SEC Begins Broad Reassessment of Crypto Policy Under Trump’s Executive Directive

Industry experts believe SEC's planned changes could expand access for US retail investors and reshape how crypto projects are evaluated.

The US Securities and Exchange Commission (SEC) is preparing to review several internal staff directives that influence how the regulator oversees the crypto industry.

This move aligns with President Donald Trump’s latest Executive Order on deregulation. It also follows guidance from the Department of Government Efficiency (DOGE), currently led by Elon Musk.

SEC to Review Howey Test and Investment Contract Framework Application

On April 5, Acting SEC Chair Mark Uyeda noted that the upcoming reviews could result in changes or full withdrawal of some statements. He emphasized that the agency’s objective is to ensure its guidance remains relevant and consistent with its current priorities.

“The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities,” the Commission stated.

One of the main targets of this reassessment is the SEC’s current framework for determining whether a digital asset qualifies as a security. This guideline relies heavily on the decades-old Howey Test.

It also reflects the views of former SEC official Bill Hinman, shared during a 2018 speech. Hinman argued that the degree of decentralization behind a token should matter more than how it was originally sold.

This view has influenced several enforcement decisions, including the legal battle with Ripple over XRP. However, many in the industry argue that the Howey Test is no longer suitable for modern blockchain technologies.

This development may pave the way for a dramatic shift in how crypto assets are evaluated. Crypto analyst Jesus Martinez believes that removing or revising the current framework could be a major turning point for retail investors in the US.

He argues that regulatory constraints have long blocked everyday users from participating in projects like launchpads and node operations. These platforms are often only accessible to those with foreign identification or institutional workarounds.

Martinez says that dismantling such outdated rules could help level the playing field for American investors.

“It’s been hurting retail for the longest time & we need to prioritize American citizens, this is a big step in that direction,” Martinez concluded.

Beyond the Howey-based framework, the SEC is also reviewing several other documents. One of these is a bulletin outlining regulatory concerns around mutual funds investing in Bitcoin futures.

The financial regulator is also reviewing a risk alert from the Division of Examination. This alert warns that digital assets pose unique investor risks, including regulatory uncertainty and cybersecurity threats.

Additionally, the Commission is reassessing whether state-chartered banks and trust companies can act as qualified custodians under the SEC’s Custody Rule.

The crypto community believes the SEC’s broad reassessment points to a shift toward a more modern and flexible regulatory approach. This shift could reshape the crypto landscape for both retail investors and institutional participants

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

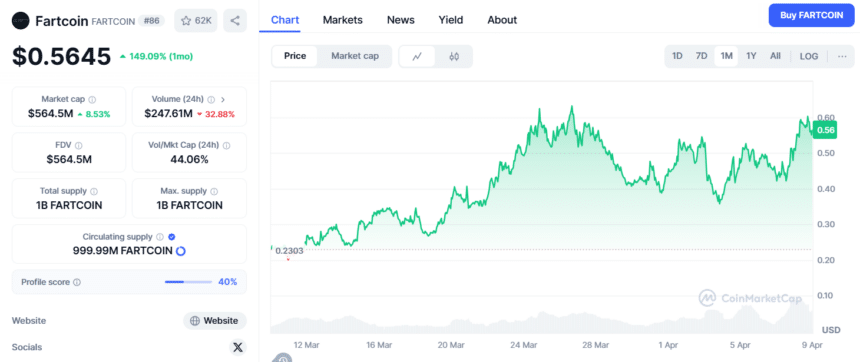

Fartcoin Surges in Value While Market Faces Setbacks

In Brief Fartcoin has increased by nearly 30% in the last 24 hours. Growing confidence among users as exchange reserves decline. Technical indicators predict a potential price target of $0.75.

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction