Pepe (PEPE) Gains Momentum With Key Breakout Retest: Is a Recovery Rally Ahead?

Date: Tue, April 01, 2025 | 09:15 AM GMT

The cryptocurrency market has kicked off Q2 on a positive note after enduring a record-breaking bearish Q1. Ethereum (ETH) declined by over 44% during the first quarter, dragging most altcoins and memecoins to multi-month lows.

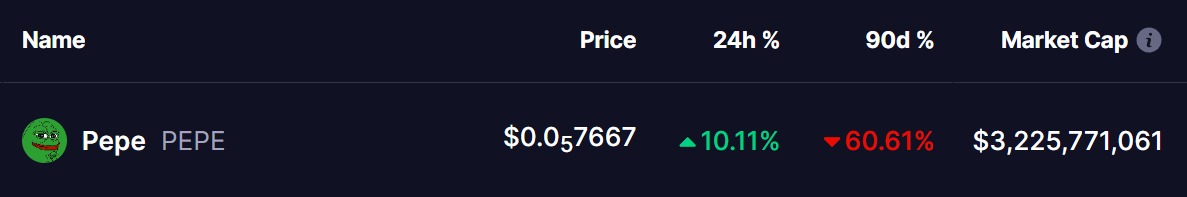

Among the affected memecoins, Pepe (PEPE) also faced significant pressure, losing over 60% of its value over the last 90 days. However, today, with the jump of 5% in ETH, PEPE is showing signs of a potential rebound as it surges by over 10% after its recent breakout and successful retest.

Source: Coinmarketcap

Source: Coinmarketcap

Retests Falling Wedge Breakout

On the daily chart, PEPE saw an impressive 265% rally in November 2024. However, following that uptrend, the price entered a correction phase, forming a falling wedge pattern, which led to an 80% drop to a low of $0.0000052. This level acted as a strong support zone where buyers stepped in to push the price higher.

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

Recently, PEPE made a significant breakout, surpassing the descending trendline of the falling wedge at $0.0000079 and reached a short-term high of $0.00000918 before pulling back due to market-wide volatility. This retracement brought PEPE back to the breakout trendline at $0.0000070, where it successfully held support and is now gaining momentum, trading at $0.0000076.

From here, the confirmation of this falling wedge breakout with a successful retest strengthens the foundation for further gains. A move above the immediate resistance at $0.00001072 will be crucial for PEPE’s bullish outlook. A breakout above this level could open doors for a rally toward the 200-day moving average and the $0.00001475 price zone, representing a potential 91% increase from current levels.

Is a Recovery Rally Ahead?

The MACD indicator is showing signs of a bullish crossover, suggesting that selling pressure might be easing. If the momentum strengthens, it could confirm a shift towards a recovery phase.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FHE is live! Bullish or bearish? Join to share 24,000 FHE!

BABY is live! Bullish or bearish? Join to share 24,000 BABY!

VIPBitget VIP Weekly Research Insights

The unique value of Proof-of-Work (PoW) tokens lies in their mining mechanism and regulatory positioning. Research shows that mining costs are a defining feature of PoW tokens, involving significant investment in hardware and electricity. When market prices approach miners' breakeven points, miners tend to hold onto their coins in anticipation of future appreciation. This behavior reduces circulating supply, shifts the supply-demand balance, and may contribute to price increases. Regulatory clarity is also critical to the investment appeal of PoW tokens. Both BTC and LTC are classified as commodities by the U.S. SEC rather than securities, which simplifies the ETF approval process. In January 2024, the approval of the BTC spot ETF triggered significant institutional inflows. LTC is currently undergoing the ETF application process. While DOGE and KAS have not yet received formal classification, their PoW nature may position them for similar treatment. Together, these factors enhance market liquidity and attract more institutional investors.