Bitcoin Drops 7% as Wall Street Futures Slide Before Monday’s Open

Dow Tanks 1,500 Points; Bitcoin Sinks as Economic Anxiety Spreads

Between 5 p.m. and 8 p.m. on Sunday, Apr. 6, the digital asset economy contracted by another $50 billion, falling from $2.53 trillion to $2.48 trillion. Bitcoin ( BTC ) hit its lowest point—$77,098—at approximately 7:24 p.m. ET and has since rebounded slightly to $77,654. The cryptocurrency appears to be functioning as a proxy indicator for Wall Street’s upcoming open, a theory that aligns with futures market behavior.

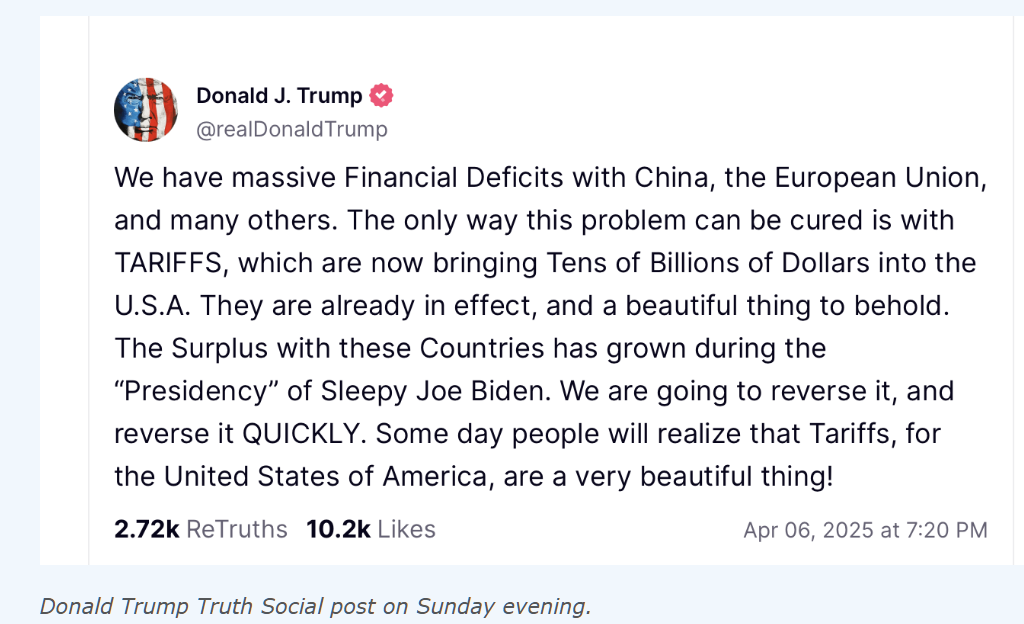

The Dow Jones Industrial average declined by 4.1% , while the SP 500 fell 4.6%. Analysts have pointed to President Trump ’s recently announced tariff policies as a key factor. These measures, introduced earlier last week, include a blanket 10% tariff on imports, with escalated rates reaching up to 50% for certain countries, notably China and Vietnam. Interestingly, the decline extended beyond equities— gold , too, is trading lower.

The precious metal is down 1.9% over the past 24 hours, now changing hands at $2,980 per ounce, below the $3,000 threshold. Market participants are turning their focus to Monday’s Wall Street open, which is shaping up to be volatile. Adding to the week’s economic narrative, first-quarter earnings will begin rolling out, accompanied by Thursday’s anticipated consumer price index (CPI) release.

Alongside BTC , alternative cryptocurrencies saw considerable drawdowns on Sunday, dragging the collective valuation of all non-bitcoin digital assets below the $1 trillion mark, settling at $930 billion. BTC itself has declined 6.3% today and sits 28.3% beneath its all-time peak achieved three months ago. Although it briefly neared $76,900, the coin has yet to breach the $76,600 figure last recorded on March 10, 2025—but it’s been inching ever closer to that foundation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Troller Cat’s Tail Is Twitching—Something Big’s Brewing in The Upcoming Meme Coin Presale

Meme coins weren’t always taken seriously. They started as internet jokes with little utility and zero roadmaps.Troller Cat Isn’t Playing Around—This Meme Coin Is Armed With StrategyMeme Coin Culture in Latin America Is Roaring—and Troller Cat Fits Right InWhitelist Access: The Smartest Way to Get Ahead of the HerdConclusion: This Is the Meme Coin Presale to Watch—Before the Cat’s Out of the Bag

Ripple vs Ethereum: XRP Will Outperform ETH by 2028, Reveals Standard Chartered

BlackRock Remains Cautious in Recommending Cryptocurrencies to Large Investors

Trump, Japanese PM Discuss Trade Tariffs Amid Negotiations