Strong Bitcoin Reaccumulation Absorbing Sell-Pressure, According to Analytics Firm Glassnode

The selling of Bitcoin ( BTC ) by long-term holders is being quickly absorbed by buyers, according to digital asset analytics firm Glassnode.

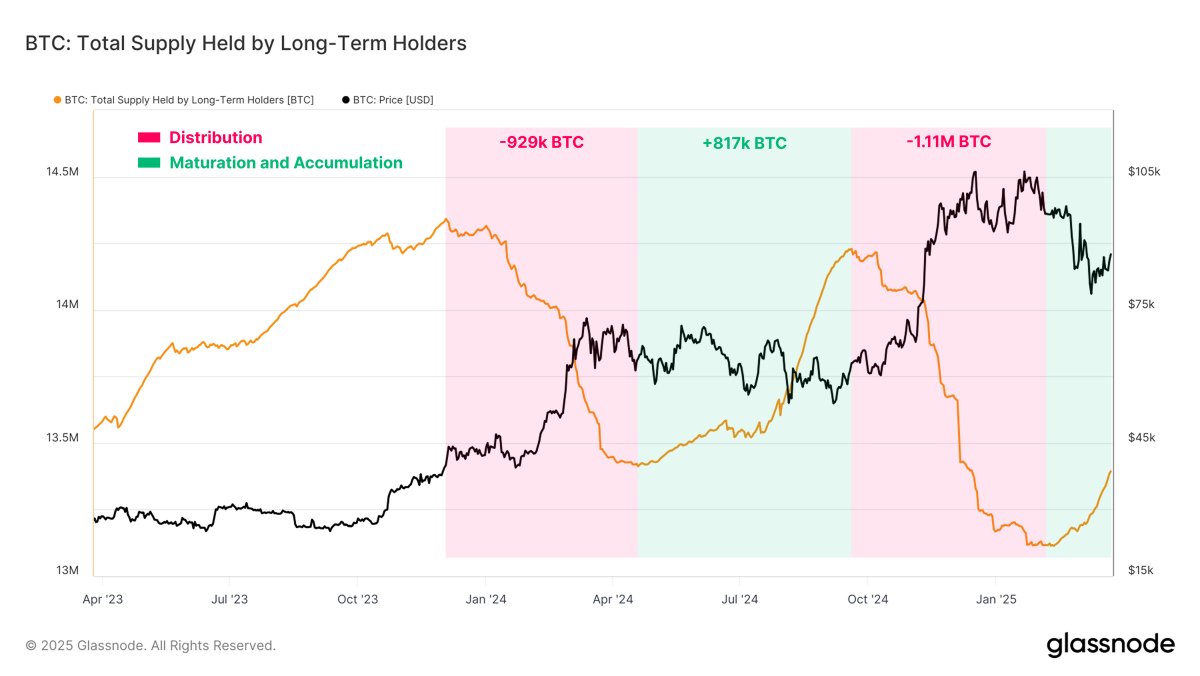

Glassnode says that long-term holders – or those holding their coins for more than 155 days – are starting to re-accumulate BTC after a second wave of selling, reducing volatility on the price chart.

“Across the 2023-25 cycle, long-term holders have distributed over 2 million BTC in two distinct waves. Yet, each has been followed by strong re-accumulation, helping absorb the sell-side pressure. This cyclical balance may be stabilizing price action.”

Source: Glassnode/X

Source: Glassnode/X

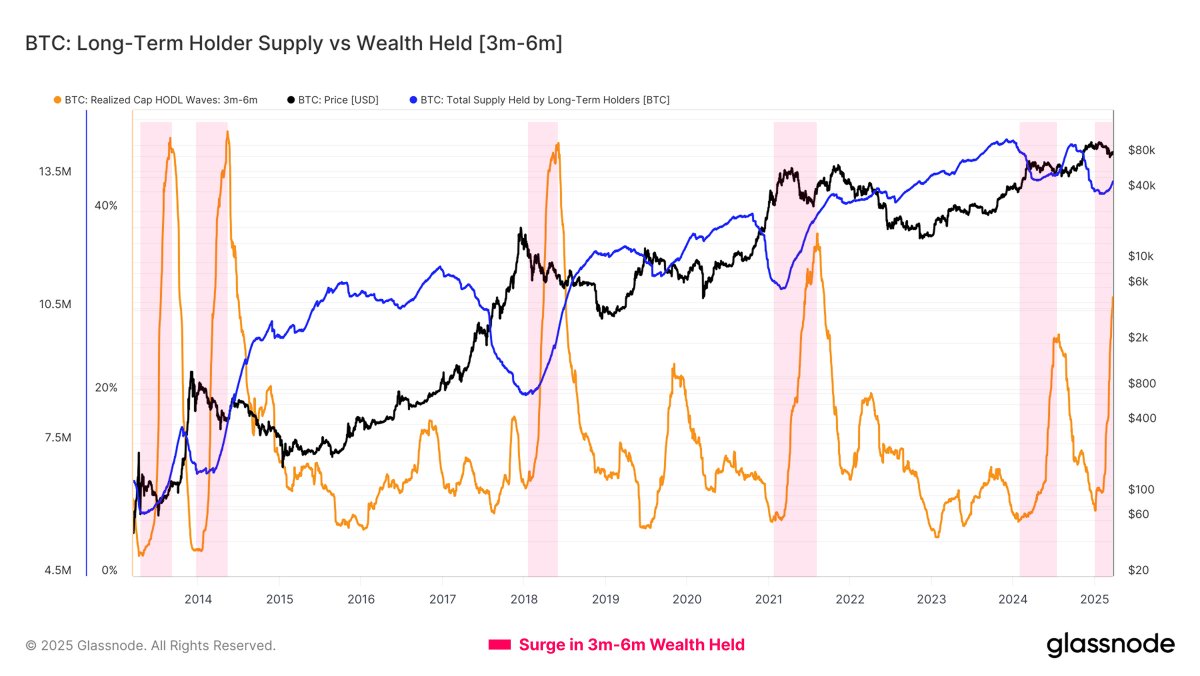

The firm says that Bitcoin holders closing in on long-term holder status are also becoming increasingly hesitant to sell the flagship crypto asset.

“Three-month to six-month Bitcoin holders – those transitioning into long-term holder status – are showing a sharp rise in wealth held. Many of these coins were acquired near all-time high levels, and their continued aging signals conviction, not capitulation.”

Source: Glassnode/X

Source: Glassnode/X

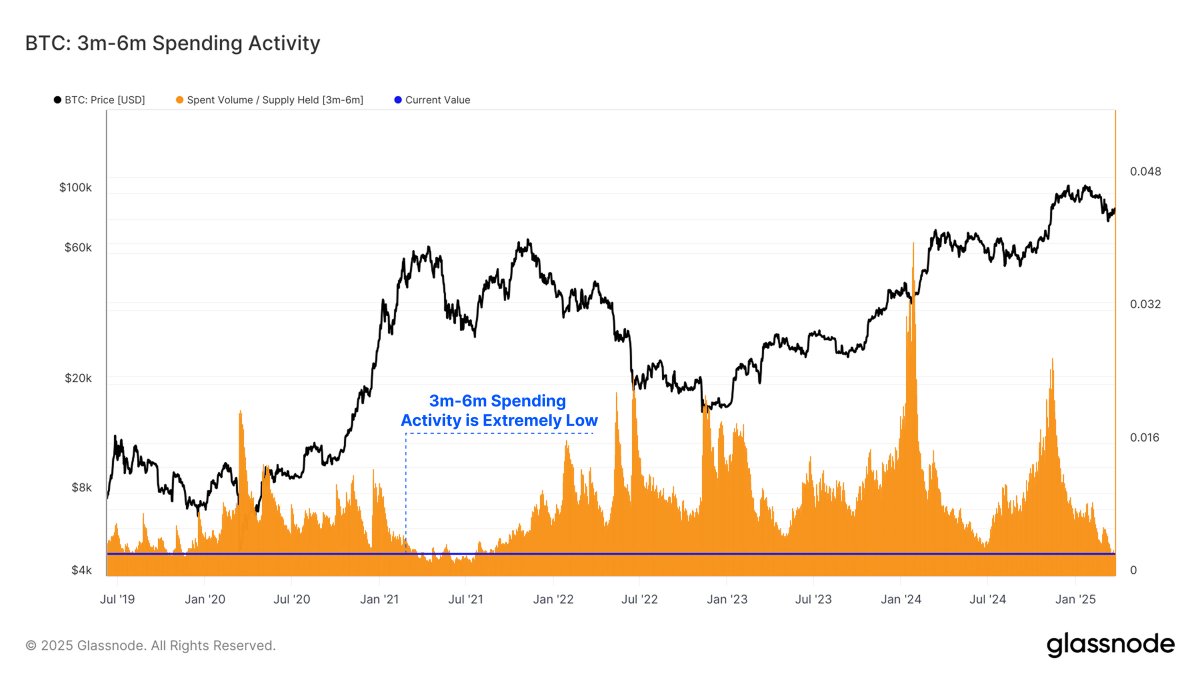

Glassnode also reports that the selling of Bitcoin by those holding BTC between three and six months has reached its lowest level in nearly four years, suggesting relative market strength.

“Spending from three to six months BTC holders is at the lowest levels since mid-2021. This inactivity reinforces the idea that recent top buyers are holding their positions rather than exiting, despite recent volatility.”

Source: Glassnode/X

Source: Glassnode/X

Bitcoin is trading for $85,151 at time of writing, up 2.3% in the last 24 hours.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/prodigital art

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether’s U.S. Treasury holding approaches record high of $120B

Share link:In this post: Today, Tether published its Q1 2025 attestation report prepared by BDO, confirming total exposure in U.S. Treasuries approaching $120B. Tether also reported over $1B in operating profit from traditional investments during the quarter, driven by solid performance in its U.S. Treasury portfolio. The milestones reinforced the company’s conservative reserve management strategy and highlighted its growing role in distributing dollar-backed liquidity at scale.

Automakers like Ford in solid April sales driven by panic buying amid tariff worries

Share link:In this post: Consumers rushed to buy vehicles on fears of potential price hikes due to the Trump tariffs. While there was strong demand which started in March, this started to wane towards the end of April. For Ford, it reported a 16% sales increase in April.

Arbitrum offers as much as $100k per report to snitch on wasteful DAOs

Share link:In this post: Arbitrum is offering up to $100,000 in ARB tokens to community members who report DAO grant misuse. The “Watchdog” program encourages confidential whistleblowing via the open-source platform, GlobaLeaks. Severity of violations determines the reward, with a funding cap of 400,000 ARB.

Meta, Microsoft earnings beat send stocks higher

Big Tech pulled US indexes back into the green Thursday, as investors waited for two more Mag 7 first-quarter reports after the bell