses with a cost basis at $1.8K haven’t re-engaged, which helps explain why this level failed to hold during the recent sell-off. pic.twitter.com/iinBRcBFZb

— glassnode (@glassnode) March 31, 2025

Additionally, more holders are exiting, selling at a loss. On March 28, about 250,000 ETH with cost bases between $2,000 and $2,050 “disappeared,” likely indicating capitulation as holders sold at a loss.

At current price levels, accumulation is limited; if bears press on, it could trigger the next wave of selling toward $1,537, a support zone where 994,000 ETH were bought.

Despite concerns, some analysts believe Ethereum is not in a death spiral but undergoing a painful transformation that may eventually benefit some of the hottest presales to consider investing in 2025.

ETH USD Has Disappointed – But Is Ethereum Evolving?

On X, one observer noted that while on-chain revenue from gas fees is falling, this doesn’t mean it is dying.

"Revenue 📉" == "Ethereum dying"

Meanwhile:

– Prior to PoS, Ethereum had no revenue

– Ethereum blocks have consistency been full

– Ethereum is doing 15x transactions with Rollups

– Fees on Ethereum sub $1

– Issuance lowered from 4.06% -> 0.7%Ethereum ain't dying. It's going… pic.twitter.com/TKZrldw945

— fabda.eth (@fabdarice) March 30, 2025

Instead, the network is evolving as Ethereum rollups like Base, Optimism, and Arbitrum process more transactions, relieving the mainnet where fees have drastically fallen.

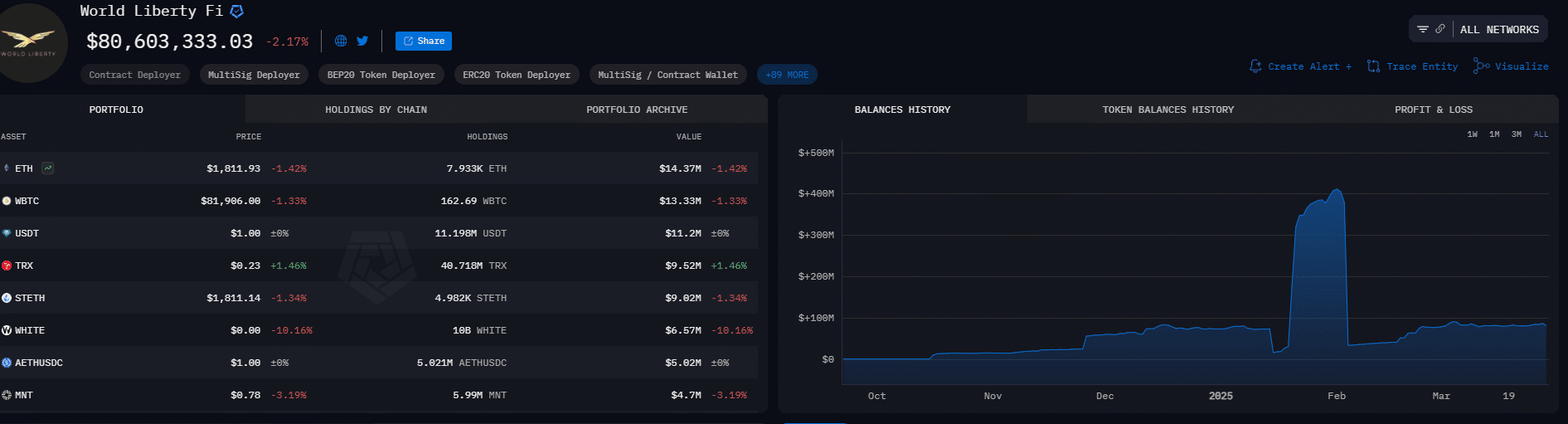

Heavyweights are also supporting Ethereum. World Liberty Financial has been actively accumulating ETH since 2024.

The firm, linked to Donald Trump, holds 91% of its crypto portfolio in Ethereum.

( Source )

In December 2024, they bought $2.5 million worth of ETH. Less than a month later, on inauguration day, they made a $47 million purchase.

Later, they added more in late January before moving them to Coinbase Prime in early February.

🇺🇸 BREAKING!!

WORLD LIBERTY FI HAS BEEN STACKING ETH OVER THE PAST WEEK.

WLF HAS PURCHASED ROUGHLY 1,500 ETH IN THE LAST 7 DAYS… FEELS LIKE THEY KNOW SOMETHING WE DON’T. pic.twitter.com/o25iRV1qT1

— Kyle Chassé / DD🐸 (@kyle_chasse) February 26, 2025

The DeFi firm added even more ETH in early March, solidifying its position as one of the largest Ethereum whales.

DISCOVER: 17 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions Analysis

Ethereum Price Prediction March 2025: Will ETH Drop Below $1,500?

- Ethereum price at $1,800, will it crash to $1,500

- Ethereum liquidation spike. Over $73 million in ETH leverage longs forcefully closed in 24 hours

- Did ETH holders capitulate at $1,800?

- Analysts say the network is evolving for good

- World Liberty Financial holds a big chunk of ETH and Ethereum-based tokens