Solana (SOL) Accumulation Peaks as Long-Term Holders Signal Possible Price Recovery Amid Weak New Investor Interest

-

Solana (SOL) shows mixed signals as long-term holders demonstrate renewed accumulation, potentially laying the groundwork for a price rebound.

-

The recent surge in accumulation among long-term holders contrasts with a noticeable decline in new address activity, suggesting a precarious market sentiment.

-

According to COINOTAG, “The growing support from long-term holders could provide necessary backing to help Solana break through key resistance levels.”

This article examines the mixed signals in Solana’s market, highlighting long-term holder accumulation and new address activity, pivotal for SOL’s price trajectory.

Solana Investors Move To Accumulate

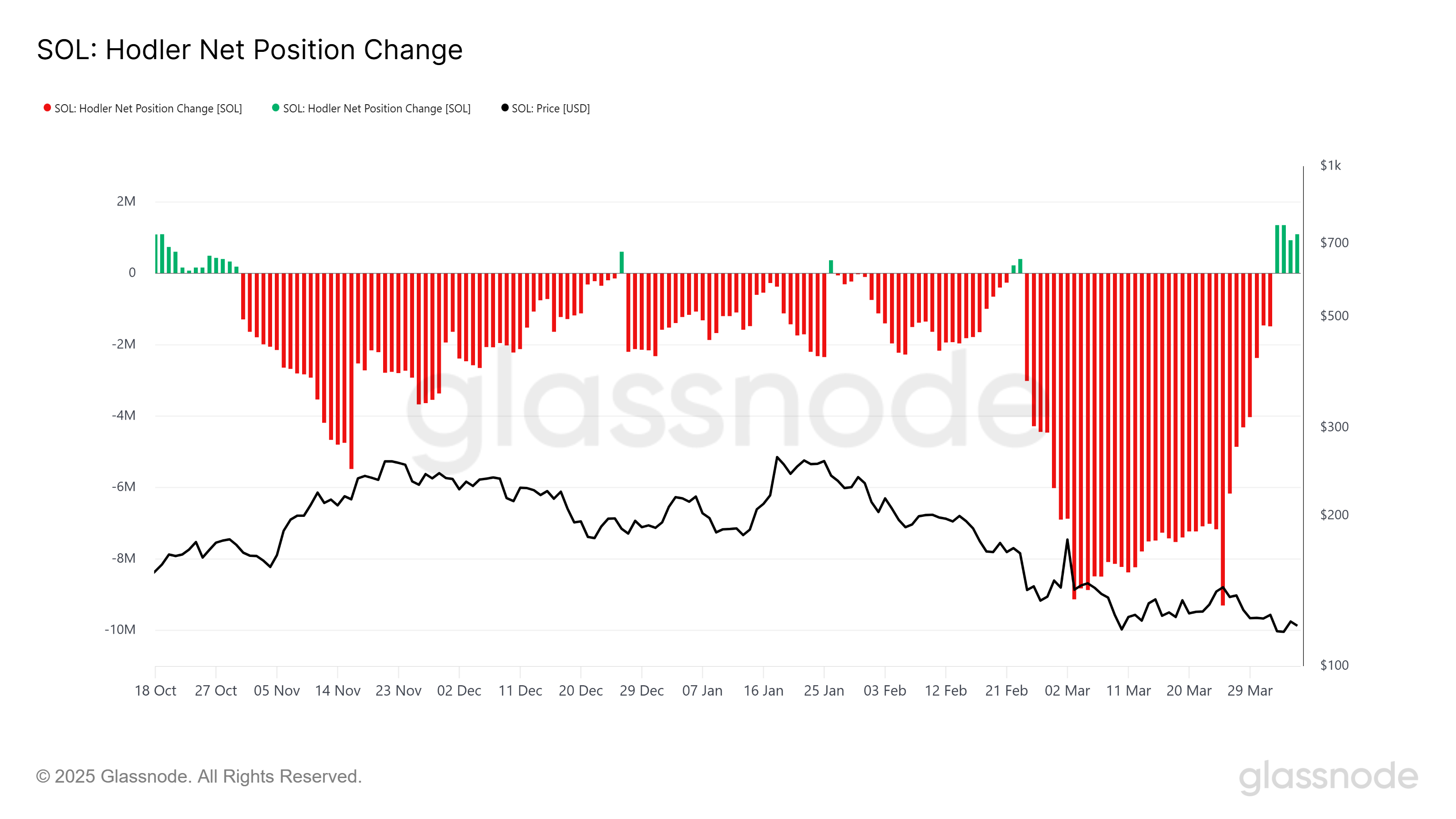

The HODLer Net Position Change for Solana has been positive for the past four days, indicating that long-term holders (LTHs) are consistently adding to their SOL positions. This is the longest streak of accumulation in over six months, demonstrating a renewed confidence in the cryptocurrency’s potential.

As these investors continue to build their holdings, Solana may be establishing a robust support base for a price rebound. The actions of LTHs are crucial in influencing the price dynamics of Solana, as their investment strategies often reflect long-term confidence in the asset’s future prospects. If this accumulation trend persists, it could set the stage for Solana to overcome significant resistance levels.

Solana HODLer Net Position Change. Source: Glassnode

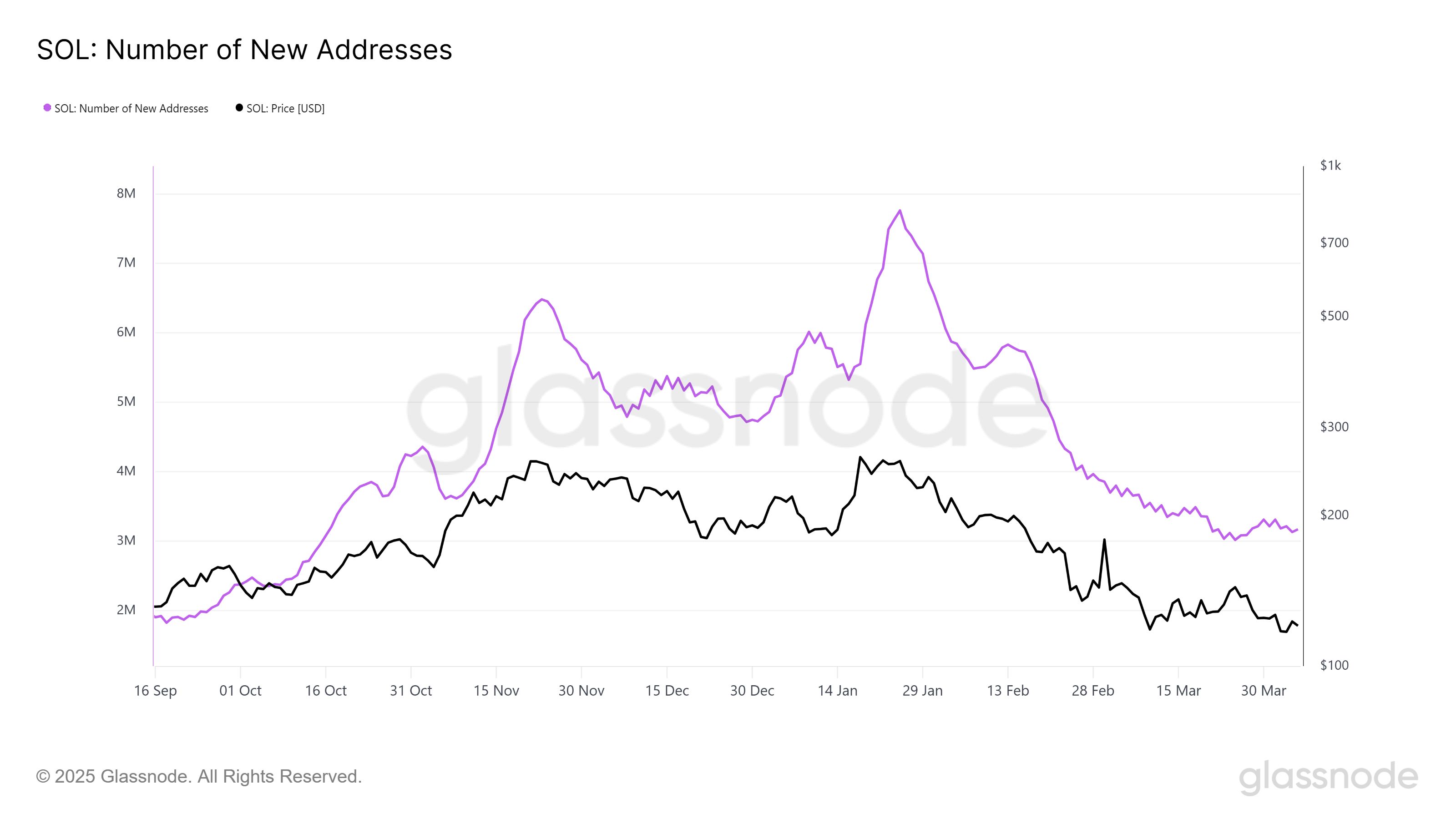

Nevertheless, amid this supportive accumulation from LTHs, broader market sentiment remains uncertain. The recent dip in the number of new addresses—a vital metric for gauging investor interest—has reached a six-month low. This decline suggests a waning influx of new investors into the market, casting a shadow over the short-term recovery potential for Solana. The last occurrence of such low new address activity was in October, indicating a more cautious sentiment among potential buyers.

This drop in new addresses raises questions about the overall demand for Solana. While LTHs are accumulating, the lack of fresh interest from new market participants may hinder significant price movements and prolong the current trading environment.

Solana New Addresses. Source: Glassnode

SOL Price Vulnerable To Correction

Currently, Solana is trading at approximately $119, lingering just above the significant support level of $118. This positioning indicates a battle to maintain upward momentum towards the $135 resistance level. However, the mixed market signals suggest SOL may encounter challenges in achieving this breakthrough.

The price trajectory indicates the possibility of a consolidation phase within the $118 to $135 range as Solana seeks to build sufficient momentum for a rally. A successful rebound could see SOL trading sideways, allowing the market to stabilize and reinforce bullish potential.

SOL Price Analysis. Source: TradingView

Conversely, a decline below the $118 support could signal a shift in market sentiment, invalidating hopes for a bullish outlook. A breach of this level could lead to further downward pressure, potentially driving Solana’s price down to $109 and exacerbating investor losses.

Conclusion

In conclusion, while Solana’s long-term holders exhibit increasing confidence through accumulation, the lack of new addresses denotes caution in the market. The current price of SOL remains precariously positioned, with the potential for either a rebound or a deeper correction depending heavily on market dynamics and investor behavior moving forward. Traders should remain vigilant regarding these indicators as they navigate Solana’s complex landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — PAXG/USDT!

Market Expert Warns of Potential Decline in Major Cryptocurrencies

In Brief Jason Pizzino warns of further losses in XRP, Solana, and Ethereum. Technical indicators suggest continued downward trends for these cryptocurrencies. Market corrections prompt investors to stay informed on price projections.

Strategy pauses Bitcoin buys as unrealised losses hit $5.91B

ZKasino scammer loses $27M after Ethereum liquidation